ME MRS 706ME-EZ 2011 free printable template

Show details

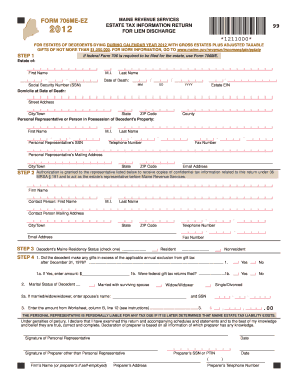

MM. DD. YYY. Social Security Number (SSN). Estate EIN. FOR ESTATES OF DECEDENTS DYING DURING CALENDAR YEAR 2011. WITH GROSS ESTATES ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ME MRS 706ME-EZ

Edit your ME MRS 706ME-EZ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ME MRS 706ME-EZ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ME MRS 706ME-EZ online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ME MRS 706ME-EZ. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ME MRS 706ME-EZ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ME MRS 706ME-EZ

How to fill out ME MRS 706ME-EZ

01

Gather all necessary personal and financial information.

02

Start with the identification section, fill in your name, address, and contact information.

03

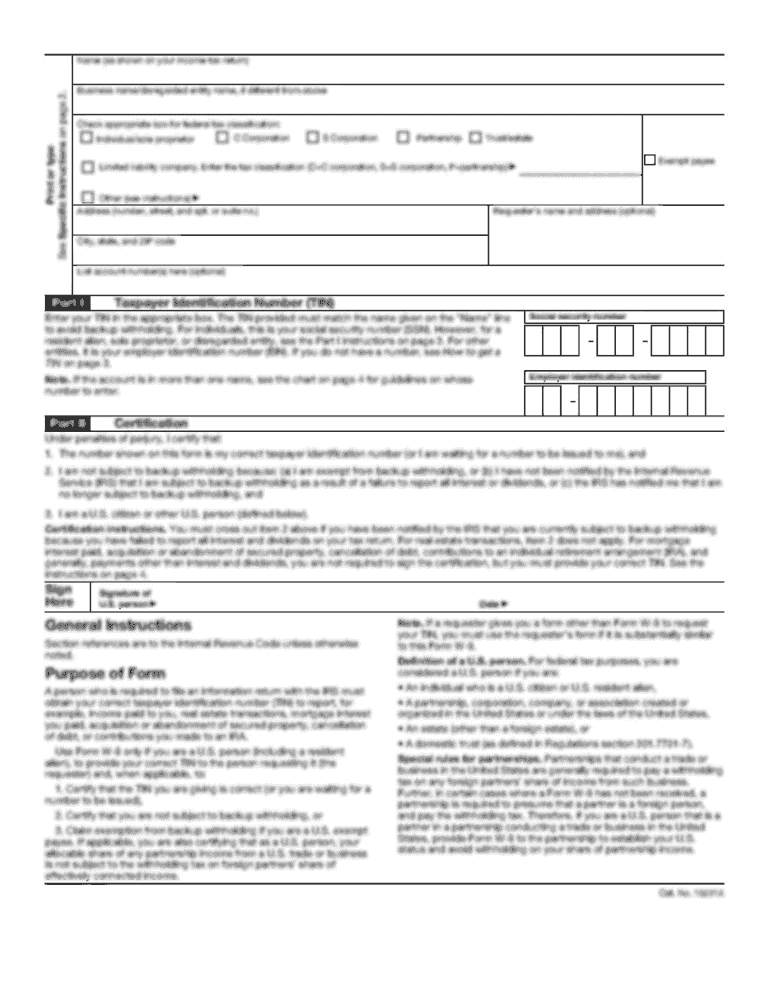

Provide your Social Security Number or Taxpayer Identification Number.

04

Complete the income section by reporting all sources of income.

05

Fill out the deductions and exemptions section if applicable.

06

Review the entire form for accuracy and completeness.

07

Sign and date the form before submission.

Who needs ME MRS 706ME-EZ?

01

Individuals who are filing their income taxes and qualify for the simplified ME MRS 706ME-EZ form.

02

Taxpayers with simple tax situations, including those with straightforward income sources and deductions.

Fill

form

: Try Risk Free

People Also Ask about

Do estates have to file income tax returns?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes. See Form 1041 instructions for information on when to file quarterly estimated taxes.

Does Maine have an estate tax or inheritance tax?

For decedents dying on or after January 1, 2013, Maine imposes a tax on estates based on the value of the Maine taxable estate, even if there is no federal estate tax.

Do I need to file a Maine estate tax return?

If a federal Form 706 is required, then a Maine estate tax return (Form 706ME) is also required if (1) the decedent was a Maine resident at the time of death or (2) the decedent was a nonresident and owned real and/or tangible personal property located in Maine at the time of death.

Is there a gift tax exemption in Maine?

(Maine does not have a state-level gift tax.) And because this exclusion applies to individuals, a married couple can use each person's exclusion amount to make a total of $30,000 in gifts to someone before a gift tax return is needed.

Do you have to pay an inheritance tax in the state of Maine?

Maine Estate Tax Exemption The estate tax threshold for Maine is $6.01 million in 2022 and $6.41 million in 2023. If your estate is worth less than that, Maine won't charge estate tax on it. If it is worth more than that, you'll owe a percentage of the estate to the government based on a series of progressive rates.

Is Maine estate tax exemption portable?

The federal estate tax regime allows a surviving spouse to use the deceased spouse's unused portion of the exemption—a feature called "portability." However, Maine's estate tax does not offer portability between spouses; each spouse has a separate exemption amount of $6.41 million.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ME MRS 706ME-EZ online?

pdfFiller makes it easy to finish and sign ME MRS 706ME-EZ online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an eSignature for the ME MRS 706ME-EZ in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your ME MRS 706ME-EZ and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit ME MRS 706ME-EZ on an Android device?

With the pdfFiller Android app, you can edit, sign, and share ME MRS 706ME-EZ on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is ME MRS 706ME-EZ?

ME MRS 706ME-EZ is a simplified estate tax return form used in the state of Maine for estates that meet certain criteria, allowing for easier reporting and processing of estate taxes.

Who is required to file ME MRS 706ME-EZ?

ME MRS 706ME-EZ must be filed by the personal representative of an estate when the gross estate is valued below a specific threshold set by the state of Maine, and when the estate does not exceed the limits for simpler reporting requirements.

How to fill out ME MRS 706ME-EZ?

To fill out ME MRS 706ME-EZ, the personal representative should gather relevant financial information of the decedent's estate, complete all sections of the form, ensuring that accurate values are reported, and submit the form according to the instructions provided on the form.

What is the purpose of ME MRS 706ME-EZ?

The purpose of ME MRS 706ME-EZ is to provide a streamlined and simplified process for reporting estate taxes for smaller estates, thereby reducing the administrative burden on the personal representative and the state.

What information must be reported on ME MRS 706ME-EZ?

ME MRS 706ME-EZ requires reporting of the decedent's assets, debts, the value of the estate, and other relevant information as specified in the instructions accompanying the form.

Fill out your ME MRS 706ME-EZ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ME MRS 706me-EZ is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.