AR Instructions ET-1 2012 free printable template

Show details

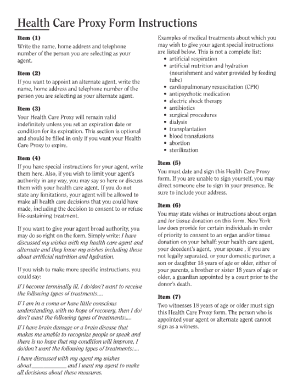

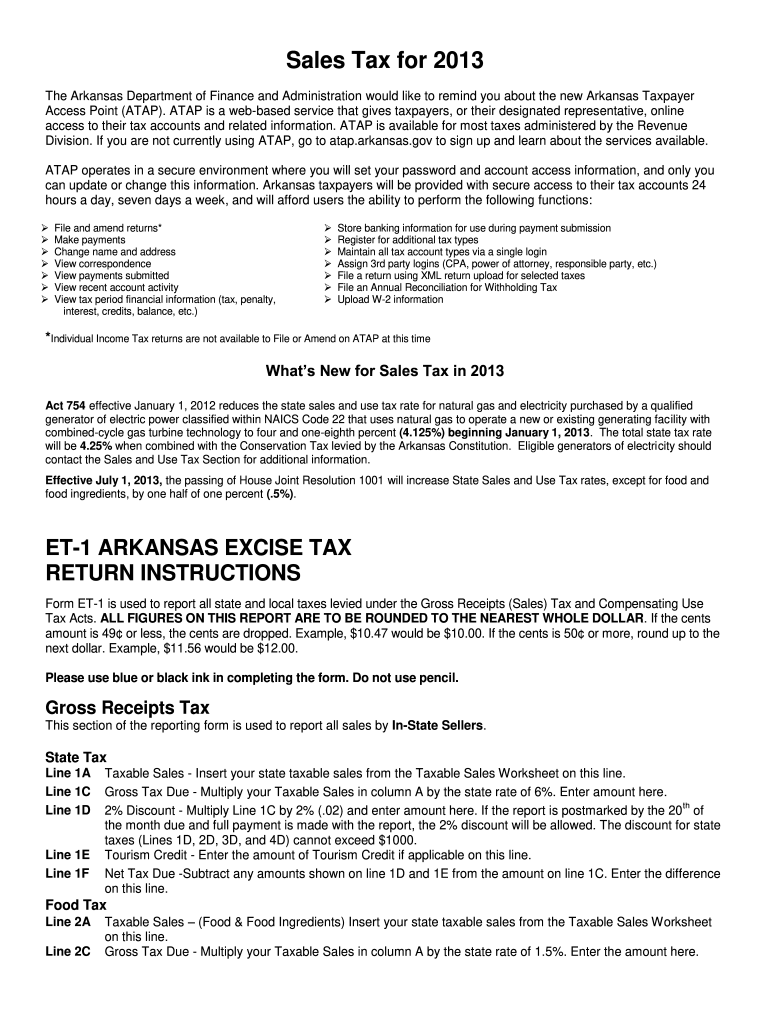

5. ET-1 ARKANSAS EXCISE TAX RETURN INSTRUCTIONS Form ET-1 is used to report all state and local taxes levied under the Gross Receipts Sales Tax and Compensating Use Tax Acts. Gov/. Tax Types reported on form ET-1 Below are brief descriptions of the taxes remitted and collected on form ET-1. For further information on the collection of these taxes please visit our Web site www. arkansas. gov/salestax or contact our office at 501 682-7104. Failure to attach your explanations will delay the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your arkansas et fill 2012 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arkansas et fill 2012 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arkansas et fill online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit arkansas 1 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

AR Instructions ET-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out arkansas et fill 2012

How to fill out Arkansas ET fill:

01

Start by accessing the Arkansas ET fill website or application.

02

Create an account or log in to your existing account.

03

Select the type of form you need to fill out from the available options.

04

Read the instructions carefully to understand the requirements and gather all the necessary information and documents.

05

Begin filling out the form by providing the requested personal information such as name, address, contact details, etc.

06

Follow the prompts to input additional details specific to the form you are filling out.

07

Double-check your entries for accuracy and completeness before proceeding.

08

If required, attach any supporting documents electronically as per the instructions provided.

09

Review all the information entered and make any necessary edits or corrections.

10

Save your progress periodically to ensure you don't lose any work.

11

Once you have completed filling out the form, review it once again to make sure everything is accurate and complete.

12

Sign the form electronically or print it out and sign it manually, depending on the instructions provided.

13

Follow the submission instructions to submit your completed form online or through the appropriate channels.

14

Keep a copy of the submitted form for your records.

Who needs Arkansas ET fill:

01

Individuals who need to fill out various types of forms required by the state of Arkansas.

02

Businesses and organizations operating in Arkansas that may have specific form requirements.

03

Anyone seeking to apply for licenses, permits, or certifications in Arkansas.

04

Residents of Arkansas who need to submit certain documents or information to state agencies.

05

Students applying for scholarships or financial aid in Arkansas.

06

Voters in Arkansas who need to complete voter registration or absentee ballot forms.

07

Individuals or organizations involved in legal matters requiring the completion of specific Arkansas forms.

08

Anyone needing to update personal information with Arkansas government agencies.

Overall, anyone who has a legal or administrative obligation that necessitates completing forms requested by the state of Arkansas will need to use the Arkansas ET fill system.

Video instructions and help with filling out and completing arkansas et fill

Instructions and Help about arkansas et form

Fill et 1 form arkansas excise tax return : Try Risk Free

People Also Ask about arkansas et fill

What is excise tax Arkansas?

Do I really need to make estimated tax payments?

Does Arkansas require estimated tax payments?

What is the economic nexus threshold in Arkansas?

What is the standard deduction for Arkansas?

What is the standard deduction for 2023 in Arkansas?

How much is standard deduction for seniors?

What is the easiest way to pay estimated taxes?

How do I pay underpayment of estimated taxes?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file arkansas et fill?

Individuals who meet the following criteria are required to file an Arkansas state income tax return:

1. Residents of Arkansas who have a gross income that exceeds the state's filing threshold.

2. Non-residents of Arkansas who earned income from Arkansas sources that exceeds the state's filing threshold.

3. Part-year residents who meet either of the above criteria.

The filing thresholds may vary each year, so it's important to consult the current year's tax forms or the Arkansas Department of Finance and Administration for specific details.

What information must be reported on arkansas et fill?

The Arkansas ET-1 form, also known as the Motor Fuel Tax Return, must include the following information:

1. Account Information: Business name, address, contact information, account number, and filing period.

2. Fuel Type: Specify the type of fuel purchased and used, such as gasoline, diesel, bio-diesel, or compressed natural gas (CNG).

3. Fuel Volume: Report the number of gallons or cubic feet of fuel consumed or sold during the filing period.

4. Purchaser/Consumer Information: Provide the name, address, and tax identification number (TIN) of the purchaser or consumer of the fuel.

5. Vehicle Information: Include the vehicle identification number (VIN), license plate number, and state of registration for each qualifying vehicle.

6. Miles Traveled: Report the total number of miles traveled by each qualifying vehicle during the filing period.

7. Tax Calculation: Calculate the fuel tax owed based on the Arkansas motor fuel tax rates and the volume of fuel consumed or sold.

8. Additional Information: Provide any additional information required by the Arkansas Department of Finance and Administration (DFA) for proper tax administration.

It is important to consult the official Arkansas DFA guidelines and instructions for accurate and up-to-date reporting requirements.

When is the deadline to file arkansas et fill in 2023?

The deadline to file Arkansas state taxes in 2023 is April 17th. This is the typical deadline for filing federal taxes as well, but it may vary slightly depending on weekends and holidays. It's advisable to verify the exact deadline closer to the tax year 2023.

What is the penalty for the late filing of arkansas et fill?

The penalty for late filing of an Arkansas ET-1 (Employer’s Quarterly Contribution and Wage Report) is 2% of the total unpaid contributions for each month or fraction of a month that the report is overdue. It should be noted that these penalties can accumulate up to a maximum of 20%. Additionally, interest is also charged on the unpaid contributions at a rate determined by the Arkansas Division of Workforce Services. It is important to file the ET-1 report on time to avoid penalties and interest.

How can I modify arkansas et fill without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your arkansas 1 form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an eSignature for the arkansas excise tax return in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your arkansas et 1 form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out arkansas excise tax return et 1 form 2021 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your arkansas et form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your arkansas et fill 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arkansas Excise Tax Return is not the form you're looking for?Search for another form here.

Keywords relevant to arkansas excise tax return form et 1

Related to form et 1 arkansas

If you believe that this page should be taken down, please follow our DMCA take down process

here

.