Get the free 2011 delaware s corporation instructions form - revenue delaware

Show details

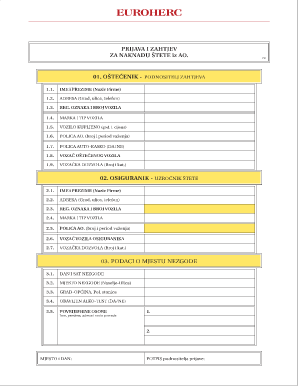

E.I. No. 1. Ordinary income (loss) from Federal Form 1120S, Schedule K, Line 1. 2. Apportionment percentage from Delaware Form 1100S, Schedule 1-D, Line 8 ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011 delaware s corporation

Edit your 2011 delaware s corporation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 delaware s corporation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

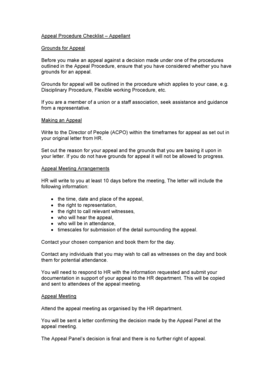

How to edit 2011 delaware s corporation online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2011 delaware s corporation. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011 delaware s corporation

How to fill out 2011 Delaware S Corporation:

Research and Understand the Requirements:

Before filling out the 2011 Delaware S Corporation form, it is important to thoroughly research and understand the requirements and obligations associated with forming an S Corporation in Delaware. Be sure to familiarize yourself with the eligibility criteria, tax obligations, and any other legal requirements.

Gather the Necessary Information:

To successfully fill out the 2011 Delaware S Corporation form, gather all the necessary information. This may include the corporation's name, principal office address, names and addresses of the directors and officers, as well as details about the company's authorized stock and shareholders.

Complete the Necessary Forms:

Obtain the 2011 Delaware S Corporation form, which can usually be found on the Delaware Secretary of State's website. Carefully fill out the form, providing accurate and up-to-date information. Ensure that all required fields are completed and that the information provided is correct.

Pay the Required Fees:

Delaware charges a fee for filing the 2011 S Corporation form. Review the current fee schedule and include the appropriate payment along with the completed form. Make sure to use the preferred payment method accepted by the Delaware Secretary of State.

Submit the Form:

Once the form is completely filled out and the fees are paid, submit the 2011 Delaware S Corporation form to the Delaware Secretary of State. Be mindful of any submission deadlines and ensure that the form reaches the correct office in a timely manner.

Who needs 2011 Delaware S Corporation?

Entrepreneurs and Small Business Owners:

Entrepreneurs and small business owners who want to form a corporation in Delaware may consider the 2011 Delaware S Corporation form. This type of corporation offers certain tax benefits and liability protections, making it an attractive option for those starting or expanding a business.

Individuals Seeking Protection from Personal Liability:

The 2011 Delaware S Corporation provides a level of personal liability protection to its shareholders. If you are an individual seeking to protect your personal assets and limit your liability to only your investment in the corporation, forming a Delaware S Corporation might be beneficial for you.

Companies Looking for Tax Advantages:

The 2011 Delaware S Corporation has a pass-through tax structure, meaning that the corporation itself does not pay federal income tax. Instead, the income is "passed through" to the shareholders and reported on their individual tax returns. This can result in potential tax advantages for the company and its shareholders.

Investors and Venture Capitalists:

Investors and venture capitalists interested in funding startups and small businesses often prefer to invest in Delaware S Corporations. Delaware is known for its business-friendly environment and well-established corporate law, making it an attractive choice for investors seeking opportunities with potential for growth and success.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 2011 delaware s corporation?

The editing procedure is simple with pdfFiller. Open your 2011 delaware s corporation in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out 2011 delaware s corporation using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign 2011 delaware s corporation. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit 2011 delaware s corporation on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share 2011 delaware s corporation from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is delaware s corporation instructions?

Delaware S Corporation Instructions provide guidance on how to file taxes for S Corporations in the state of Delaware.

Who is required to file delaware s corporation instructions?

S Corporations operating in the state of Delaware are required to file Delaware S Corporation Instructions.

How to fill out delaware s corporation instructions?

Delaware S Corporation Instructions can be filled out by following the instructions provided by the Delaware Division of Revenue.

What is the purpose of delaware s corporation instructions?

The purpose of Delaware S Corporation Instructions is to ensure that S Corporations in Delaware accurately report their income and pay the correct amount of taxes.

What information must be reported on delaware s corporation instructions?

Delaware S Corporation Instructions typically require information on the corporation's income, deductions, credits, and other relevant financial data.

Fill out your 2011 delaware s corporation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 Delaware S Corporation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.