PA UC-2 2006 free printable template

Show details

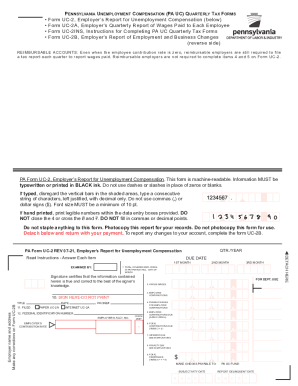

INSTRUCTIONS: PENNSYLVANIA UNEMPLOYMENT COMPENSATION (PA UC) QUARTERLY TAX FORMS Form UC-2, Employer's Report for Unemployment Compensation (below) Form UC-2A, Employer's Quarterly Report of Wages

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA UC-2

Edit your PA UC-2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA UC-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA UC-2 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PA UC-2. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA UC-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA UC-2

How to fill out PA UC-2

01

Obtain the PA UC-2 form from the Pennsylvania Department of Labor website or your local unemployment office.

02

Fill in your personal information, including your name, address, and social security number at the top of the form.

03

Indicate your employment history by listing your previous employers, including their names, addresses, and dates of employment.

04

If applicable, provide information regarding any reasons for separation from your previous jobs.

05

Answer questions regarding your current employment status and availability for work.

06

Review the form for accuracy and completeness before signing and dating it.

07

Submit the completed PA UC-2 form either online, by mail, or in-person at your local unemployment office.

Who needs PA UC-2?

01

Individuals who have lost their job and are seeking unemployment compensation in Pennsylvania.

02

Workers who are unable to work due to various reasons such as layoffs, company closures, or personal circumstances that qualify them for unemployment benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is the employment termination form pa?

Employees should be provided with a UC-1609 form upon separation for any reason.

What is PA UC tax?

Employee contributions (UC withholding) is 0.06 percent (60 cents per $1,000 gross wages). This applies to all employees, including employees of reimbursable employers, and is not subject to appeal. There is no cap on the gross wages upon which employee withholding is calculated.

What is a UC 1609 form?

THIS FORM PROVIDES THE EMPLOYEE WITH THE EMPLOYER'S INFORMATION TO BE USED IF HE/SHE WISHES TO APPLY FOR UNEMPLOYMENT COMPENSATION BENEFITS.

How do I get a UC number in PA?

Registering for a UC account number is easy. Just visit the Pennsylvania Online Business Entity Registration site to access the Online PA-100. The employment information furnished by the enterprise will provide the basis for determining whether such employment is covered under the PA UC Law.

How do I get a copy of my 1099 from unemployment PA?

How can I get my 1099-G tax form? If you did not receive your 2020 UC 1099-G or 2020-2021 PUA 1099-G forms in the mail or misplaced them, you can also retrieve your forms online using the UC dashboard or PUA dashboard.

What is U C on Pa w2?

Unemployment Compensation (UC)

What is a PA UC account number?

UC Account Number The UC number facilitates the recording of contributions paid by and benefit payment charges assessed to each individual employer. It also acts as a mechanism to identify the employer in correspondence.

Does Pennsylvania require a termination letter?

In Pennsylvania, employment is at-will, which means employers have the right to terminate an employee without reason and without giving him or her prior notice.

How do I register as an employer in Pennsylvania?

Companies who pay employees in Pennsylvania must register with the PA Department of Revenue for an Employer Account ID and the PA Department of Labor and Industry for an Unemployment Compensation (UC) Account Number. Apply online for both at the PA-100 Enterprise Registration System to receive the numbers immediately.

What is the UC program for unemployment?

The Unemployment Compensation (UC) program provides temporary income support if you lose your job through no fault of your own or if you are working less than your full-time hours. If you qualify, you will receive money for a limited time to help you meet expenses while you seek new employment.

How do I get my PA UC account number?

If you do not know your PA UC account number, please call the Unemployment Compensation Resource Center at 833-728-2367. If an account number has not been assigned, please register with the department by submitting the Pennsylvania Enterprise Registration Form (PA-100) at .pa100.state.pa.us.

What is a PA uc2 form?

PA Form UC-2, Employer's Report for Unemployment Compensation. This form is machine-readable. Information MUST be typewritten or printed in BLACK ink.

Do you have to claim unemployment on your PA state taxes?

These benefits are not taxable by the Commonwealth of Pennsylvania and local governments. You may choose to have federal income tax withheld from your benefit payments at the rate of 10 percent of your weekly benefit rate plus the allowance for dependents (if any).

How do I get my unemployment tax form in PA?

How can I get my 1099-G tax form? If you did not receive your 2020 UC 1099-G or 2020-2021 PUA 1099-G forms in the mail or misplaced them, you can also retrieve your forms online using the UC dashboard or PUA dashboard.

What is Pennsylvania UC account number?

PA Employer UC Account Number This seven-digit number is shown on the New Employer Confirmation Letter (Form UC-1408), Notice of Pennsylvania Unemployment Compensation Responsibilities (Form UC-851), and the Contribution Rate Notice (Form UC-657).

How do I file PA unemployment tax?

Online: An online application can be filed using our secure website 7 days a week, 24 hours a day. Telephone: An application can be filed on the statewide unemployment compensation toll-free number at 1-888-313-7284.

How long does it take to get UC benefits in PA?

If you are eligible for UC, you may receive benefits until you have been paid the maximum benefit amount (MBA) allowed on your claim or until your benefit year has expired. Your benefit year expires one year (52 weeks) after your application for benefits (AB) date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify PA UC-2 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including PA UC-2. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make edits in PA UC-2 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your PA UC-2, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit PA UC-2 on an Android device?

You can edit, sign, and distribute PA UC-2 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is PA UC-2?

PA UC-2 is a form used in Pennsylvania for employers to report wages paid and unemployment compensation contributions to the Pennsylvania Department of Labor and Industry.

Who is required to file PA UC-2?

Employers in Pennsylvania who have employees covered under the Unemployment Compensation Law are required to file the PA UC-2 form.

How to fill out PA UC-2?

To fill out PA UC-2, employers must provide information including their business details, employee wages, and the total amount of contributions owed to the unemployment compensation fund.

What is the purpose of PA UC-2?

The purpose of PA UC-2 is to account for wages paid to employees and ensure that employers are contributing the correct amount to the state's unemployment compensation system.

What information must be reported on PA UC-2?

Information that must be reported includes the employer's identification details, employee names, social security numbers, total wages paid, and any contributions owed.

Fill out your PA UC-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA UC-2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.