Get the free Grant deed

Show details

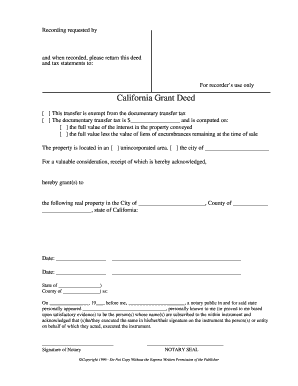

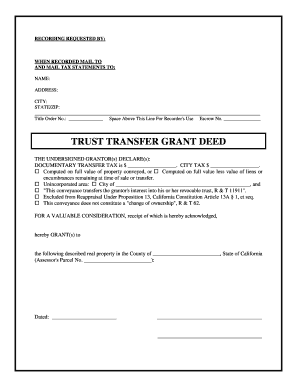

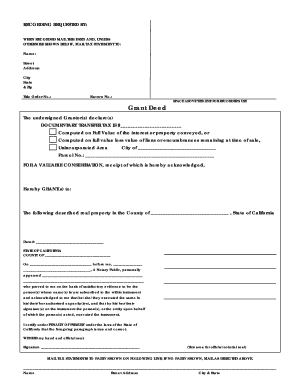

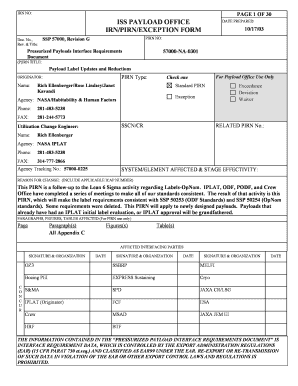

RECORDING REQUESTED BY AND WHEN RECORDED MAILTO SPACE ABOVE THIS LINE IS FOR RECORDER S USE A. P. N. Order No. Escrow No. GRANT DEED DOCUMENTARY TRANSFER TAX. Computed on the consideration or value of property conveyed OR Signature of Declarant or Agent determining tax - Firm Name FOR A VALUABLE CONSIDERATION receipt of which is hereby acknowledged hereby GRANT S to the real property in the City of County of State of California described as Dated STATE OF CALIFORNIA COUNTY OF personally...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign grant deed

Edit your grant deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your grant deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit grant deed online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit grant deed. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out grant deed

How to fill out grant deed:

01

Start by obtaining a blank grant deed form from your local county recorder's office or through an online legal document provider.

02

Gather all the necessary information, including the names and addresses of the grantor (current owner) and the grantee (new owner), the property's legal description, and the assessor's parcel number (APN).

03

Carefully read through the instructions on the grant deed form to ensure you understand the requirements and any specific formatting guidelines.

04

Fill in the grantor's information in the designated section of the form, including their full legal name and address.

05

Provide the grantee's information accurately, including their complete legal name and address.

06

Write down the property's legal description in the appropriate field. This information is usually found on the property's original deed or the latest tax bill.

07

Include the APN number, which is assigned by the local assessor's office and identifies the property for tax purposes.

08

Review the completed grant deed form to ensure that all the information is filled out correctly and without any errors or omissions.

09

Have the grantor sign the grant deed in the presence of a notary public. The grantee's signature is typically not required but may be necessary depending on local regulations.

10

Submit the grant deed to the county recorder's office, along with any required fees, to officially record the transfer of ownership.

Who needs a grant deed?

01

Property owners who wish to transfer ownership of their property to another individual or entity.

02

Individuals or entities purchasing real estate or receiving property as a gift or inheritance.

03

Anyone involved in property transactions, such as buyers, sellers, and estate planners, to establish a clear and legal record of property ownership.

Fill

form

: Try Risk Free

People Also Ask about

What is the strongest form of deed?

What Is the Strongest Type of Deed? For real estate buyers, a general warranty deed provides greater protection than any other type of deed. While it's the best deed for the grantee, it gives the grantor the most liability.

Why is grant deed important?

A grant deed is used to transfer ownership of real property, often in conjunction with tax or foreclosure sales. It offers more protection to the buyer than a quitclaim deed but less than a general warranty deed.

Is a grant deed different from a title?

California law allows the use of three different types of deeds to convey title to real estate. A grant deed is the middle-level deed because it includes more guarantees of title than a quitclaim deed but few guarantees than a warranty deed. The grant deed is also sometimes known as the special warranty deed.

What is the difference between a deed and a grant deed?

Deed. Deeds are valuable to buyers because they provide certain protections regarding the sale of property. A grant deed is a deed that “grants” certain promises to the buyer: The property has not already been transferred to someone else.

What is the best deed a grantee can receive?

General warranty deeds give the grantee the most protection, special warranty deeds give the grantee more limited protection, and a quitclaim deed gives the grantee the least protection under the law.

What is the meaning of grant deed?

What Is a Grant Deed? A grant deed, also known as a special or limited warranty deed, is a legal document used to transfer real estate between a previous owner (the grantor) and a new owner (the grantee).

Is grant deed the same as title?

California law allows the use of three different types of deeds to convey title to real estate. A grant deed is the middle-level deed because it includes more guarantees of title than a quitclaim deed but few guarantees than a warranty deed. The grant deed is also sometimes known as the special warranty deed.

What is the difference between gift deed and grant deed?

Gift Deed – A gift deed is a special type of grant deed that “gifts” ownership of real property interest to another person or entity. This deed is different from a standard grant deed because it specifically designates that the transfer was not subject to a sale, and the grantor received no monetary compensation.

Is a grant deed a gift?

They usually convey the title in fee simple, and they typically include the word “grant” in their operative language. They are, however, unique in that they are “gifts.” They are transfers of title to property without anything given in return.

Do you need a lawyer to transfer a deed in Texas?

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

How do I transfer a property title to a family member in Texas?

A real estate deed in Texas must be in written form and needs to include the following items in order to be legally binding: Names of both the grantor and the grantee. A statement from the grantor explaining that they're transferring ownership of the property to the grantee. A legal and accurate property description.

What are the requirements for a deed in Texas?

However, Texas does have certain requirements in order for a deed to be deemed valid. For example, the parties should be named, the intent to convey property must be clear from the wording, the property must be sufficiently described, and the deed must be signed and acknowledged by the grantor.

How do I transfer property to a family member tax free Texas?

In order to gift a house or other real estate to a family member, the current owner of the property will need to sign a Gift Deed to give the property to the family member.

How do you transfer ownership of a property from a parent to a child in Texas?

When a property owner wants to transfer property title to any family member, such as a parent, child, brother, sister, aunt, uncle, niece, nephew, or spouse, the property owner simply needs to sign a Warranty Deed to transfer the property. You cannot simply scratch out a name on a prior deed and write in the new name.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify grant deed without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your grant deed into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for signing my grant deed in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your grant deed and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete grant deed on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your grant deed, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is grant deed?

A grant deed is a legal document used to transfer ownership of real property from one party to another.

Who is required to file grant deed?

The grantor, or the person selling or transferring the property, is required to file a grant deed.

How to fill out grant deed?

To fill out a grant deed, you will need to include the names of the grantor and grantee, a legal description of the property, and any other relevant information.

What is the purpose of grant deed?

The purpose of a grant deed is to officially transfer ownership of real property from one party to another.

What information must be reported on grant deed?

Information such as the names of the grantor and grantee, legal description of the property, and any additional terms or conditions of the transfer.

Fill out your grant deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Grant Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.