Get the free k cns 010

Show details

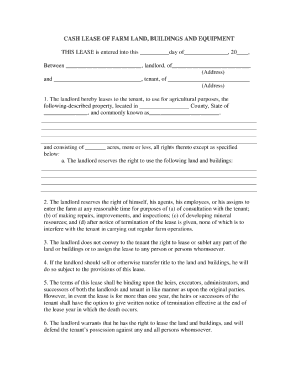

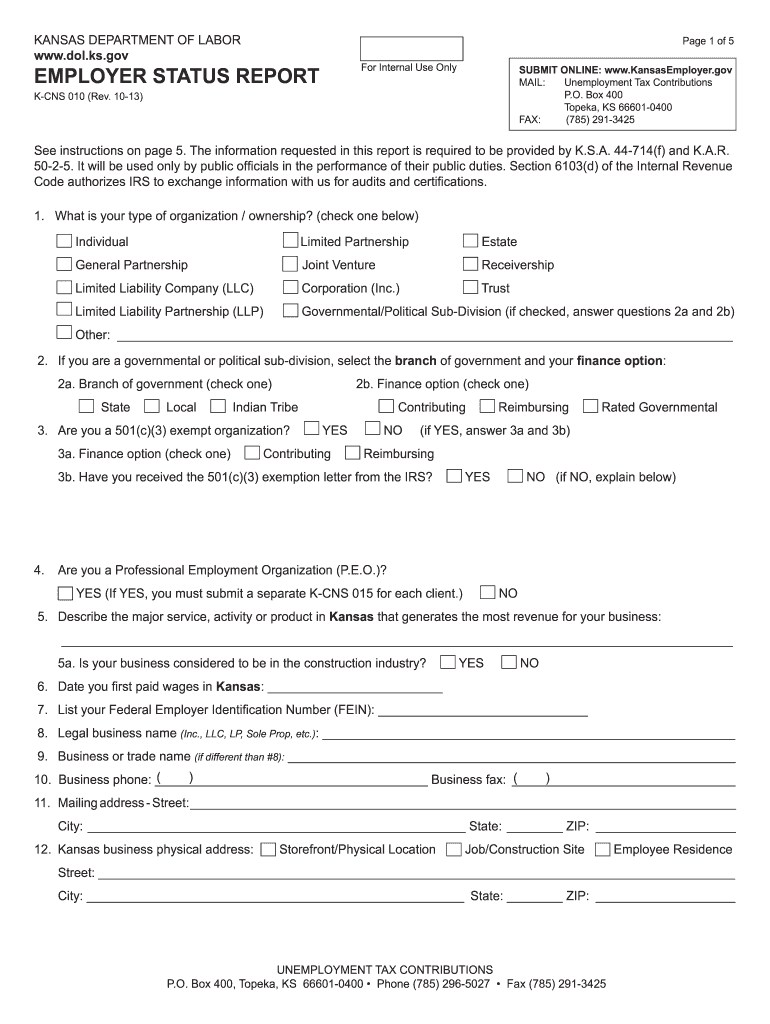

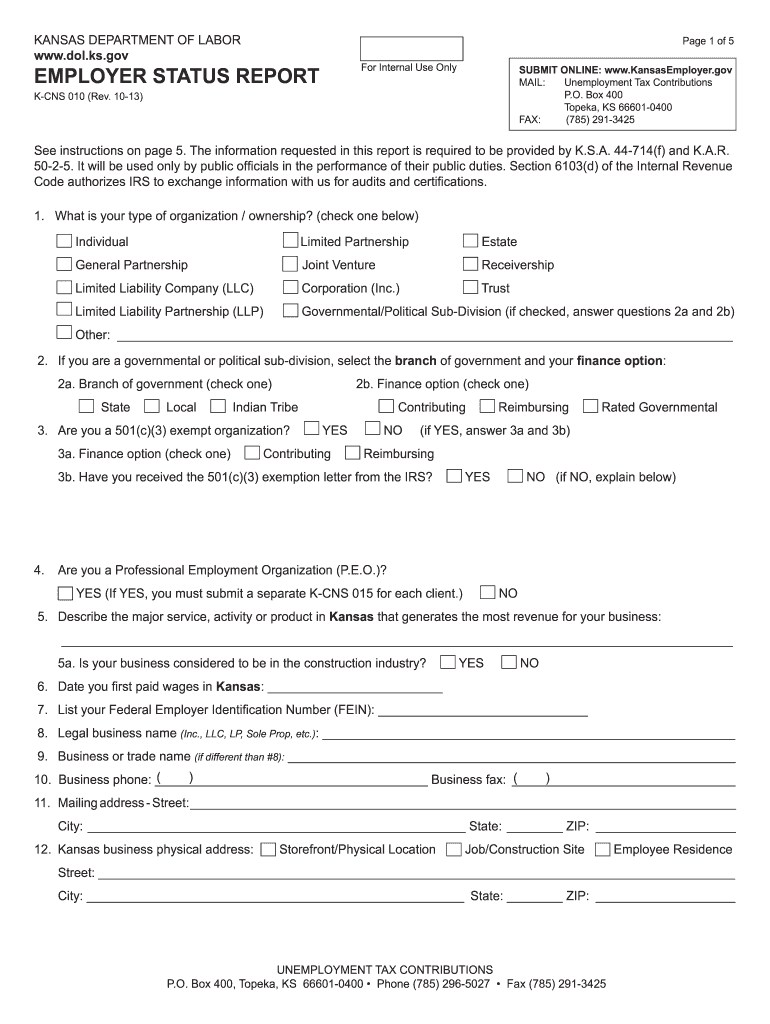

KansasEmployer. gov MAIL Unemployment Tax Contributions P. O. Box 400 Topeka KS 66601-0400 FAX 785 291-3425 K-CNS 010 Rev. 10-13 See instructions on page 5. If YES you must complete a K-CNS 015 for each client that you represent. 5. Describe your major service or product in Kansas that portion producing the major income source. I certify that the information I have provided on this report is complete correct and true to the best of my knowledge a...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kcns 010 form

Edit your k cns 010 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your k cns 010 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing k cns 010 form online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit k cns 010 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out k cns 010 form

How to fill out kcns 010:

01

Start by gathering all the necessary information, such as the individual's full name, address, and contact details.

02

Fill in the appropriate sections of the form, including the personal information section, which may require details such as date of birth and social security number.

03

Provide any relevant employment or education history in the designated section.

04

If applicable, include information about any dependents or family members who are also applying.

05

Double-check all the information entered to ensure accuracy and completeness.

06

Sign and date the form in the designated area.

07

Submit the completed kcns 010 form according to the specific instructions provided.

Who needs kcns 010:

01

Individuals who are applying for a specific program, service, or benefit that requires the completion of kcns 010.

02

Anyone seeking to provide their personal information and relevant details to an organization or agency that utilizes kcns 010 as a standard form.

03

Employers or educational institutions that may require applicants to complete kcns 010 as part of the application or enrollment process.

Fill

form

: Try Risk Free

People Also Ask about

What is K CNS 010?

Status Report (K-CNS 010): Regulations issued under the Kansas Employment Security Law provide, "Every employing unit for which services are performed in employment shall file a report to determine status within 15 days after such first employment." The purpose of the Status Report is to provide information for this

What forms do new employees need to fill out in Kansas?

Employee Forms FSA Claim Form (with claim filing instructions) Shared Leave Donation Form (DA-223) Shared Leave Request Form (DA-325) Workers Compensation - Injured Employee's Report of Injury (WC-9) W-4 Employee's Withholding Allowance Certificate. Workers Compensation - Mileage Form [PDF version]

What paperwork does a new employee need to fill out?

Both a W-2 and a W-4 tax form. These forms will come in handy for both you and your new hire when it's time to file income taxes with the IRS. A DE 4 California Payroll tax form. Issued by the Employment Development Department, this form helps employees calculate the correct state tax withholding from their paycheck.

Is mandatory overtime legal in Kansas?

For minimum wage workers in Kansas, the overtime pay rate amounts to $10.88 per hour (1.5 x $7.25). An employer doesn't violate overtime laws by requiring employees to work overtime, (ie “mandatory overtime”), as long as they are properly compensated at the premium rate required by law.

What debit card does Kansas unemployment use?

Through U.S. Bank, the Kansas Department of Labor (KDOL) deposits your unemployment benefit payments onto your card, making cash available to you through ATMs, MasterCard member financial institutions and other locations, such as grocery stores, that accept MasterCard debit cards.

What is the K CNS 100?

Each quarter a Quarterly Wage Report and Unemployment Tax Return form (K-CNS 100) is mailed to each active employer who sent in a paper report the previous quarter and does not meet the electronic filing requirement.

What is my Kansas employer account number?

Kansas UI Account Number You can find your UI Account Number on any previous Form K-CNS 100, or on any notices you have received from the Department of Labor. If you're unable to locate this, contact the agency at (800) 292-6333.

What disqualifies you for unemployment in Kansas?

Fired/Layoff/Suspension If your employer forces you to stop working, this is considered an involuntary separation. Generally, you will not be disqualified. However, if evidence shows that the employer ended your employment because you engaged in misconduct connected with your work, then you will be disqualified.

What is the tax ID number for the Kansas Department of Labor?

What is the Payer's Federal Identification number? The Kansas Department of Labor Federal ID # is: 74-2822699.

What is the K CNS 010 for?

Status Report (K-CNS 010): Regulations issued under the Kansas Employment Security Law provide, "Every employing unit for which services are performed in employment shall file a report to determine status within 15 days after such first employment." The purpose of the Status Report is to provide information for this

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my k cns 010 form in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your k cns 010 form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an eSignature for the k cns 010 form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your k cns 010 form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit k cns 010 form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share k cns 010 form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is k cns 010?

K CNS 010 is a form used to report certain financial transactions to the government.

Who is required to file k cns 010?

Any individual or organization that meets the criteria set by the government must file K CNS 010.

How to fill out k cns 010?

K CNS 010 can be filled out online or by submitting a physical copy to the designated authority.

What is the purpose of k cns 010?

The purpose of K CNS 010 is to track and monitor financial transactions for regulatory purposes.

What information must be reported on k cns 010?

K CNS 010 requires details such as transaction amount, parties involved, date of transaction, and purpose of transaction.

Fill out your k cns 010 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

K Cns 010 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.