AR Instructions ET-1 2012 free printable template

Show details

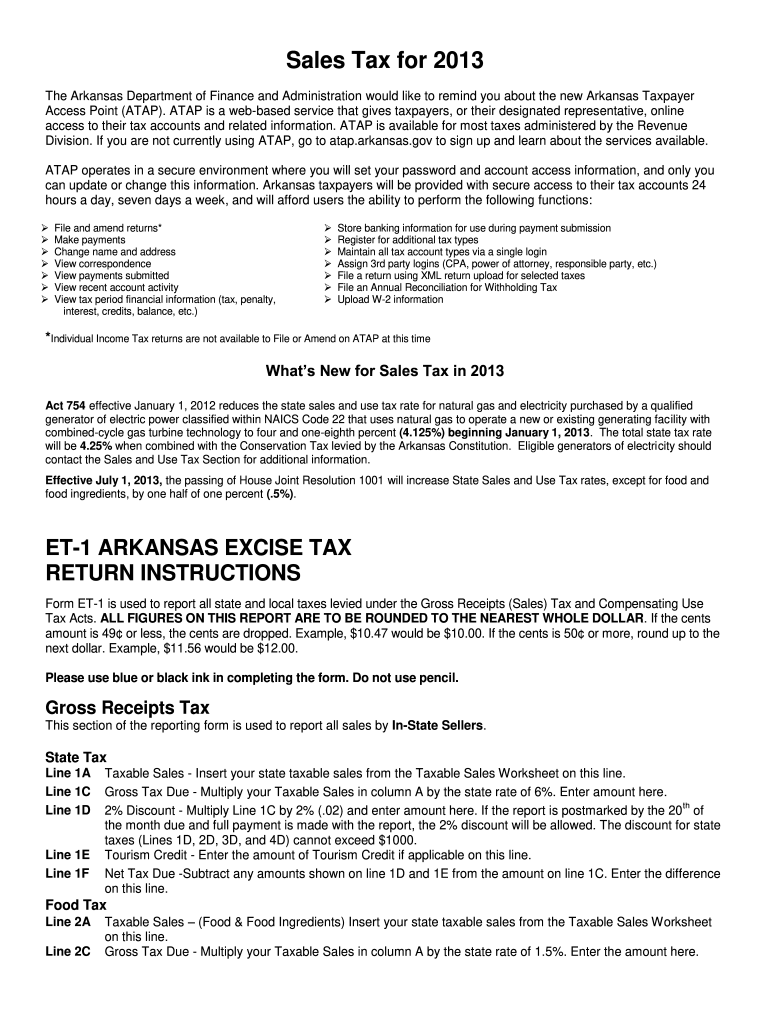

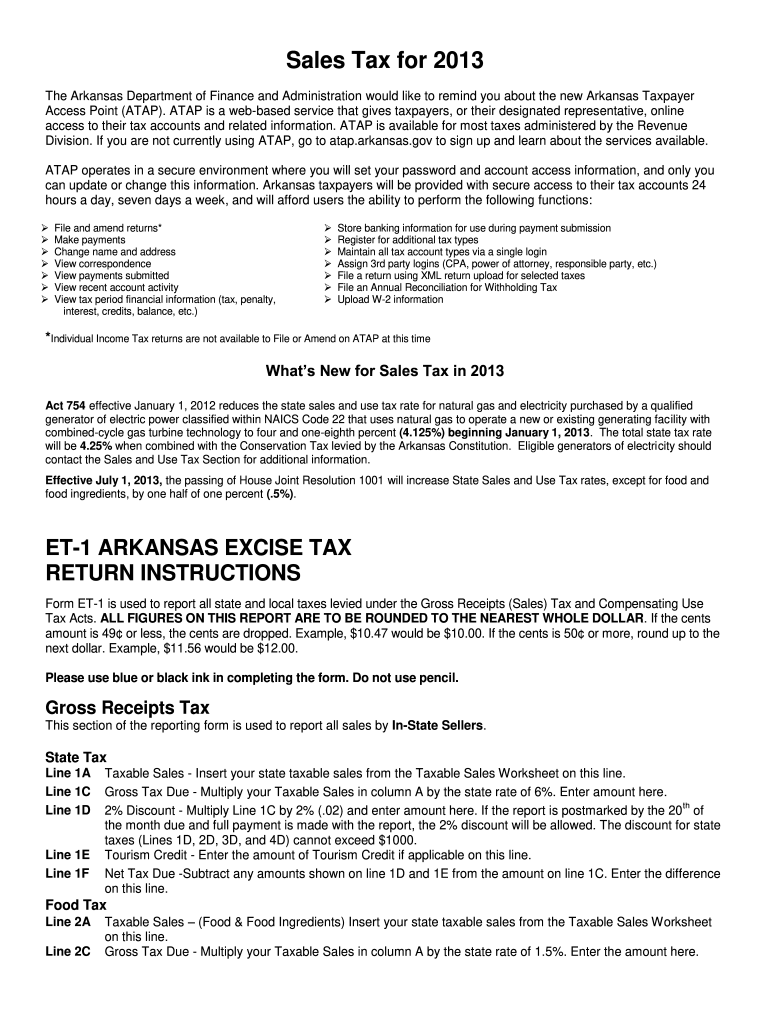

5. ET-1 ARKANSAS EXCISE TAX RETURN INSTRUCTIONS Form ET-1 is used to report all state and local taxes levied under the Gross Receipts Sales Tax and Compensating Use Tax Acts. Gov/. Tax Types reported on form ET-1 Below are brief descriptions of the taxes remitted and collected on form ET-1. For further information on the collection of these taxes please visit our Web site www. arkansas. gov/salestax or contact our office at 501 682-7104. Failure to attach your explanations will delay the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AR Instructions ET-1

Edit your AR Instructions ET-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AR Instructions ET-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AR Instructions ET-1 online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AR Instructions ET-1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR Instructions ET-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AR Instructions ET-1

How to fill out AR Instructions ET-1

01

Begin by gathering all necessary personal information, including your name, address, and contact details.

02

Locate the section for your social security number and enter it accurately.

03

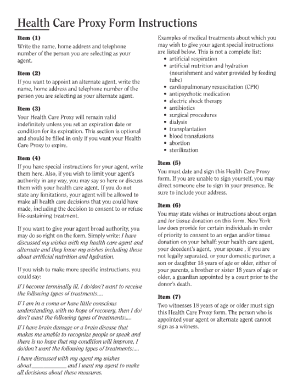

Review the instructions for the specific purpose of AR Instructions ET-1 to understand any additional requirements.

04

Proceed to fill out any income or employment information as required.

05

Double-check all entries for accuracy and completeness before finalizing the form.

06

Submit the form according to the instructions, whether electronically or by mail.

Who needs AR Instructions ET-1?

01

Individuals applying for specific benefits or services that require AR Instructions ET-1.

02

Anyone who needs to report their financial information or personal details for administrative purposes.

03

Applicants for state or federal assistance programs that necessitate filling out this particular form.

Fill

form

: Try Risk Free

People Also Ask about

What is excise tax Arkansas?

The Arkansas sales tax is 6.5% of the gross receipts from the sales of tangible personal property and certain selected services.

Do I really need to make estimated tax payments?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Does Arkansas require estimated tax payments?

Arkansas follows the IRS standards for estimated payments. If you will owe $1000 or more in tax for the current year, you are required to make 90% of the tax due, over quarterly payments.

What is the economic nexus threshold in Arkansas?

Do you have economic nexus in Arkansas? Arkansas considers vendors who make more than $100,000 in sales annually or more than 200 transactions in the state to have economic nexus. This means the state considers these vendors obligated to collect sales tax from buyers in the state.

What is the standard deduction for Arkansas?

Arkansas standard deduction for tax year 2021 is $4,400 for married filing jointly and $2,200 for all other filers.

What is the standard deduction for 2023 in Arkansas?

The federal Tax Cuts and Jobs Act of 2017 (TCJA) increased the standard deduction (set at $13,850 for single filers and $27,700 for joint filers in 2023) while suspending the personal exemption by reducing it to $0 through 2025.

How much is standard deduction for seniors?

For the 2022 tax year, seniors filing single or married filing separately get a standard deduction of $14,700. For those who are married and filing jointly, the standard deduction for 65 and older is $25,900.

What is the easiest way to pay estimated taxes?

Using the Electronic Federal Tax Payment System (EFTPS) is the easiest way for individuals as well as businesses to pay federal taxes. Make ALL of your federal tax payments including federal tax deposits (FTDs), installment agreement and estimated tax payments using EFTPS.

How do I pay underpayment of estimated taxes?

Complete Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and TrustsPDF. Your income varies during the year. Complete Form 2210, Schedule AI, Annualized Income Installment Method PDF(found within the form).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify AR Instructions ET-1 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your AR Instructions ET-1 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an eSignature for the AR Instructions ET-1 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your AR Instructions ET-1 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out AR Instructions ET-1 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your AR Instructions ET-1. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is AR Instructions ET-1?

AR Instructions ET-1 refers to the specific guidelines and forms required for the reporting and filing of certain taxes in Arkansas. It is a document that guides individuals and businesses on how to comply with the state's tax regulations.

Who is required to file AR Instructions ET-1?

Typically, individuals and businesses that engage in activities requiring tax reporting in Arkansas are required to file AR Instructions ET-1. This includes businesses that meet certain income thresholds or have specific tax obligations as defined by the state.

How to fill out AR Instructions ET-1?

To fill out AR Instructions ET-1, follow these steps: gather necessary financial documents, complete the form with accurate income and deduction information, ensure that all required signatures are included, and submit it by the specified deadline.

What is the purpose of AR Instructions ET-1?

The purpose of AR Instructions ET-1 is to provide a standardized method for reporting specific income or tax-related information to the Arkansas Department of Finance and Administration. It aims to streamline the tax return process and ensure compliance with state laws.

What information must be reported on AR Instructions ET-1?

The information that must be reported on AR Instructions ET-1 includes the taxpayer's identification information, details about income earned, deductions claimed, credits applied, and any additional relevant tax information as required by Arkansas law.

Fill out your AR Instructions ET-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AR Instructions ET-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.