Get the free planned giving

Show details

Give cash donations only as a last option. Checks are preferred. Always ask for an immediate receipt Temporary Receipt For Funds VA-Form 10-2815. OFFICIAL BUSINESS If you are interested in making a donation to VA or if you would like more information about how you can help support veterans contact the facility near you. Department of Veterans Affairs Contact VAVS IB 10-214 P96231 February 2008 Welcome The Department of Veterans Affairs Voluntary ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign planned giving

Edit your planned giving form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your planned giving form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit planned giving - volunteer online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit planned giving - volunteer. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out planned giving

How to fill out planned giving

01

Determine your charitable goals and the organizations you wish to support.

02

Consult with a financial advisor or estate planner to understand the best options for your situation.

03

Select the type of planned giving you want to implement (such as bequests, charitable gift annuities, or trust donations).

04

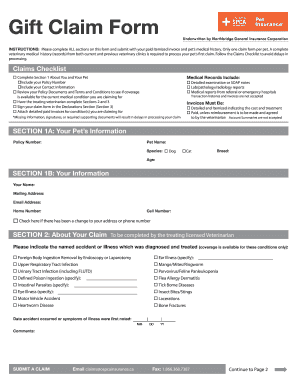

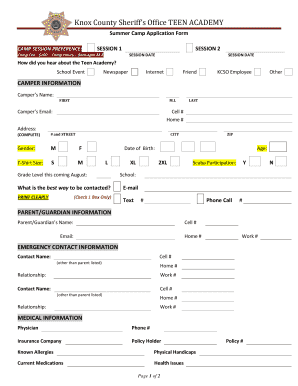

Complete the necessary forms or documentation required by the charity.

05

Review and update your will or estate plan to include your planned gifts.

06

Communicate your plans with family members and the charitable organizations involved.

Who needs planned giving?

01

Individuals who wish to leave a legacy to charities after their death.

02

Those looking to reduce estate taxes and provide for loved ones while supporting charitable causes.

03

Donors who want to make significant contributions that require long-term financial planning.

04

People who are interested in creating a sustainable income stream for themselves and their chosen charities.

Fill

form

: Try Risk Free

People Also Ask about

How to do planned giving?

Bequests make up every nine out of ten planned gifts, and they're the easiest way for both donors and nonprofits to get started with planned giving. To create a bequest, a donor simply needs to name your nonprofit as a beneficiary in their will.

What is the meaning of planned giving?

Planned giving is the process of donating planned gifts, also known as legacy gifts, which are contributions that are arranged in the present and allocated at a future date. Commonly donated through a will or trust, planned gifts are usually granted when a donor passes away.

What is the difference between planned giving and major gifts?

Planned giving is often more about long-term legacy, while major giving can be about addressing immediate needs and forging a deeper connection with the organization's vision. In this article, we will explore the different types of major gifts.

What is another name for planned giving?

Deferred donation planned gifts Charitable bequests are the most common and accessible types of planned giving. With a bequest, a donor names your organization in their will or trust, making you a beneficiary of their estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is planned giving?

Planned giving is a method of supporting a charitable organization through a donor's financial assets, typically arranged in advance, often via a will, trust, or other planned financial arrangements.

Who is required to file planned giving?

Individuals who include planned gifts in their estate plans or those who are making substantial charitable contributions through planned giving vehicles may be required to file specific documentation, typically their estate or gift tax returns, depending on the amount and nature of the gift.

How to fill out planned giving?

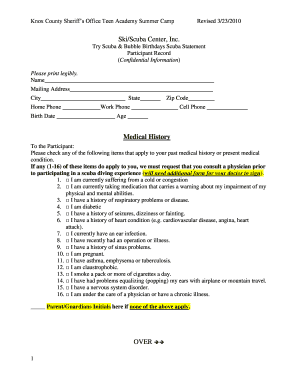

To fill out planned giving documentation, one typically needs to provide information regarding the donor's intention, details of the planned gift (such as assets involved), beneficiary information, and any relevant legal documentation supporting the planned giving arrangement.

What is the purpose of planned giving?

The purpose of planned giving is to enable individuals to make significant charitable contributions, often in a way that maximizes tax benefits for themselves and their heirs while supporting the missions of nonprofit organizations.

What information must be reported on planned giving?

Information that must be reported on planned giving includes the donor's name, the value of the gift, the type of asset being given, the intended recipient organization, and any specific terms or conditions related to the gift.

Fill out your planned giving online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Planned Giving - Volunteer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.