Get the free Publication 1167 (Rev. 3-2007). General Rules and Specifications for Substitute Form...

Show details

Revenue Procedure 2007-24 Reprinted from IR Bulletin 2007-11 Dated March 12, 2007, Publication 1167 General Rules and Specifications for Substitute Forms and Schedules IRS Department of the Treasury

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign publication 1167 rev 3-2007

Edit your publication 1167 rev 3-2007 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 1167 rev 3-2007 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing publication 1167 rev 3-2007 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit publication 1167 rev 3-2007. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out publication 1167 rev 3-2007

01

To fill out publication 1167 rev 3-2007, you need to have a complete understanding of its purpose and requirements. This publication is specifically designed for individuals or companies involved in tax reporting and compliance.

02

Start by familiarizing yourself with the specific instructions provided in the publication. It is essential to read through each section carefully to ensure accurate completion and compliance with the necessary regulations.

03

Gather all the relevant financial and tax-related documents that are required for the reporting process. These documents may include income statements, expense records, receipts, and any other relevant documentation.

04

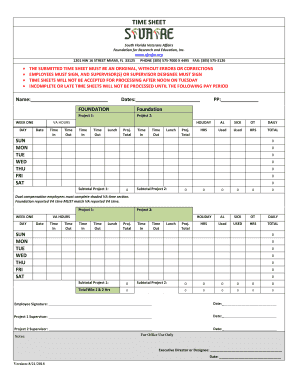

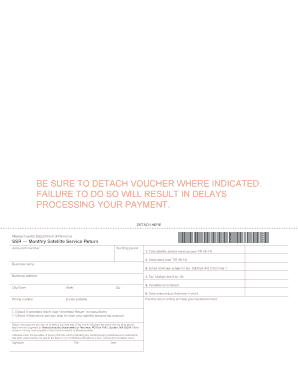

Review the form and identify the specific sections that need to be completed. The publication may have various sections, each dedicated to different aspects of tax reporting or compliance. Pay close attention to any additional schedules or supporting forms that may be required.

05

Fill out the form in accordance with the provided instructions. Ensure that all the required information is accurately entered, and be cautious of any specific formatting guidelines such as dates, currency, or numerical representations.

06

Double-check all the entered information before finalizing the form. Mistakes or inaccuracies can lead to potential issues or delays in tax processing or compliance. Take the time to verify the accuracy of names, addresses, financial figures, and any other relevant details.

07

Once you have completed the form, sign and date it where required. Depending on the specific instructions, there may be additional signatures or certifications needed from authorized individuals or representatives.

08

Make copies of the completed form and any supporting documentation for your records. It is essential to retain these documents for future reference or potential audits.

Who needs publication 1167 rev 3-2007?

01

Individuals or companies involved in tax reporting and compliance require publication 1167 rev 3-2007. This publication provides the necessary instructions and guidelines for accurately completing the required forms and ensures compliance with tax regulations.

02

This publication may be particularly relevant for taxpayers who need to report their income, expenses, or deductions for the purposes of calculating their tax liability. It may also be required by businesses or organizations that maintain specific financial records and are obligated to adhere to tax reporting requirements.

03

Additionally, tax professionals, accountants, or individuals responsible for preparing and submitting tax forms on behalf of others may find publication 1167 rev 3-2007 useful. It offers detailed instructions and insights into the correct completion of the form, ensuring accurate reporting and compliance with tax laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is publication 1167 rev 3?

Publication 1167 rev 3 is a tax form used by individuals and businesses to report certain financial transactions.

Who is required to file publication 1167 rev 3?

Individuals and businesses who engage in specific financial transactions are required to file publication 1167 rev 3.

How to fill out publication 1167 rev 3?

To fill out publication 1167 rev 3, you need to provide the required information about your financial transactions in the designated sections of the form. Consult the instructions provided with the form for detailed guidance.

What is the purpose of publication 1167 rev 3?

The purpose of publication 1167 rev 3 is to ensure compliance with tax laws by reporting certain financial transactions.

What information must be reported on publication 1167 rev 3?

Publication 1167 rev 3 requires the reporting of specific details about the financial transactions, such as the date, nature of the transaction, and the monetary value.

Can I create an electronic signature for the publication 1167 rev 3-2007 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your publication 1167 rev 3-2007.

Can I create an electronic signature for signing my publication 1167 rev 3-2007 in Gmail?

Create your eSignature using pdfFiller and then eSign your publication 1167 rev 3-2007 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I fill out publication 1167 rev 3-2007 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your publication 1167 rev 3-2007. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your publication 1167 rev 3-2007 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Publication 1167 Rev 3-2007 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.