Get the free When Form 2290 Taxes are DueInternal Revenue Service - IRS.gov

Show details

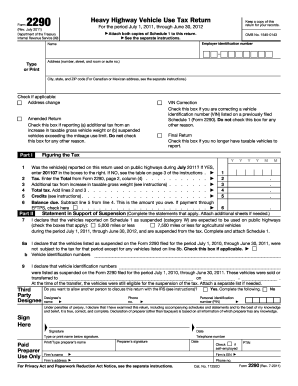

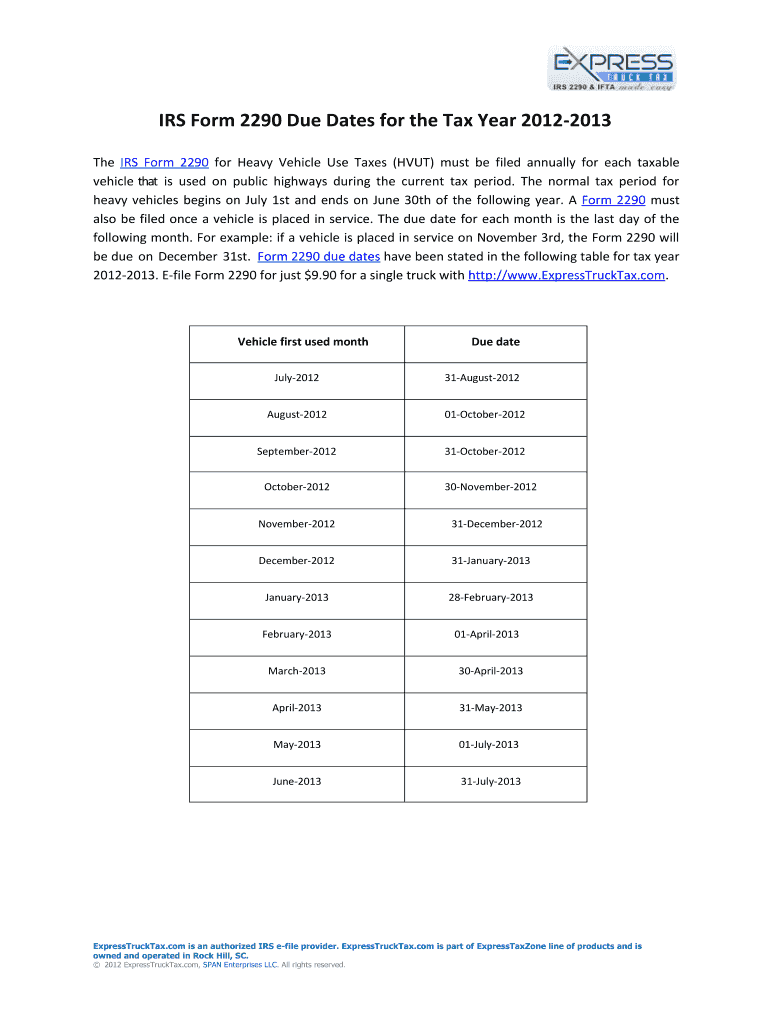

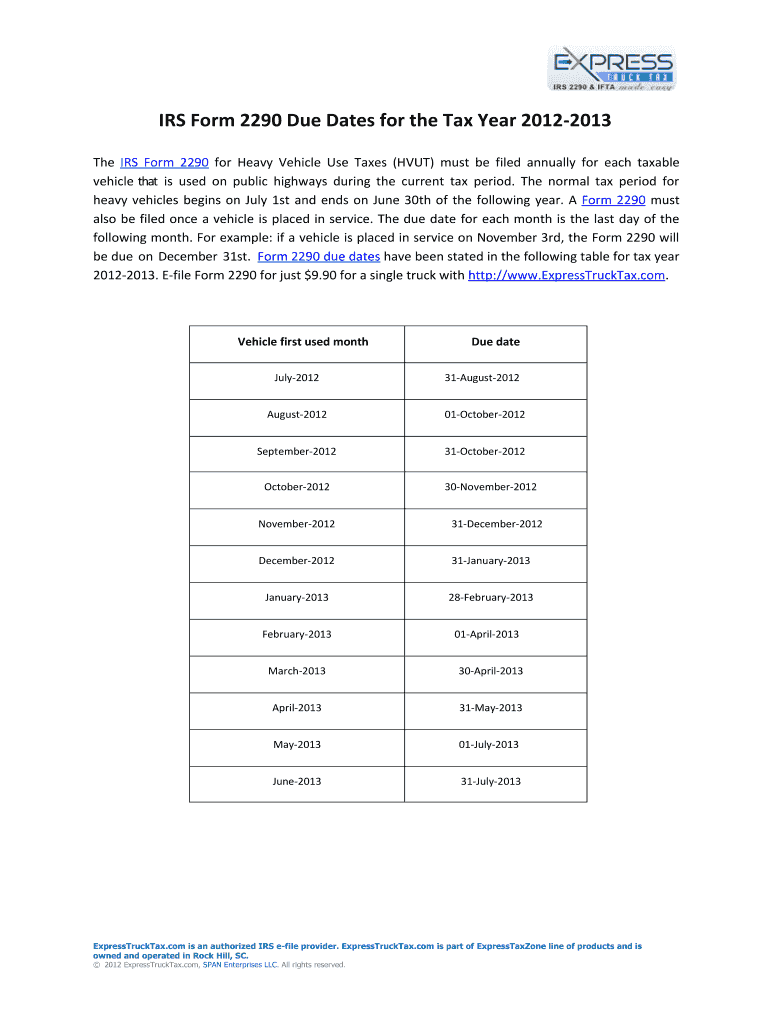

Form 2290 due dates have been stated in the following table for tax year 2012-2013. E-file Form 2290 for just 9. IRS Form 2290 Due Dates for the Tax Year 2012-2013 The IRS Form 2290 for Heavy Vehicle Use Taxes HVUT must be filed annually for each taxable vehicle that is used on public highways during the current tax period. The normal tax period for heavy vehicles begins on July 1st and ends on June 30th of the following year. A Form 2290 must also be filed once a vehicle is placed in...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign when form 2290 taxes

Edit your when form 2290 taxes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your when form 2290 taxes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing when form 2290 taxes online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit when form 2290 taxes. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out when form 2290 taxes

How to fill out Form 2290 taxes:

01

Gather necessary information: Start by collecting all the required information, such as your Employer Identification Number (EIN), Vehicle Identification Number (VIN), and details of the vehicles you are filing for.

02

Download or obtain the Form 2290: Visit the official website of the Internal Revenue Service (IRS) and locate Form 2290. You can either download a printable version or request a copy to be sent to you.

03

Complete the form: Fill out the necessary fields in Form 2290. This includes providing your personal information, EIN, vehicle details, and the tax period for which you are filing.

04

Calculate the tax amount: Use the information provided regarding the taxable weight of your vehicles to calculate the tax amount owed. The IRS provides a tax table to assist you with this calculation.

05

Sign and date the form: Ensure that the form is signed and dated to validate your submission. Unsigned or undated forms may be considered incomplete and could lead to issues with your tax filing.

06

Submit the form to the IRS: Once you have completed all the necessary steps and double-checked your information, you can send the completed Form 2290 to the IRS. There are several methods for submission, including mailing the form or electronically filing it. Choose the method that best suits your needs.

Who needs to fill out Form 2290 taxes:

01

Truck owners: If you own a heavy vehicle weighing 55,000 pounds or more and use it on public highways, you are required to file Form 2290 and pay the Heavy Highway Vehicle Use Tax (HVUT).

02

Businesses with heavy vehicles: Companies or businesses that own and operate heavy vehicles are also responsible for filing Form 2290 and paying the HVUT.

03

Agricultural vehicles: Even though certain agricultural vehicles may qualify for reduced or exemption rates, they still need to file Form 2290 to report the vehicle's information.

Remember, it's always a good idea to consult the IRS guidelines or seek professional advice if you are unsure about your specific tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

How early can you file 2290?

The filing season for Form 2290 filers is July 1 through June 30. The filing deadline for Form 2290 is based on the month you first use the taxable vehicle on public highways during the reporting period.

When can I file 2290 for 2023?

John must file Form 2290 by August 31, 2022, for the period beginning July 1, 2022, through June 30, 2023.

How do I know when my 2290 is due?

1. When is the Form 2290 due date? The IRS Form 2290 due date for Heavy Vehicle Use Taxes (HVUT) is on August 31 of every year. The current tax period for heavy highway vehicles begins on July 1, 2023, and ends on June 30, 2024.

What happens if you file 2290 late?

The penalty for failing to file your IRS Form 2290 by the deadline is equal to 4.5% of the total tax amount due, and the penalty will increase monthly for up to five months.

How do I pay my 2290 online?

With e-file, you'll receive it almost immediately after we accept your e-filed Form 2290. Step 1: Gather Your Information. Employer Identification Number. Step 2: Choose a 2290 e-file Provider and File. Step 3: Choose a Payment Option.

What are the due dates for Form 2290?

What is the IRS Form 2290 due date? If you have vehicles with a combined gross weight of 55,000 pounds or more, the IRS requires you to file Heavy Vehicle Use Tax Form 2290 each year by August 31.

When can I file my 2290 for 2022?

Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. The current period begins July 1, 2022, and ends June 30, 2023. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Note.

Can you pay 2290 on IRS website?

Pay. You must pay the tax in full with your Form 2290. Pay your taxes by credit card or debit card. You can pay by internet, phone or mobile device whether you e-file or mail your return.

How do you fill out a 2290?

0:36 2:14 Learn How to Fill the Form 2290 Internal Revenue Service Tax YouTube Start of suggested clip End of suggested clip And if yes enter 2 0 1 1 0 7 on line 1. Using. The tax grid on the second page of the form 2290MoreAnd if yes enter 2 0 1 1 0 7 on line 1. Using. The tax grid on the second page of the form 2290 determine the tax rate of your vehicle. Using the weight of your vehicle.

How do I pay my 2290 tax?

You can pay by internet, phone or mobile device. Electronic Funds Withdrawal. You can authorize a direct debit as part of the e-file process. Electronic Federal Tax Payment System (EFTPS).

How to fill out 2290 form?

0:36 2:14 Learn How to Fill the Form 2290 Internal Revenue Service Tax YouTube Start of suggested clip End of suggested clip And if yes enter 2 0 1 1 0 7 on line 1. Using. The tax grid on the second page of the form 2290MoreAnd if yes enter 2 0 1 1 0 7 on line 1. Using. The tax grid on the second page of the form 2290 determine the tax rate of your vehicle. Using the weight of your vehicle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my when form 2290 taxes directly from Gmail?

when form 2290 taxes and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit when form 2290 taxes on an Android device?

You can make any changes to PDF files, like when form 2290 taxes, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I complete when form 2290 taxes on an Android device?

Use the pdfFiller mobile app and complete your when form 2290 taxes and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is when form 2290 taxes?

Form 2290 is used to report and pay the federal vehicle use tax to the IRS.

Who is required to file when form 2290 taxes?

Anyone who owns and operates a heavy highway motor vehicle with a gross weight of 55,000 pounds or more is required to file Form 2290 and pay the tax.

How to fill out when form 2290 taxes?

Form 2290 can be filled out electronically through the IRS website or by paper form. The form requires information about the vehicle, including VIN number, taxable gross weight, and payment information.

What is the purpose of when form 2290 taxes?

The purpose of Form 2290 is to collect the federal vehicle use tax which is used to maintain and improve the highways.

What information must be reported on when form 2290 taxes?

Information such as the vehicle's VIN number, taxable gross weight, and payment information must be reported on Form 2290.

Fill out your when form 2290 taxes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

When Form 2290 Taxes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.