Get the free Removal of Federal Reserve Banks as Federal Depositaries

Show details

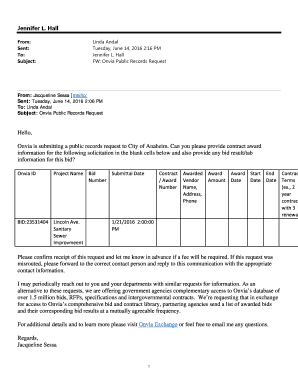

This document contains proposed regulations regarding the removal of Federal Reserve banks as authorized depositaries for Federal tax deposits, affecting taxpayers who make Federal tax deposits using

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign removal of federal reserve

Edit your removal of federal reserve form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your removal of federal reserve form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing removal of federal reserve online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit removal of federal reserve. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out removal of federal reserve

How to fill out Removal of Federal Reserve Banks as Federal Depositaries

01

Gather necessary documentation, including the reason for removal and any supporting financial statements.

02

Complete the formal request form provided by the Federal Reserve.

03

Clearly state the reasons for requesting the removal of the Federal Reserve Bank as a federal depositary.

04

Ensure all required signatures from authorized representatives are included.

05

Submit the completed form along with any supporting documents to the appropriate Federal Reserve office.

06

Follow up to confirm receipt and inquire about the processing timeline.

Who needs Removal of Federal Reserve Banks as Federal Depositaries?

01

Entities that no longer wish to maintain a Federal Reserve Bank account for deposits.

02

Organizations looking to shift their financial operations to alternative banking institutions.

03

Businesses that have undergone significant changes in structure or operations that affect their banking needs.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between central bank and Reserve Bank?

The Board of Governors—located in Washington, D.C.—is the governing body of the Federal Reserve System.

What is the difference between central bank and federal reserve?

The Reserve Bank of India (RBI) is India's central bank, which was created under the Reserve Bank of India Act on April 1, 1935. The Reserve Bank of India is the country's central bank and is responsible for the supply of money in India and also the oversight of the Indian banking sector.

Who can remove members of the Federal Reserve Board?

ing to the Fed's statute, the president must have a reason or 'cause' to remove a member of the board.

What is the difference between the central bank and the Federal Reserve bank?

Unlike most central banks, the Federal Reserve is semi-decentralized, mixing government appointees with representation from private-sector banks. At the national level, it is run by a Board of Governors, consisting of seven members appointed by the President of the United States and confirmed by the Senate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Removal of Federal Reserve Banks as Federal Depositaries?

The Removal of Federal Reserve Banks as Federal Depositaries refers to the process whereby a financial institution or entity formally ends its status of using Federal Reserve Banks to hold or manage its deposits.

Who is required to file Removal of Federal Reserve Banks as Federal Depositaries?

Entities that are currently maintaining deposits with Federal Reserve Banks and wish to terminate that relationship are required to file the Removal of Federal Reserve Banks as Federal Depositaries.

How to fill out Removal of Federal Reserve Banks as Federal Depositaries?

To fill out the Removal of Federal Reserve Banks as Federal Depositaries, the entity must complete a designated application form provided by the Federal Reserve, supplying identifying information and reasons for the removal.

What is the purpose of Removal of Federal Reserve Banks as Federal Depositaries?

The purpose of Removal of Federal Reserve Banks as Federal Depositaries is to officially document and process the withdrawal of an entity's access to Federal Reserve deposit services, which may reflect changes in their banking relationships or operational needs.

What information must be reported on Removal of Federal Reserve Banks as Federal Depositaries?

The information that must be reported includes the entity's name, tax identification number, details of the deposits to be removed, reasons for removal, and any required signatures of authorized representatives.

Fill out your removal of federal reserve online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Removal Of Federal Reserve is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.