IRS 1040 Lines 16a and 16b 2010 free printable template

Show details

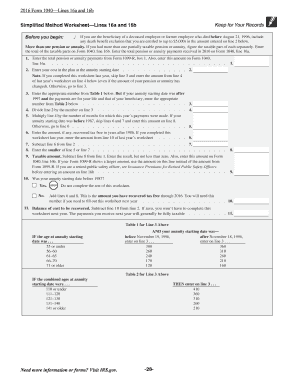

Simplified Method Worksheet-Lines 16a and 16b Form 1040 2010 (Keep for Your Records) Name(s) as shown on 1040 Social Security Number Before you begin: If you are the beneficiary of a deceased employee

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1040 Lines 16a and 16b

Edit your IRS 1040 Lines 16a and 16b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1040 Lines 16a and 16b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 1040 Lines 16a and 16b online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS 1040 Lines 16a and 16b. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1040 Lines 16a and 16b Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1040 Lines 16a and 16b

How to fill out IRS 1040 Lines 16a and 16b

01

Locate Line 16a on IRS Form 1040.

02

Determine the amount of your Social Security benefits for the year.

03

Enter the total amount of Social Security benefits received in Line 16a.

04

Locate Line 16b on IRS Form 1040.

05

Calculate the taxable amount of your Social Security benefits using the IRS worksheet for benefits.

06

Enter the taxable amount in Line 16b.

Who needs IRS 1040 Lines 16a and 16b?

01

Individuals who receive Social Security benefits and need to report them on their tax return.

02

Taxpayers who may have a portion of their Social Security benefits taxable based on their overall income.

Fill

form

: Try Risk Free

People Also Ask about

Who files IRS form 5329?

Form 5329 must be filed by taxpayers with retirement plans or education savings accounts who owe an early distribution or another penalty. Taxpayers who do not file the form could end up owing more in penalties and taxes.

What is reasonable cause for form 5329?

Form 5329 Waiver Example Reasonable causes for missing the RMD include serious illness, mental incapacity, or an error made by the bank. You will need to file a request for a waiver of this penalty.

What is the IRS simplified method?

The IRS developed a method of determining the tax-free portion of a retirement pension, referred to as the “Simplified Method” or “Safe Harbor.” The Simplified Method provides a dollar amount of each monthly payment that is not subject to federal income tax.

What is the purpose of Form 5329?

Use Form 5329 to report additional taxes on IRAs, other qualified retirement plans, modified endowment contracts, Coverdell ESAs, QTPs, Archer MSAs, or HSAs.

What is the simplified method worksheet use for?

Under the Simplified Method, you figure the taxable and tax-free parts of your annuity payments by completing the Simplified Method Worksheet in the Instructions for Form 1040 (and Form 1040-SR) or in Publication 575.

Do I need to use the simplified method worksheet?

It is required to use the Simplified Method if your annuity starting date (the date on line 3 above) was after July 1, 1986, and you used this method last year to figure the taxable part.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 1040 Lines 16a and 16b in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign IRS 1040 Lines 16a and 16b and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I fill out IRS 1040 Lines 16a and 16b using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign IRS 1040 Lines 16a and 16b and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit IRS 1040 Lines 16a and 16b on an iOS device?

Create, edit, and share IRS 1040 Lines 16a and 16b from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is IRS 1040 Lines 16a and 16b?

Lines 16a and 16b of the IRS Form 1040 pertain to the reporting of qualified dividends. Line 16a shows the total amount of qualified dividends, while Line 16b indicates the amount that is taxable.

Who is required to file IRS 1040 Lines 16a and 16b?

Taxpayers who have received qualified dividends during the tax year are required to file Lines 16a and 16b on their IRS Form 1040.

How to fill out IRS 1040 Lines 16a and 16b?

To fill out Lines 16a and 16b, first determine the total amount of qualified dividends by reviewing your dividend statements. Enter this amount on Line 16a. Then, calculate the amount of qualified dividends that are taxable and enter that figure on Line 16b.

What is the purpose of IRS 1040 Lines 16a and 16b?

The purpose of Lines 16a and 16b is to accurately report qualified dividends for tax purposes, allowing taxpayers to benefit from lower tax rates that may apply to these dividends.

What information must be reported on IRS 1040 Lines 16a and 16b?

On Line 16a, you must report the total amount of qualified dividends received. On Line 16b, you need to report the portion of those dividends that are taxable.

Fill out your IRS 1040 Lines 16a and 16b online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1040 Lines 16a And 16b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.