IRS Publication 915 2014 free printable template

Instructions and Help about IRS Publication 915

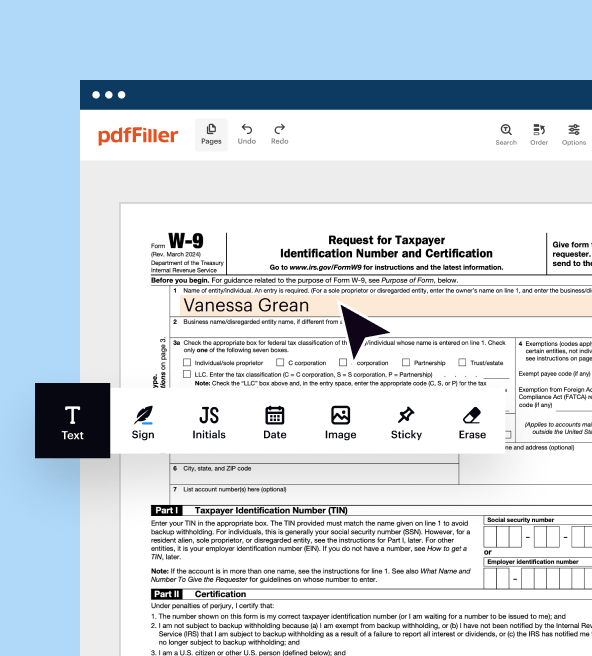

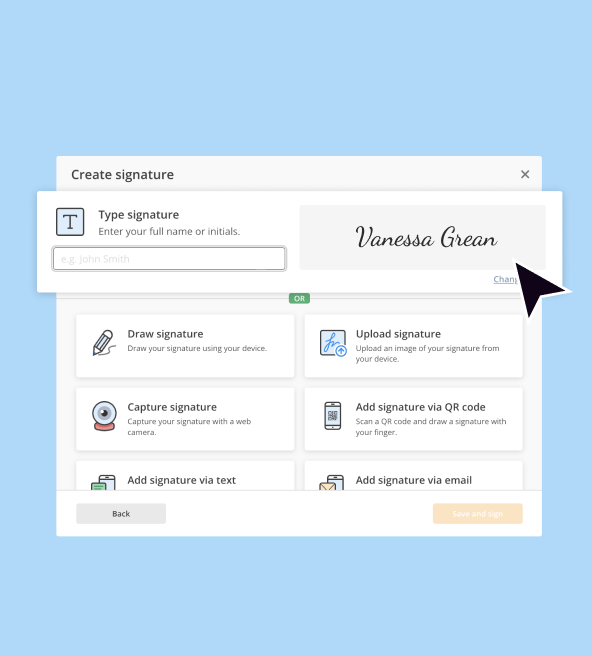

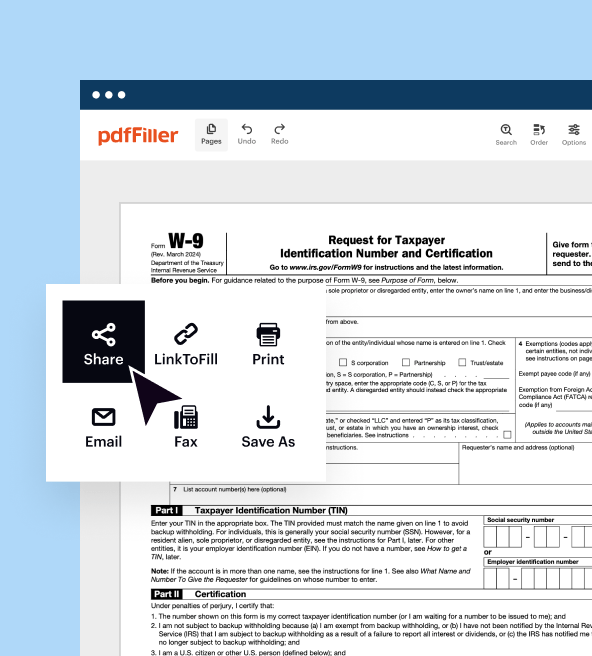

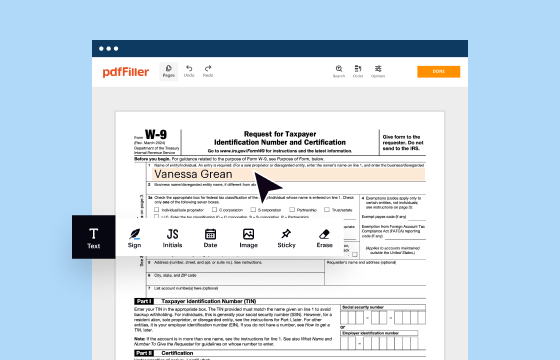

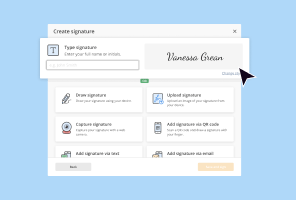

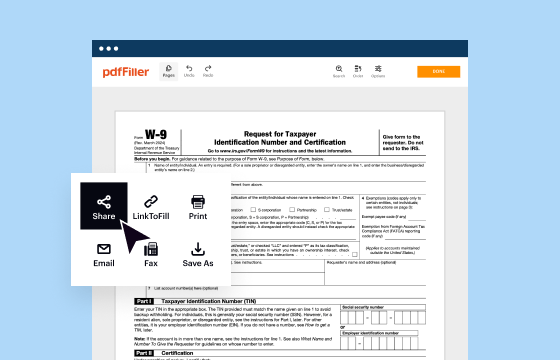

How to edit IRS Publication 915

How to fill out IRS Publication 915

About IRS Publication previous version

What is IRS Publication 915?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS Publication 915

How can I correct a mistake on my filed print tax form 915?

If you discover an error after filing your print tax form 915, you should submit an amended form. Ensure you clearly mark it as amended and provide the correct information. It’s important to keep a record of both the original and amended forms for your documentation.

What should I do if I receive a notice regarding my print tax form 915?

If you receive a notice related to your print tax form 915, carefully review the provided details. Prepare any necessary documentation and respond promptly to clarify or rectify any issues mentioned in the notice.

Are there specific service fees associated with e-filing the print tax form 915?

Yes, certain e-filing platforms may charge service fees for submitting your print tax form 915 electronically. It's advisable to check the fees closely on your chosen e-filing service to ensure you are informed of all potential costs.

How can I verify the status of my submitted print tax form 915?

To verify the status of your submitted print tax form 915, check the e-filing platform used for submission, as they often provide tracking features. Additionally, you may contact the appropriate tax authority for updates on processing times.

What common errors should I avoid when completing the print tax form 915?

Common errors include misentering taxpayer identification numbers, incorrect amounts, and not signing the form. To avoid these, double-check all entries and ensure you follow checklists available for the print tax form 915.

See what our users say