IRS 433-F 2012 free printable template

Show details

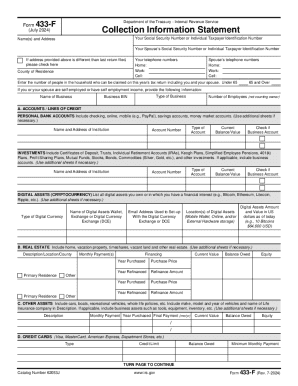

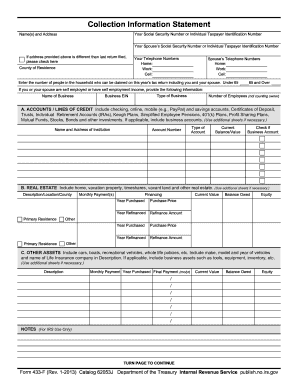

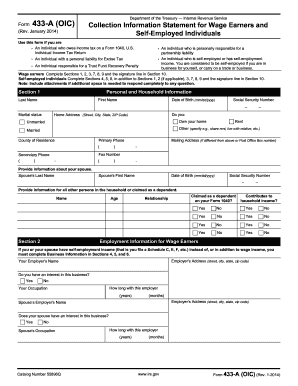

Your Signature Spouse s Signature Date Instructions Who should use Form 433-F Section D Credit Cards Form 433-F is used to obtain current financial information necessary for determining how a wage earner or selfemployed individual can satisfy an outstanding tax liability. List all credit cards and lines of credit even if there is no balance owed. Note You may be able to establish an Online Payment Agreement on the IRS web site. List all credit cards and lines of credit even if there is no...balance owed. Note You may be able to establish an Online Payment Agreement on the IRS web site. To apply online go to http //www.irs.gov click on I need to pay my taxes and select Installment Agreement under the heading What if I can t pay now If you are requesting an Installment Agreement you should submit Form 9465 Installment Agreement Request along with Form 433-F. A large down payment may streamline the installment agreement process pay your balance faster and reduce the amount of...penalties and interest charged. Section E Business Information Complete this section if you or your spouse are selfemployed or have self-employment income. This includes self-employment income from online sales. E1 List all Accounts Receivable owed to you or your business. To apply online go to http //www.irs.gov click on I need to pay my taxes and select Installment Agreement under the heading What if I can t pay now If you are requesting an Installment Agreement you should submit Form 9465...Installment Agreement Request along with Form 433-F. A large down payment may streamline the installment agreement process pay your balance faster and reduce the amount of penalties and interest charged. Section E Business Information Complete this section if you or your spouse are selfemployed or have self-employment income. This includes self-employment income from online sales. E1 List all Accounts Receivable owed to you or your business. Include federal state and local grants and contracts....E2 Complete if you or your business accepts credit card payments e.g. Visa MasterCard etc.. Collection Information Statement Your Social Security Number or Individual Taxpayer Identification Number Name s and Address Your Spouse s Social Security Number or Individual Taxpayer Identification Number If address provided above is different than last return filed please check here County of Residence Your Telephone Numbers Home Work Cell Spouse s Telephone Numbers Enter the number of people in the...household who can be claimed on this year s tax return including you and your spouse. Under 65 65 and Over If you or your spouse are self employed or have self employment income provide the following information Name of Business Type of Business Business EIN Number of Employees not counting owner A. ACCOUNTS / LINES OF CREDIT Include checking online mobile e*g* PayPal and savings accounts Certificates of Deposit Trusts Individual Retirement Accounts IRAs Keogh Plans Simplified Employee Pensions...401 k Plans Profit Sharing Plans Mutual Funds Stocks Bonds and other investments.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 433-F

How to edit IRS 433-F

How to fill out IRS 433-F

Instructions and Help about IRS 433-F

How to edit IRS 433-F

To edit the IRS 433-F form electronically, users can utilize pdfFiller's tools. This platform enables straightforward modifications to the document, allowing users to insert necessary information and ensure all data is accurate before submission. It’s important to save the document after editing to preserve any changes made.

How to fill out IRS 433-F

Filling out the IRS 433-F form requires specific financial information about the taxpayer's assets and liabilities. Follow these steps to complete the form accurately:

01

Gather necessary financial documents, including bank statements and asset valuations.

02

Provide detailed information about income sources, such as salary or other revenue streams.

03

List all debts and obligations in the specified sections of the form.

04

Be thorough in describing assets including real estate, vehicles, and personal property.

05

Review the completed form to ensure all information is correct before submission.

About IRS 433-F 2012 previous version

What is IRS 433-F?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 433-F 2012 previous version

What is IRS 433-F?

IRS 433-F is a tax form used by individuals to report financial information to the IRS, particularly in the context of applying for a payment plan or settling tax liabilities. This form helps the IRS assess a taxpayer's current financial condition for payment plans or offers in compromise.

What is the purpose of this form?

The primary purpose of IRS 433-F is to provide the IRS with a detailed view of a taxpayer’s financial situation. This includes information on income, expenses, assets, and liabilities, which assists the IRS in determining appropriate payment arrangements or offers in compromise for tax debts.

Who needs the form?

Taxpayers who have outstanding tax debts and wish to set up a payment plan or negotiate a settlement are required to complete IRS 433-F. This form is often used by individuals or businesses that need to demonstrate their financial circumstances to the IRS for resolution of their tax issues.

When am I exempt from filling out this form?

You may be exempt from completing IRS 433-F if your tax debt is less than a certain threshold or if you are eligible for an automatic full-pay option. Additionally, if you’ve already established a payment agreement with the IRS, you may not need to file this form again unless your circumstances have changed significantly.

Components of the form

The IRS 433-F form consists of several sections requiring detailed information. Key components include sections for reporting personal information, income sources, monthly living expenses, debts, and personal assets. Each section must be filled out with care to ensure compliance with IRS requirements.

What are the penalties for not issuing the form?

Failure to submit IRS 433-F when required may result in penalties, including the possibility of enforced collection actions by the IRS. This could lead to wage garnishments or bank levies, emphasizing the importance of timely and accurate filing to avoid such adverse consequences.

What information do you need when you file the form?

When filing IRS 433-F, you will need to provide accurate and comprehensive financial documentation. This includes details about all sources of income, a list of monthly expenses, and a comprehensive view of all assets and liabilities. Ensure you have current bank statements, pay stubs, and other relevant financial documents on hand.

Is the form accompanied by other forms?

IRS 433-F is typically filed alongside Form 9465 (Installment Agreement Request) if you are requesting a payment plan. Depending on your specific tax situation, additional forms may be required to support your request for a settlement or payment modification.

Where do I send the form?

The completed IRS 433-F form should be submitted to the appropriate address as indicated in the instructions accompanying the form. This may vary based on the taxpayer's location and the type of circumstances surrounding the submission, such as an installment agreement or offer in compromise.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It is the most convenient when the IRS was shut down the month of January 2019, and forms still needed to be filed.

Very trust worthy people behind the system of PDFfiller. They are extremely fast, even in the midst of work load demands of the clients like me.

See what our users say