Get the free E-Invoicing / E-Billing

Show details

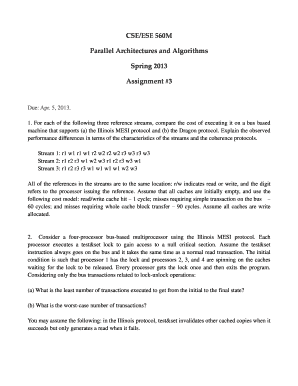

September 24 and 25, 2012. Hilton Hotel. Berlin ... Standardizing E-Invoice infrastructure across some 500,000 companies in the Nordics. — Eliminating paper .... How established companies (utilities/telecoms/insurance/credit)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign e-invoicing e-billing

Edit your e-invoicing e-billing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your e-invoicing e-billing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit e-invoicing e-billing online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit e-invoicing e-billing. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out e-invoicing e-billing

How to fill out e-invoicing e-billing:

01

Gather necessary information: Before filling out an e-invoice or e-billing, you need to gather all the relevant information such as your business details, customer details, invoice number, payment terms, itemized list of products or services provided, and any applicable taxes or discounts.

02

Choose the right format: Depending on the e-invoicing platform or software you are using, you may have different options for the format of your invoice. Select the appropriate format that meets your business needs and complies with local regulations.

03

Input your business details: Start by entering your business's name, address, contact information, and tax identification number. These details are essential for identifying your company as the sender of the invoice.

04

Enter customer details: Include your customer's name, address, and contact details. Ensure that the information is accurate to avoid any issues with delivery or payment.

05

Add invoice number and date: Every e-invoice should have a unique identifier to track and manage payments efficiently. Assign an invoice number and specify the date of the billing.

06

Provide payment terms: Clearly state the terms of payment, including the due date, accepted payment methods, and any applicable late payment penalties or discounts for early payment.

07

Itemize products or services: List each product or service provided, along with a description, quantity, price per unit, and total amount. Make sure to calculate subtotals and include any applicable taxes.

08

Include additional charges or discounts: If there are any additional charges or discounts, such as shipping fees or promotional offers, mention them separately to provide transparency to your customer.

09

Calculate the total amount: Sum up all the individual totals, including taxes and any additional charges or discounts, to determine the final amount payable. Double-check your calculations to avoid errors.

10

Review and proofread: Take a moment to review the completed e-invoice for any errors or typos. Ensure that all the information is accurate and consistent.

11

Send the e-invoice: Once you are satisfied with the invoice, send it through the chosen e-invoicing platform or software. Make sure to follow any specific procedures or instructions provided by the platform.

Who needs e-invoicing e-billing:

01

Businesses of all sizes: E-invoicing and e-billing are beneficial for businesses of all sizes, from small startups to large enterprises. It allows them to streamline their invoicing processes, reduce paperwork, and enhance efficiency.

02

Freelancers and self-employed professionals: Freelancers and self-employed professionals often rely on timely payments, and e-invoicing e-billing enables them to create professional invoices quickly, track payment status, and maintain better financial records.

03

Service-based industries: Industries that offer services rather than physical products can greatly benefit from e-invoicing e-billing. It allows them to provide detailed billing information, track work hours, and easily generate invoices based on the services provided.

04

Businesses with international clients: E-invoicing e-billing can simplify invoicing procedures for businesses that have international clients. It eliminates the need for physical mail and facilitates faster payment processing across borders.

05

Companies seeking cost and time savings: Adopting e-invoicing e-billing can significantly reduce the costs and time associated with traditional invoicing methods. It eliminates printing, postage, and administrative tasks, enabling businesses to redirect their resources to more critical areas.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send e-invoicing e-billing for eSignature?

Once you are ready to share your e-invoicing e-billing, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for the e-invoicing e-billing in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your e-invoicing e-billing in seconds.

How do I edit e-invoicing e-billing straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing e-invoicing e-billing right away.

Fill out your e-invoicing e-billing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

E-Invoicing E-Billing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.