Get the free P1045 2000. Tax Professionals Program Application and Product Order Blanks for Tax Y...

Show details

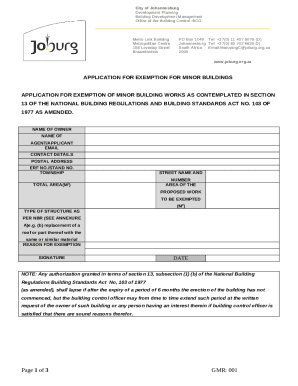

EXPEDITE 2000 PUBLICATION 1045 PROCESSING BY ON-LINE ORDERING Federal Tax Forms CD-ROM (Publication 1796) Order from National Technical Information Service at www.irs.gov/cdorders for $21.00 TAX Professionals

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign p1045 2000 tax professionals

Edit your p1045 2000 tax professionals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your p1045 2000 tax professionals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit p1045 2000 tax professionals online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit p1045 2000 tax professionals. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out p1045 2000 tax professionals

How to fill out p1045 2000 tax professionals:

01

Gather all necessary documents: Make sure you have all relevant tax forms, income statements, receipts, and any other supporting documentation needed for filing your taxes.

02

Understand the form: Familiarize yourself with the layout and instructions of the p1045 2000 tax professionals form. Read through the instructions carefully to ensure you understand each section and the information required.

03

Provide personal information: Fill in your name, address, Social Security number, and any other personal information as requested on the form.

04

Enter income information: Report your income accurately, including wages, tips, business income, rental income, investments, and any other sources of income. Follow the instructions to properly calculate and report each income category.

05

Deductions and credits: Take advantage of any deductions and credits you may be eligible for. This can include expenses related to education, home ownership, medical expenses, or charitable contributions. Carefully follow the instructions for each deduction and credit to ensure accurate reporting.

06

Double-check for accuracy: Review all the information you have entered to make sure it is accurate and complete. Any errors or omissions could result in penalties or delays in processing your tax return.

07

Sign and date the form: Once you have completed all sections, sign and date the p1045 2000 tax professionals form. If filing jointly, both spouses must sign.

08

Submit the form: Depending on your filing method, either mail the form to the appropriate tax authority or submit it electronically using an online tax filing service or software.

Who needs p1045 2000 tax professionals:

01

Individuals with complex financial situations: If your taxes involve multiple sources of income, extensive deductions, or special circumstances such as owning a business or rental properties, p1045 2000 tax professionals may be necessary to accurately navigate the complexities of tax laws and regulations.

02

High-income earners: Individuals with high levels of income may benefit from the expertise of p1045 2000 tax professionals who can ensure that tax planning strategies are effectively utilized to minimize tax liabilities.

03

Small business owners: Small business owners often face unique tax challenges, such as reporting business income, managing deductions, and complying with self-employment tax requirements. p1045 2000 tax professionals can provide valuable guidance and ensure compliance with tax laws specific to business owners.

04

Individuals seeking professional advice: Even if your tax situation is relatively straightforward, you may still choose to seek the assistance of p1045 2000 tax professionals to ensure accuracy and maximize potential deductions or credits. Their expertise and knowledge can provide peace of mind and potentially lead to greater tax savings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit p1045 2000 tax professionals online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your p1045 2000 tax professionals and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for signing my p1045 2000 tax professionals in Gmail?

Create your eSignature using pdfFiller and then eSign your p1045 2000 tax professionals immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit p1045 2000 tax professionals on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign p1045 2000 tax professionals on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is p1045 tax professionals program?

The p1045 tax professionals program is a program specifically designed for tax professionals. It provides them with resources and training to better understand and navigate the tax system.

Who is required to file p1045 tax professionals program?

The p1045 tax professionals program is not something that is filed. It is a program that tax professionals can choose to participate in to enhance their knowledge and skills in tax preparation.

How to fill out p1045 tax professionals program?

As the p1045 tax professionals program is not something that is filled out, there is no specific process to follow for filling it out. Tax professionals interested in the program can visit the official website or contact the relevant authorities for more information on how to participate.

What is the purpose of p1045 tax professionals program?

The purpose of the p1045 tax professionals program is to provide tax professionals with the necessary resources and training to effectively serve their clients and stay updated on the latest developments in tax laws and regulations.

What information must be reported on p1045 tax professionals program?

As the p1045 tax professionals program is not a filing requirement, there is no specific information that needs to be reported on it. It is a voluntary program for tax professionals.

Fill out your p1045 2000 tax professionals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

p1045 2000 Tax Professionals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.