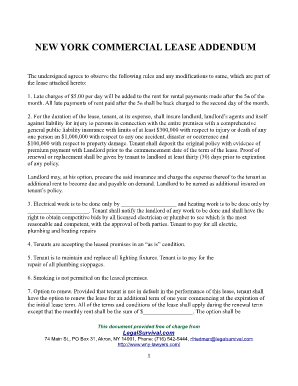

NYS DMV MV-327 2011 free printable template

Show details

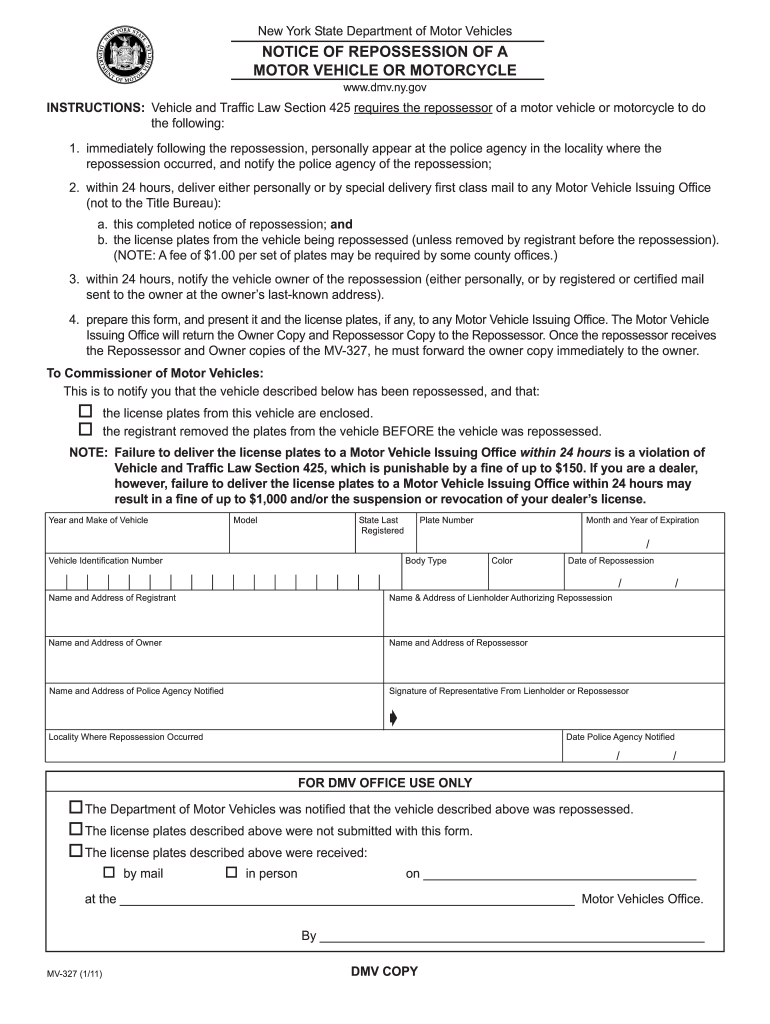

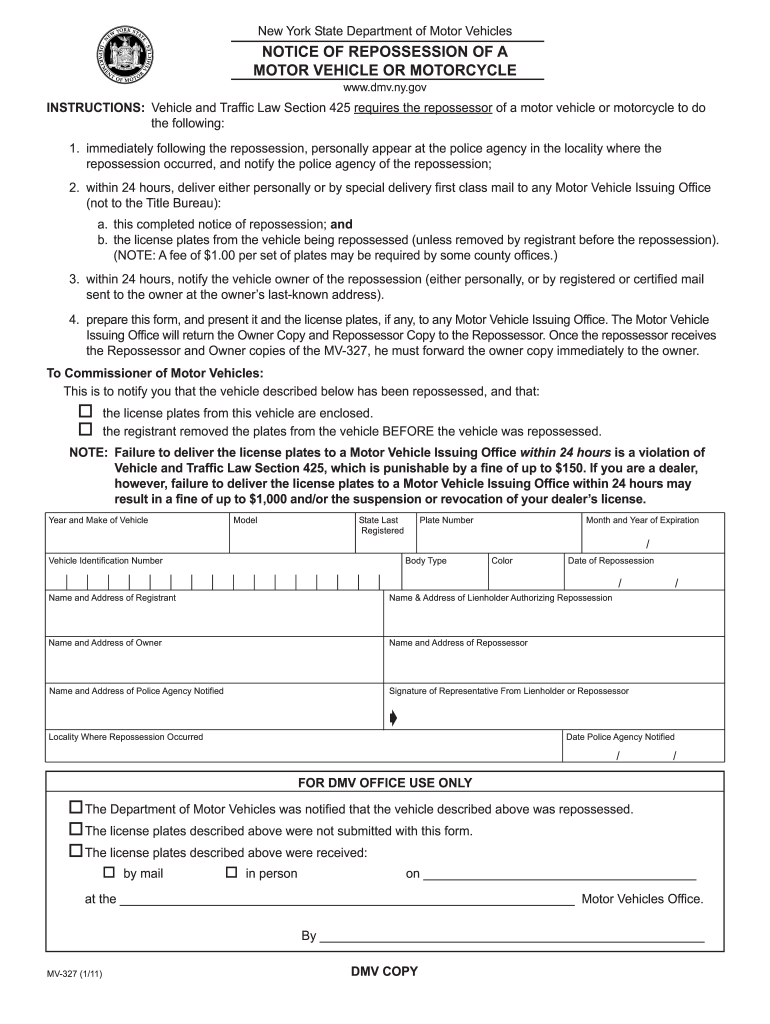

Once the repossessor receives the Repossessor and Owner copies of the MV-327 he must forward the owner copy immediately to the owner. New York State Department of Motor Vehicles NOTICE OF REPOSSESSION OF A MOTOR VEHICLE OR MOTORCYCLE www. dmv*ny. gov INSTRUCTIONS Vehicle and Traffic Law Section 425 requires the repossessor of a motor vehicle or motorcycle to do the following 1. immediately following the repossession personally appear at the police agency in the locality where the repossession...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NYS DMV MV-327

Edit your NYS DMV MV-327 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NYS DMV MV-327 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NYS DMV MV-327 online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NYS DMV MV-327. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NYS DMV MV-327 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NYS DMV MV-327

How to fill out NYS DMV MV-327

01

Obtain a copy of the NYS DMV MV-327 form from the DMV website or your local DMV office.

02

Fill out the top section with your personal information, including your name, address, and driver's license number.

03

Provide details about the vehicle, such as make, model, year, and VIN.

04

Complete the sections related to any prior accidents or damages if applicable.

05

Have the form signed by a licensed inspector or authorized individual if required.

06

Make sure to double-check all the information for accuracy.

07

Submit the completed form to the appropriate DMV office either in person or via mail.

Who needs NYS DMV MV-327?

01

Individuals applying for a duplicate or replacement title for their vehicle in New York State.

02

Owners of vehicles that have undergone changes that require them to validate the existing title information.

Instructions and Help about NYS DMV MV-327

Fill

form

: Try Risk Free

People Also Ask about

Is New York a right to cure state?

In some states, borrowers are allowed to cure their default within a specified time frame. Curing the default means catching up on payments, and it's a way to avoid auto repossession. But in New York, your car is up for repossession as soon as you're in default.

How many days can you be late on a repossession?

Two or three consecutive missed payments can lead to repossession, which damages your credit score. And some lenders have adopted technology to remotely disable cars after even one missed payment. You have options to handle a missed payment, and your lender will likely work with you to find a solution.

What happens if you get behind on car payments?

If you ignore your lender's notifications and continue missing your car payments, your car will eventually get repossessed. Remember that auto loans are secured, and your car is used as collateral. That means your lender has the full legal right to repossess your vehicle if you stop making the agreed monthly payments.

What to do if you get behind on car payments?

Four tips to get back on track if you're behind on your auto loan Call your lender as soon as you know you will fall behind on your payments. Ask if you can change your payment due date. Work with your lender to develop a payment plan. Think about whether your vehicle is still affordable.

How late can I be on my car payment before they repo it?

Two or three consecutive missed payments can lead to repossession, which damages your credit score. And some lenders have adopted technology to remotely disable cars after even one missed payment. You have options to handle a missed payment, and your lender will likely work with you to find a solution.

What are the repossession laws in New York?

If the consumer has paid off 60 percent or more of their loan, the creditor has to sell the vehicle within 90 days. However, if the consumer has not paid off at least 60 percent of their loan, the creditor can choose to keep the vehicle instead of selling it.

What to do if your car is repossessed in New York?

1. Immediately following the repossession, personally appear at the police agency in the locality where the repossession occurred, and notify the police agency of the repossession; 2. Within 11 days, personally deliver or mail by first class mail to any Motor Vehicles office (not to the Title Bureau): a.

What happens if I'm 5 days late on my car payment?

You may be charged a late fee if your payment arrives outside of the grace period. Typically, auto lenders wait 30 days after your payment due date to report the payment as late to the credit bureaus.

Can you get another car if your behind on payments?

You can sometimes trade in a vehicle if you're behind on your loan payments – but it may depend on how far behind you are. If the lender is already trying to recover what you owe them by taking the car, chances are you won't get the financing you're looking for. It all depends on your equity situation.

What to do if you can't pay your car payment?

Can't Afford Your Car Payment? Here's What to Do Contact Your Lender. Request a Deferral. Refinance Your Car Loan. Trade In or Sell Your Vehicle. Voluntarily Surrender It. Instant Action to Take Now if You Can't Afford Your Car Payment.

Is charge off the same as repo?

“When a car gets repossessed as the result of payment delinquency, the lender will sell the vehicle and put that money toward the balance of the loan. A charge-off means that the lender has determined your debt to be uncollectible, but you're still in ownership of the vehicle.

What happens to a repo after 7 years?

Other Ways To Improve Your Credit As time passes, your car repossession will fall to the bottom of your credit report, until seven years have passed and it is removed from your history completely. In the meantime, you can improve your score and repair your credit history by paying off loans on time.

How long can you go before your car gets repossessed?

Two or three consecutive missed payments can lead to repossession, which damages your credit score. And some lenders have adopted technology to remotely disable cars after even one missed payment. You have options to handle a missed payment, and your lender will likely work with you to find a solution.

What happens if you don't pay deficiency balance?

If you refuse to pay, the debt will most likely be sold to collections. But either the lender or the collector can choose to file a lawsuit against you, which could result in a wage garnishment, a levy against your bank account or a lien against your other property.

What are the repossession laws in New York State?

If the consumer has paid off 60 percent or more of their loan, the creditor has to sell the vehicle within 90 days. However, if the consumer has not paid off at least 60 percent of their loan, the creditor can choose to keep the vehicle instead of selling it.

Can a charged off auto loan be reinstated?

If you don't have the funds to redeem the vehicle by paying off the loan in full, you might be able to get the car back through reinstatement. To reinstate the car loan, you bring the loan current by making up all of the past-due payments, including applicable fees and late charges, in one lump sum.

Is New York a right to cure state?

Before ultimately making the decision to terminate, the non-performing contractor must be given an opportunity to cure its breach. The opportunity to cure a breach of contract is a well established and fundamental right, routinely recognized by New York courts[1].

What happens when your car is repossessed in NY?

You will have a right to know when and where the sale will take place, as well as the right to bid on the car and try to buy it back. If you have paid more than 60% of the loan when your car is repossessed, then your lender must auction the car within 90 days.

How many months can you be behind on your car payment?

Most lenders won't begin repossession until you've missed three or more payments. Although there usually is a grace period between 60 and 90 days, a more staunch lender has the right to give notice of repossession for even one missed payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the NYS DMV MV-327 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your NYS DMV MV-327 in seconds.

How can I fill out NYS DMV MV-327 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your NYS DMV MV-327. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I complete NYS DMV MV-327 on an Android device?

Use the pdfFiller app for Android to finish your NYS DMV MV-327. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is NYS DMV MV-327?

NYS DMV MV-327 is a form used by the New York State Department of Motor Vehicles to report a change of address for vehicle registration or driver's license.

Who is required to file NYS DMV MV-327?

Any individual who changes their address and wants to update their vehicle registration or driver's license with the New York State DMV is required to file NYS DMV MV-327.

How to fill out NYS DMV MV-327?

To fill out NYS DMV MV-327, provide your current address, the new address you are moving to, your vehicle information, and your contact details. Follow the instructions on the form carefully.

What is the purpose of NYS DMV MV-327?

The purpose of NYS DMV MV-327 is to officially notify the New York State DMV of a change of address to ensure that vehicle registration and driver's license records are accurate and up to date.

What information must be reported on NYS DMV MV-327?

The information that must be reported on NYS DMV MV-327 includes your current address, new address, vehicle information (like make, model, and VIN), and your personal identification details.

Fill out your NYS DMV MV-327 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NYS DMV MV-327 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.