IRS 1040-X 2007 free printable template

Instructions and Help about IRS 1040-X

How to edit IRS 1040-X

How to fill out IRS 1040-X

About IRS 1040-X 2007 previous version

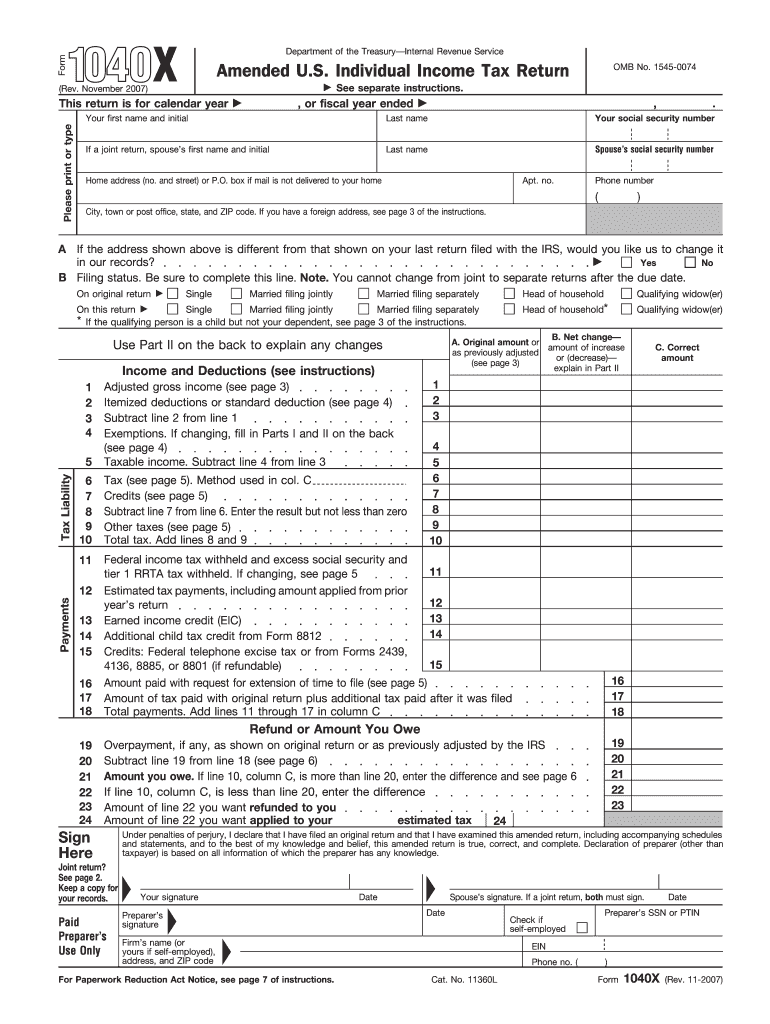

What is IRS 1040-X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040-X

What should I do if my amended 1040x 2007 form is rejected?

If your 1040x 2007 form is rejected, carefully review the rejection codes or reasons provided. Correct any errors and resubmit promptly, ensuring to double-check all information for accuracy to avoid recurring issues.

How can I track the status of my 1040x 2007 form after submission?

To track the status of your submitted 1040x 2007 form, you may utilize the IRS online tools or contact their support for updates. It usually takes several weeks for the IRS to process amendments, so patience is essential during this period.

Are there specific requirements for e-signing my 1040x 2007 form?

Yes, when filing an e-amended 1040x 2007 form, ensure that your e-signature complies with IRS regulations. Typically, this means you must use an accepted e-filing software that supports electronic signatures and guarantees data security.

What common mistakes should I avoid when submitting the 1040x 2007 form?

Common mistakes include not providing all the necessary supporting documents, failing to sign the form, or miscalculating entries. Avoid these by double-checking all details and confirming compliance with IRS guidelines before submission.

What should I prepare if I receive a notice related to my 1040x 2007 form?

If you receive a notice concerning your 1040x 2007 form, gather all pertinent documentation, such as previous returns and evidence supporting your amendments. Respond promptly and clearly, addressing all issues raised by the IRS to facilitate a smooth resolution.

See what our users say