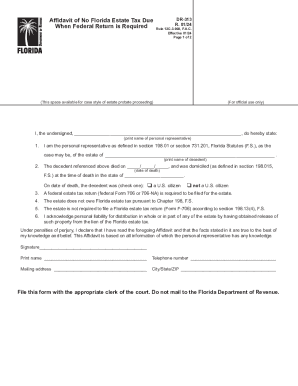

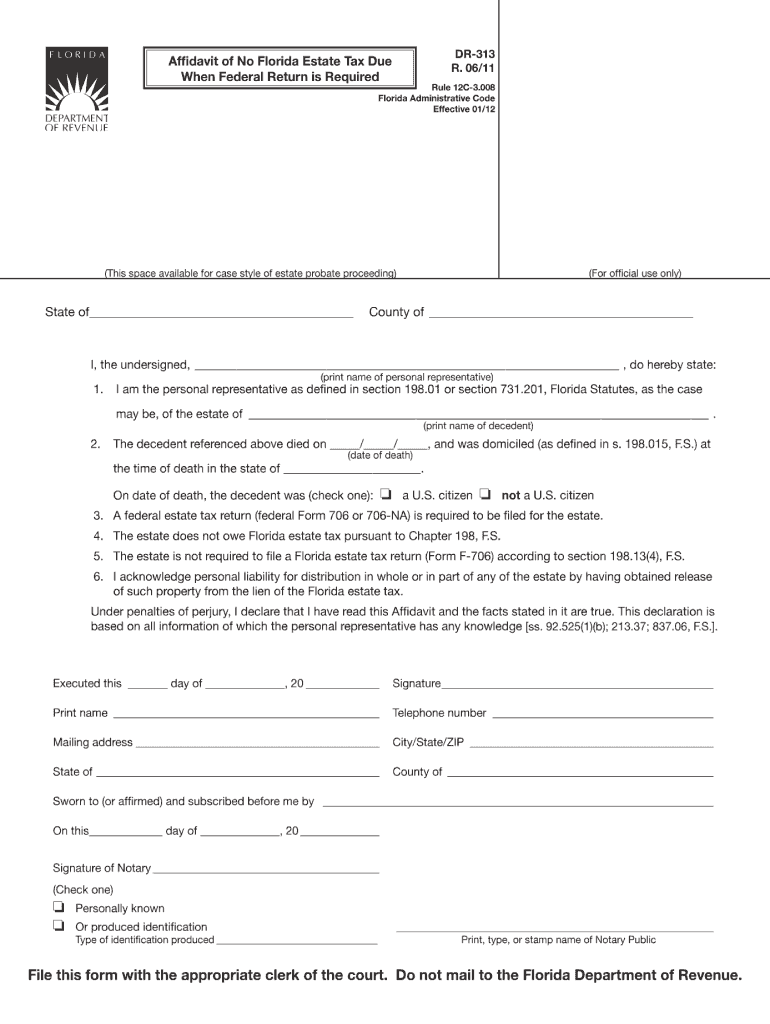

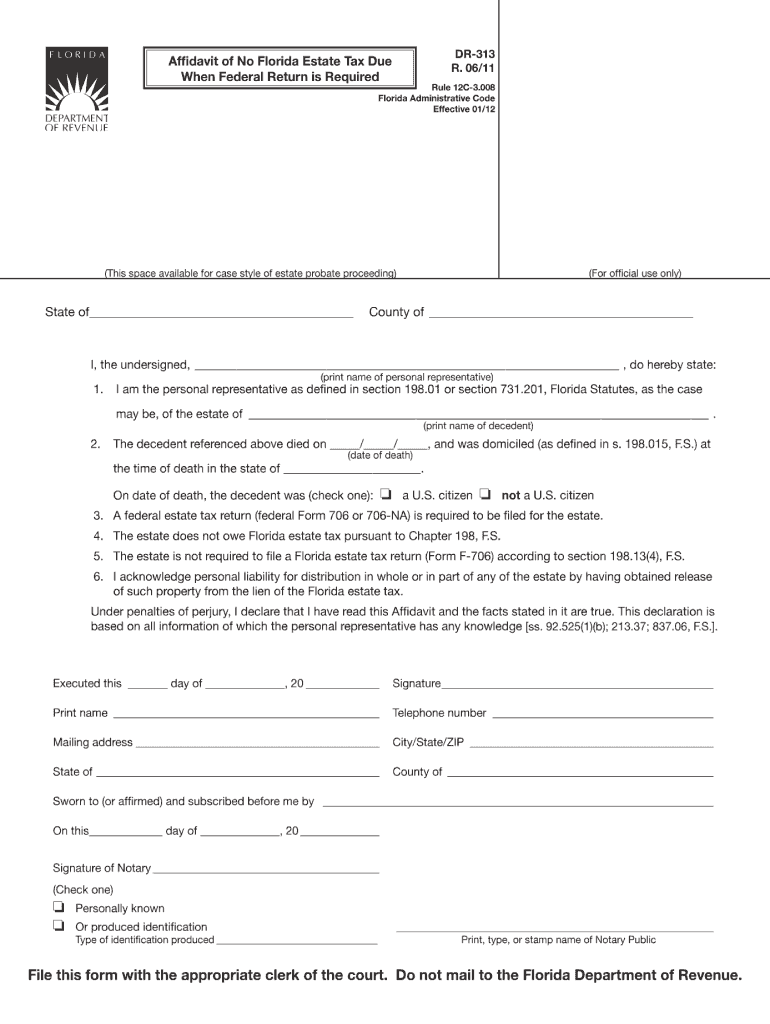

FL DoR DR-313 2011 free printable template

Show details

B) Estates that are not required to file federal Form 706 or 706A, should use form DR-312, Affidavit of No. Florida Estate Tax Due. When to Use Form DR-313 ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DoR DR-313

Edit your FL DoR DR-313 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DoR DR-313 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL DoR DR-313 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit FL DoR DR-313. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DoR DR-313 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DoR DR-313

How to fill out FL DoR DR-313

01

Begin by downloading the FL DoR DR-313 form from the Florida Department of Revenue website.

02

Enter your name and contact information in the designated sections.

03

Fill out the identification number and address fields accurately.

04

Provide details about the type of exemption you are applying for in the specified section.

05

Include any relevant supporting documentation or information as required.

06

Review the form for any errors or missing information before submitting.

07

Sign and date the form at the bottom to certify the information is correct.

08

Submit the completed form to the appropriate Florida Department of Revenue office.

Who needs FL DoR DR-313?

01

Individuals or businesses seeking a specific tax exemption in Florida.

02

Property owners applying for property tax exemptions.

03

Non-profit organizations requesting exemption based on their tax-exempt status.

Fill

form

: Try Risk Free

People Also Ask about

Where can I find Florida probate forms?

Printable Probate forms can be accessed from the left side menu or the Sixth Judicial Circuit's website. These forms are also available for purchase at both of our Legal Resource Center locations. Forms listed on this site are not an attempt by the Clerk & Comptroller to practice law or give legal advice.

Can I do my own probate in Florida?

Do I Need a Lawyer for Florida Probate? Yes, in almost all cases you will need a Florida Probate Lawyer. Except for “disposition without administration” (very small estates) and those estates in which the executor (personal representative) is the sole beneficiary, Florida law requires the assistance of an attorney.

Where do I file a will in Manatee County Florida?

Manatee County Clerk of Circuit Court 1115 Manatee Avenue West, Bradenton, FL 34205. 1115 Manatee Avenue West, Bradenton, FL 34205. (941) 749-1800.

Where to purchase Florida probate forms?

To purchase this product or to learn more please call 1-888-AT-LEXIS.

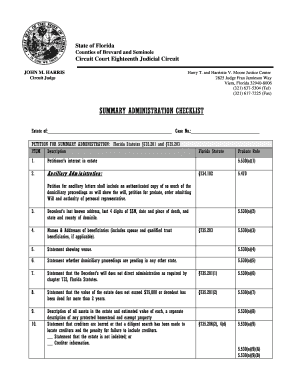

What is a summary administration form for probate in Florida?

The Petition for Summary Administration is a document used for Summary Administration. This is a more “expedited” version of probate. Summary administration is only available if the estate is valued at less than $75,000 worth of assets or in cases where the decedent has been deceased for more than two years.

What is a Petition for formal probate in Florida?

The Petition for Administration is the document filed in a Florida probate court seeking to open the estate of a deceased person. The Petition seeks a couple of things. First, it seeks to have a Will–if there is one–admitted to probate. If there is no Will, then it seeks to open an intestate estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit FL DoR DR-313 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including FL DoR DR-313, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I get FL DoR DR-313?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific FL DoR DR-313 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out the FL DoR DR-313 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign FL DoR DR-313 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is FL DoR DR-313?

FL DoR DR-313 is a form used by the Florida Department of Revenue to report certain tax-related information regarding sales and use taxes.

Who is required to file FL DoR DR-313?

Businesses and individuals who are required to report and remit sales and use taxes in Florida must file FL DoR DR-313.

How to fill out FL DoR DR-313?

To fill out FL DoR DR-313, provide accurate business information, detail your taxable sales and exempt sales, calculate the tax due, and include any relevant attachments.

What is the purpose of FL DoR DR-313?

The purpose of FL DoR DR-313 is to report sales and use taxes collected by businesses in Florida to ensure compliance with state tax laws.

What information must be reported on FL DoR DR-313?

Information that must be reported includes the total sales, taxable sales, exempt sales, tax collected, and any adjustments or credits.

Fill out your FL DoR DR-313 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DoR DR-313 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.