IRS 1040 Lines 16a and 16b 2015 free printable template

Show details

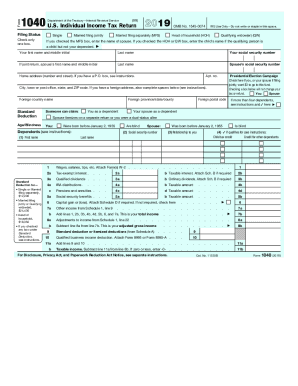

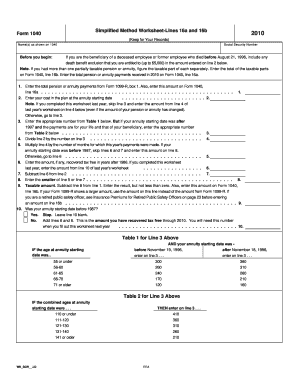

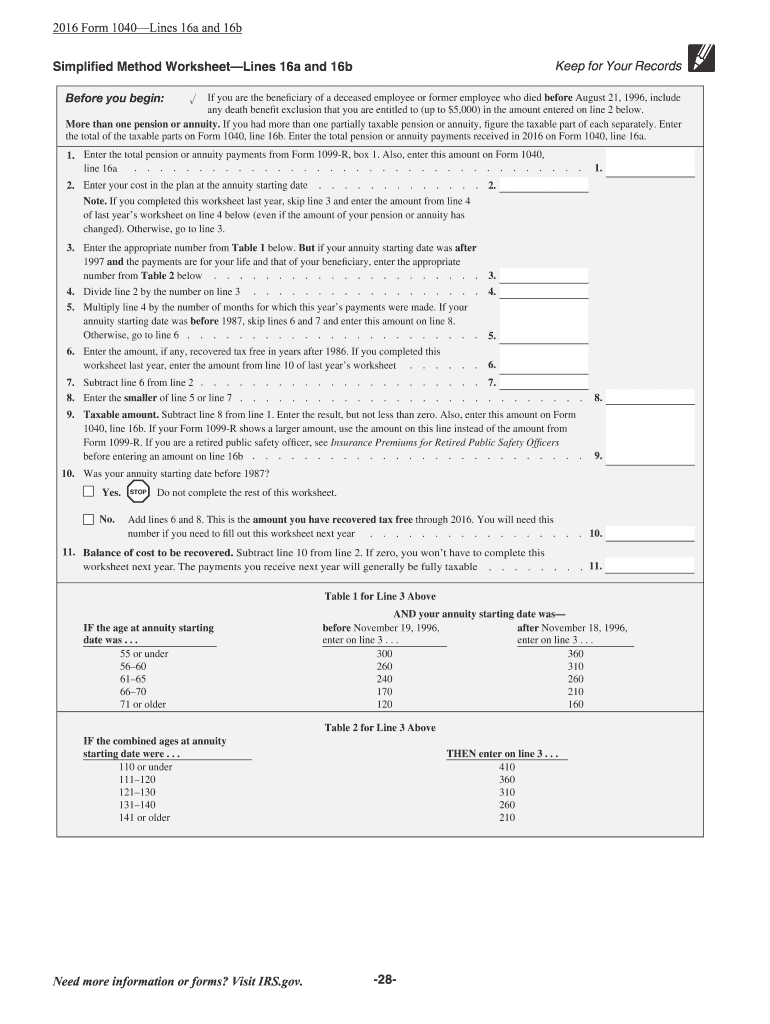

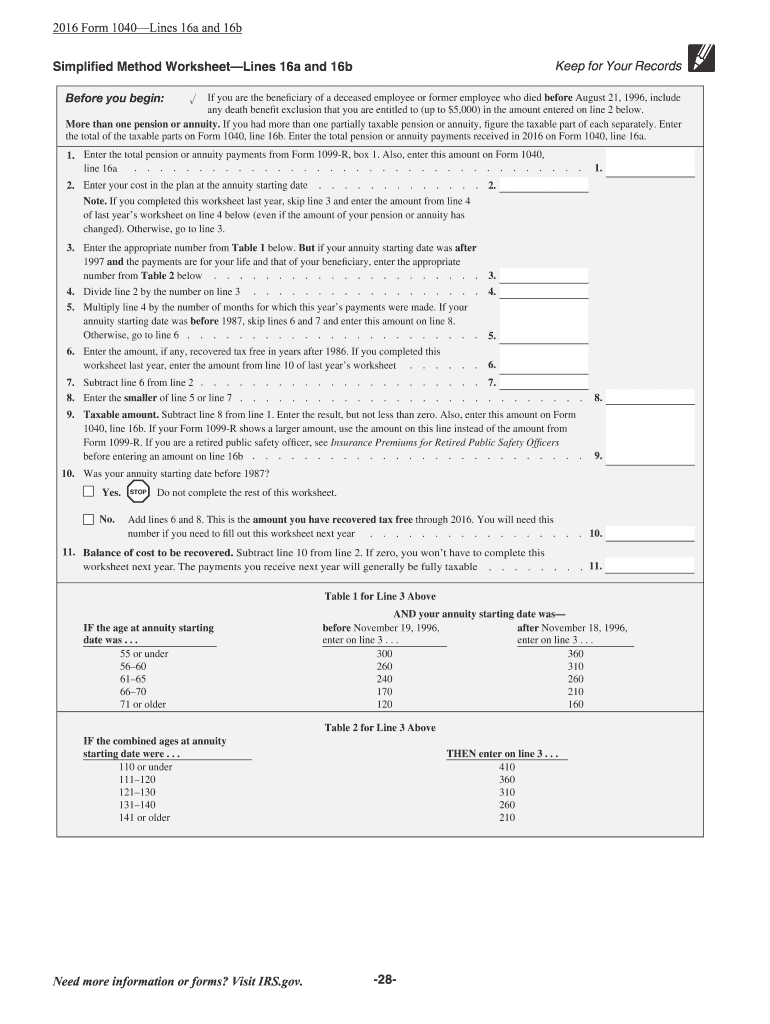

2013 Form 1040 Lines 16b Through 21 Keep for Your Records Simplified Method Worksheet Lines 16a and 16b Before you begin If you are the beneficiary of a deceased employee or former employee who died before August 21 1996 include any death benefit exclusion that you are entitled to up to 5 000 in the amount entered on line 2 below.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1040 Lines 16a and 16b

Edit your IRS 1040 Lines 16a and 16b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1040 Lines 16a and 16b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 1040 Lines 16a and 16b online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS 1040 Lines 16a and 16b. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1040 Lines 16a and 16b Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1040 Lines 16a and 16b

How to fill out IRS 1040 Lines 16a and 16b

01

Locate IRS Form 1040 and navigate to Line 16a.

02

Determine if you have received any qualified dividends. If yes, enter the total amount on Line 16a.

03

Next, move to Line 16b. This line is for any amount of dividends that are subject to tax at a different rate.

04

If you have any additional dividends taxed differently, enter that amount on Line 16b.

05

Double-check both amounts for accuracy before submission.

Who needs IRS 1040 Lines 16a and 16b?

01

Taxpayers who have received qualified dividends during the tax year.

02

Individuals required to report their dividend income for accurate tax calculation.

Fill

form

: Try Risk Free

People Also Ask about

Who files IRS form 5329?

Form 5329 must be filed by taxpayers with retirement plans or education savings accounts who owe an early distribution or another penalty. Taxpayers who do not file the form could end up owing more in penalties and taxes.

What is reasonable cause for form 5329?

Form 5329 Waiver Example Reasonable causes for missing the RMD include serious illness, mental incapacity, or an error made by the bank. You will need to file a request for a waiver of this penalty.

What is the IRS simplified method?

The IRS developed a method of determining the tax-free portion of a retirement pension, referred to as the “Simplified Method” or “Safe Harbor.” The Simplified Method provides a dollar amount of each monthly payment that is not subject to federal income tax.

What is the purpose of Form 5329?

Use Form 5329 to report additional taxes on IRAs, other qualified retirement plans, modified endowment contracts, Coverdell ESAs, QTPs, Archer MSAs, or HSAs.

What is the simplified method worksheet use for?

Under the Simplified Method, you figure the taxable and tax-free parts of your annuity payments by completing the Simplified Method Worksheet in the Instructions for Form 1040 (and Form 1040-SR) or in Publication 575.

Do I need to use the simplified method worksheet?

It is required to use the Simplified Method if your annuity starting date (the date on line 3 above) was after July 1, 1986, and you used this method last year to figure the taxable part.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IRS 1040 Lines 16a and 16b online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your IRS 1040 Lines 16a and 16b to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an eSignature for the IRS 1040 Lines 16a and 16b in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your IRS 1040 Lines 16a and 16b right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit IRS 1040 Lines 16a and 16b straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing IRS 1040 Lines 16a and 16b, you can start right away.

What is IRS 1040 Lines 16a and 16b?

IRS 1040 Lines 16a and 16b relate to reporting tax credits derived from dividends and qualified dividends respectively. Line 16a is used to report total ordinary dividends, while Line 16b specifies the amount of qualified dividends.

Who is required to file IRS 1040 Lines 16a and 16b?

Taxpayers who have received ordinary dividends or qualified dividends during the tax year must complete Lines 16a and 16b on their IRS 1040 form. This includes individuals and entities that earn dividend income.

How to fill out IRS 1040 Lines 16a and 16b?

To fill out Lines 16a and 16b, review your Form 1099-DIV, which reports dividends received. Enter the total amount of ordinary dividends on Line 16a and the amount of qualified dividends on Line 16b. Ensure the totals match the amounts reported on your Form 1099-DIV.

What is the purpose of IRS 1040 Lines 16a and 16b?

The purpose of Lines 16a and 16b is to properly report dividend income for tax assessment. This ensures taxpayers are taxed at the correct rates, distinguishing between ordinary and qualified dividends which may be taxed at different rates.

What information must be reported on IRS 1040 Lines 16a and 16b?

On Line 16a, report the total amount of ordinary dividends received. On Line 16b, report the amount of those dividends that are classified as qualified dividends, which typically receive preferential tax rates.

Fill out your IRS 1040 Lines 16a and 16b online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1040 Lines 16a And 16b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.