Get the free reverse mortgage statement

Show details

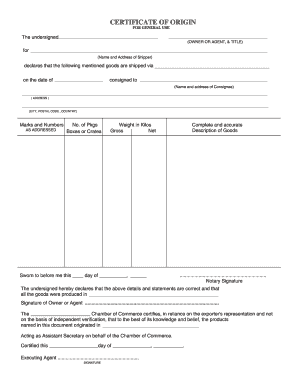

How to Read My Reverse Mortgage Statement sample on next page Account Number This is your reverse mortgage account number.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how to read a reverse mortgage statement celink form

Edit your celink reverse mortgage statement form online

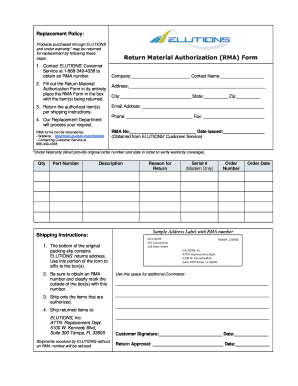

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to read a reverse mortgage statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit reverse mortgage information statement online

Use the instructions below to start using our professional PDF editor:

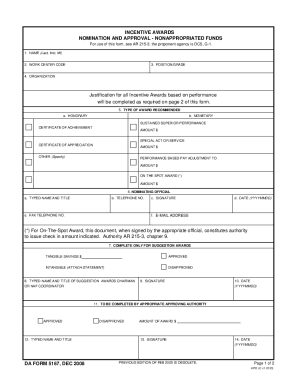

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit reverse mortgage statement form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reverse mortgage statement form

How to fill out how to read a:

01

Start by writing a clear introduction that explains what the topic is about and why it is important.

02

Break down the steps or process of reading a into concise and easy-to-understand points. Include any necessary instructions or explanations.

03

Use appropriate formatting, such as bullet points or numbered lists, to organize the information visually and make it easier to follow.

04

Consider adding additional resources or references, such as books or websites, for readers who want to explore the topic further.

Who needs how to read a:

01

Individuals who are new to reading a and want to learn the basics.

02

Students or researchers who are studying or working on projects related to a and need a guide to help them navigate the process.

03

People who are interested in expanding their knowledge and understanding of a and want a comprehensive resource to refer to.

Remember to use clear and concise language, provide relevant examples or illustrations, and ensure the information is accurate and up-to-date.

Fill

form

: Try Risk Free

People Also Ask about

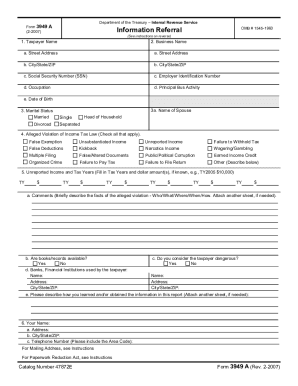

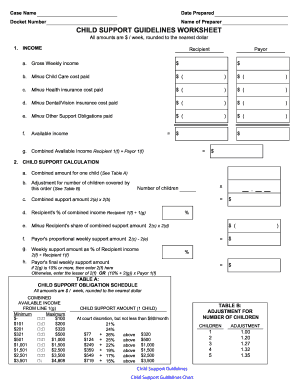

What is the loan balance on a reverse mortgage statement?

Current Line of Credit Loan Balance – This line shows how much of the original line of credit has been drawn since the loan closed. Current Available Line of Credit – This is the amount that could be drawn from the mortgage today.

Why are there 2 notes on a reverse mortgage?

The quick answer to why reverse mortgage loans have 2 Deeds of Trust and 2 Notes is that the first deed of trust secures the lender's position and HUD assumes the second position because HUD is insuring that the homeowner will continue to receive loan payments in the event that the lender becomes incapable of making

What does current total loan balance mean?

The loan balance is what you have left to pay on the mortgage principal. The difference between the original mortgage amount and the amount you've made in principal payments gives you the loan balance.

What is the dark side of reverse mortgage?

Your home's equity will shrink. A big downside to reverse mortgages is the loss of home equity. Because you're not paying down your reverse mortgage balance, you'll make less profit when you sell, or limit your borrowing power if you need a new loan.

Do you get a monthly statement on a reverse mortgage?

Each month, the borrower will receive a monthly statement that is sent by a company called a loan servicer. The servicer may or may not be a division of the lender who made the reverse mortgage. An example of a reverse mortgage statement is shown below.

What is the second note on a reverse mortgage?

The Second Note is not a separate loan encumbering the property as a traditional first and second loan. Instead, it secures any payments made to the borrower by HUD on their reverse mortgage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit reverse mortgage statement form from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your reverse mortgage statement form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for signing my reverse mortgage statement form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your reverse mortgage statement form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I edit reverse mortgage statement form on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing reverse mortgage statement form.

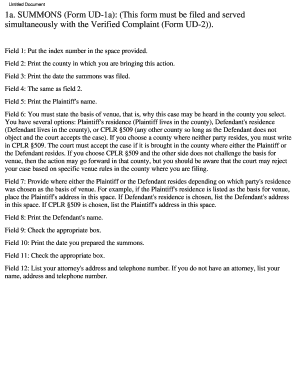

What is mortgage statement example?

A mortgage statement example is a document that outlines the details of a mortgage loan, including the outstanding balance, payment history, interest rate, and terms of the loan. It often includes a summary of payments made during the period and any additional fees or costs.

Who is required to file mortgage statement example?

Mortgage statements are typically provided by lenders to borrowers. Lenders are required to issue these statements to homeowners who have an active mortgage loan, especially for tax reporting purposes or when requested by the borrower.

How to fill out mortgage statement example?

To fill out a mortgage statement example, you should provide information such as the borrower’s name and address, loan number, payment amount, due date, current interest rate, principal balance, and payment history. Ensure accurate reporting of any additional fees or escrows.

What is the purpose of mortgage statement example?

The purpose of a mortgage statement example is to provide borrowers with a clear understanding of their mortgage loan status, including the amount owed, payment history, interest rates, and upcoming payments. It helps borrowers manage their finances and aids in tax preparation.

What information must be reported on mortgage statement example?

A mortgage statement example must report the borrower’s name and address, account number, loan balance, interest rate, payment amount, due date, payment history, any late fees, and escrow information, if applicable.

Fill out your reverse mortgage statement form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reverse Mortgage Statement Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.