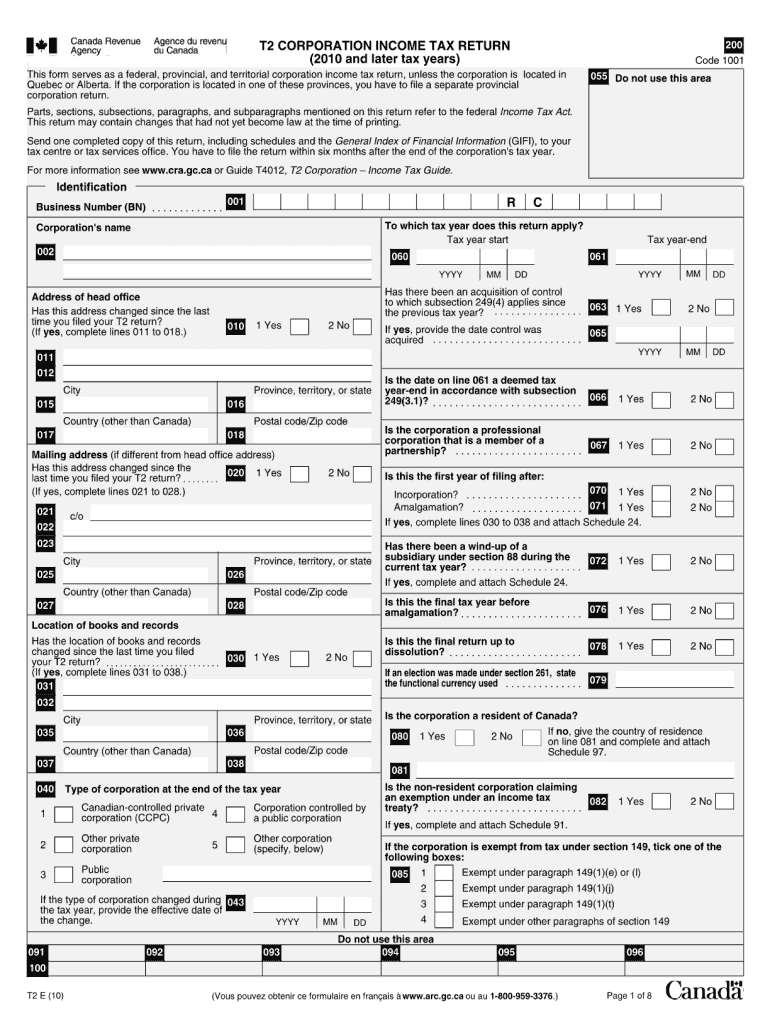

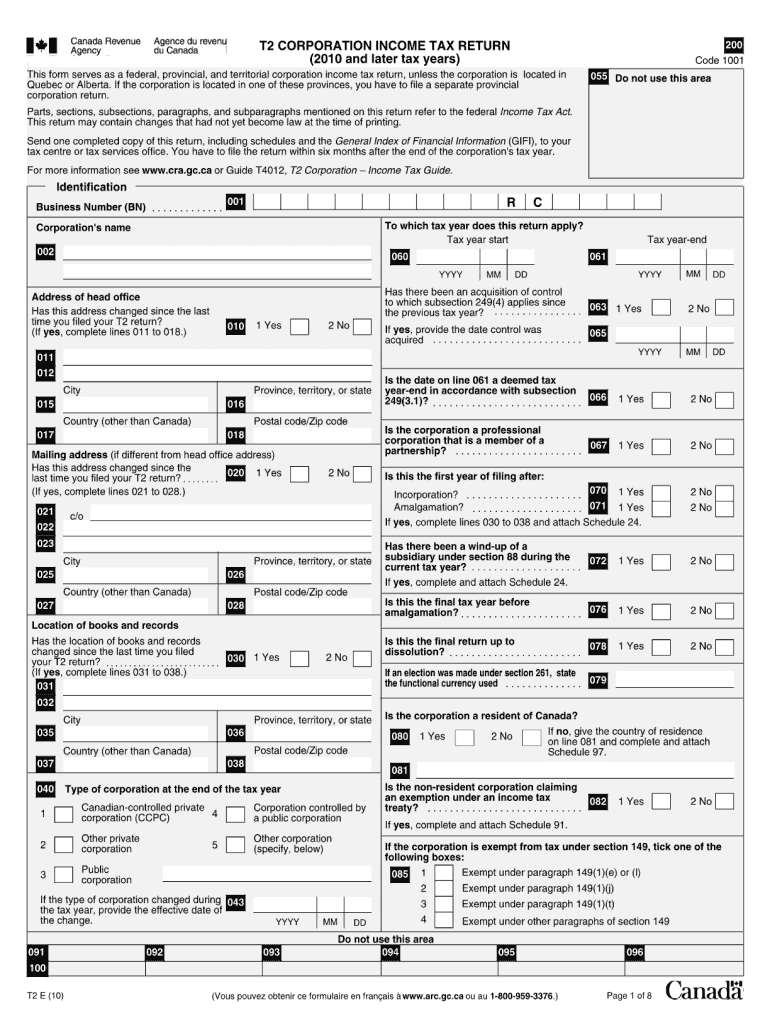

Canada T2 Corporation Income Tax Return 2010 free printable template

Get, Create, Make and Sign Canada T2 Corporation Income Tax Return

Editing Canada T2 Corporation Income Tax Return online

Uncompromising security for your PDF editing and eSignature needs

Canada T2 Corporation Income Tax Return Form Versions

How to fill out Canada T2 Corporation Income Tax Return

How to fill out Canada T2 Corporation Income Tax Return

Who needs Canada T2 Corporation Income Tax Return?

Instructions and Help about Canada T2 Corporation Income Tax Return

Hi my name is Kara Bertie I'm a chartered professional accountant serving clients located throughout the GTA in Ontario Canada in today's tutorial video I am going to show you how you can file your own tea to corporate income tax return for your small business generally I would recommend this only if you have a very small business with simple business expenses and no really tax complexities involved let's begin step 1 you need to compile the following basic statements a balance sheet income statement trial balance and general ledger you can use many free online accounting software's which can easily export these statements for you, I would recommend using waive accounting for the purposes of this tutorial video I have created sample statements you can see here I have a balance sheet within company name and the year-end date the statement details the assets of the company the liabilities and the shareholders' equity in addition there is also an income statement which details the revenues and expenses of the corporation it also calculates the net income which is revenue minus your expenses step 2 to download the schedules required go to Google and search t2 returns and schedules click on the first link from the CRA here you are provided all the PDF fillable files of corporate tax return schedules required to file a return in Canada no you will not need to follow all these schedules but only particular ones step 3 download the following schedules onto your computer for the purposes of this video I have downloaded all these schedules already you will need the t2 corporate income tax return schedule which is schedule 200 or commonly referred to as the jacket download also schedule 1 net income for income tax purposes schedule 8 capital cost allowance schedule 50 shareholder loan a shareholder information schedule 524 Ontario specialty types this schedule is not required unless you're filing a return for a corporation located in Ontario download also schedule 546 Corporations Information Act annual return for Ontario corporations again if you're not an entire Ontario corporation you do not need to file the schedule next download schedule 100 which is for the balance sheet schedule 125 which is the income statement and schedule 141 which is the notes' checklist download all of these schedules onto your computer as a PDF fillable step 4 now that you have all the schedules downloaded we can begin preparation of the tea to corporate tax return start by completing schedule 100 which is in putting the balance sheet you compiled earlier you can see I have inputted the company's corporation name business number and new end date these three things will be required to be inputted on every schedule of the corporate tax return this schedule is organized by assets liabilities shareholders equity and retained earnings these numbers have all been obtained from the financial statements compiled earlier the CRA provides a field code for each balance sheet item if you...

People Also Ask about

What is T 2 2023 benefit information?

What is a T2 form mean?

What is T2 benefits?

What is T2 form?

What is a T 2 document?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the Canada T2 Corporation Income Tax Return in Chrome?

How do I fill out the Canada T2 Corporation Income Tax Return form on my smartphone?

How do I complete Canada T2 Corporation Income Tax Return on an iOS device?

What is Canada T2 Corporation Income Tax Return?

Who is required to file Canada T2 Corporation Income Tax Return?

How to fill out Canada T2 Corporation Income Tax Return?

What is the purpose of Canada T2 Corporation Income Tax Return?

What information must be reported on Canada T2 Corporation Income Tax Return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.