Sample Email Sending Statement Of Account

What is sample email sending statement of account?

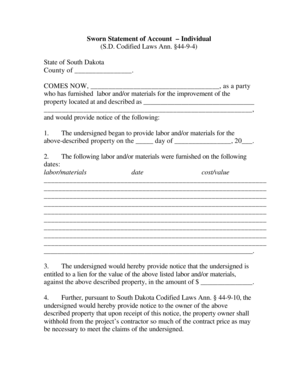

A sample email sending statement of account is a template that allows you to send a detailed summary of financial transactions to your customers or clients. It includes information about their purchases, payments, and any outstanding balances. This statement helps provide clarity and transparency in financial dealings.

What are the types of sample email sending statement of account?

There are various types of sample email sending statements of account that can be customized based on specific business needs. Some common types include: 1. Basic statement of account: This type includes essential information such as the customer's name, account number, current balance, and a summary of recent transactions. 2. Detailed statement of account: This type provides a more comprehensive overview of financial activities by including additional details such as itemized transactions, due dates, and payment history. 3. Past due statement of account: This type is used to remind customers about any outstanding balances and encourages prompt payment. 4. Summary statement of account: This type provides a condensed version of financial activities, highlighting key figures and important information. These are just a few examples, and businesses can customize their statements to suit their specific requirements.

How to complete sample email sending statement of account

Completing a sample email sending statement of account is a straightforward process. Here are the steps to follow: 1. Open the template: Start by selecting the desired statement of account template or create a new one using a tool like pdfFiller. 2. Import customer data: Input the necessary customer information such as their name, contact details, and account number into the template. 3. Include transaction details: Fill in the statement with the relevant financial data, including purchase details, payment amounts, dates, and any applicable fees. 4. Customize the design: Personalize the layout and design of the statement to match your branding or add any additional relevant information. 5. Proofread and review: Double-check the statement for accuracy, ensuring that all the information is correct and easy to understand. 6. Attach and send: Once you are satisfied with the statement, save it as a PDF and attach it to an email. Address the email to the intended recipient and send it.

With pdfFiller, completing and sending sample email sending statements of account is convenient and efficient. The platform empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.