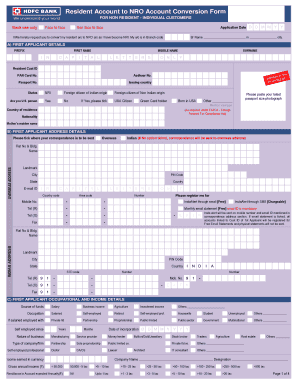

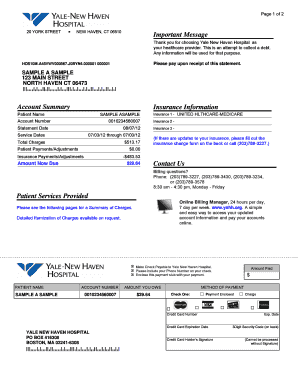

Sample Statement Of Account For Collection

What is sample statement of account for collection?

A sample statement of account for collection is a document that outlines the details of a customer's unpaid balance and serves as a formal request for payment. It includes information such as the customer's name, account number, outstanding balance, due date, and payment instructions. This statement is typically sent to customers who have not paid their bills on time or have outstanding debts.

What are the types of sample statement of account for collection?

There are various types of sample statements of account for collection, depending on the specific needs of the business or organization. Some common types include:

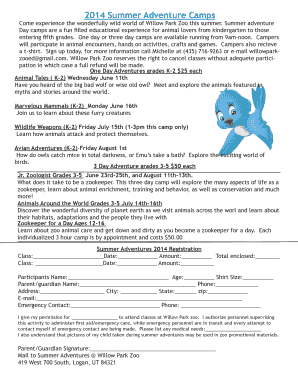

How to complete sample statement of account for collection

Completing a sample statement of account for collection is a straightforward process. Here are the steps involved:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.