Get the free Federal Insurance Contributions Act (FICA) Taxation of Amounts Under Employee Benefi...

Show details

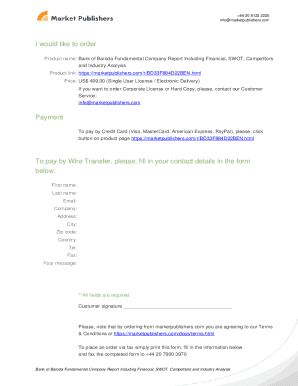

This document provides final regulations for employers regarding the taxation of nonqualified deferred compensation under the Federal Insurance Contributions Act (FICA), detailing the timing and handling

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal insurance contributions act

Edit your federal insurance contributions act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal insurance contributions act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing federal insurance contributions act online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit federal insurance contributions act. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal insurance contributions act

How to fill out Federal Insurance Contributions Act (FICA) Taxation of Amounts Under Employee Benefit Plans

01

Review the employee benefit plans that are subject to FICA taxation.

02

Gather information about the amounts paid to employees under these plans.

03

Determine the FICA tax rates applicable for the current fiscal year (Social Security and Medicare rates).

04

Calculate the total taxable amounts for each employee under the benefit plans.

05

Compute the employee's and employer's share of FICA taxes based on the taxable amounts.

06

Report the calculated FICA taxes on the appropriate payroll tax forms (such as Form 941 or Form 943).

07

Ensure timely payment of the FICA taxes to the IRS, following the established deadlines.

Who needs Federal Insurance Contributions Act (FICA) Taxation of Amounts Under Employee Benefit Plans?

01

Employers who offer employee benefit plans that provide taxable amounts.

02

Payroll departments responsible for calculating and remitting payroll taxes.

03

Employees receiving benefits that are subject to FICA taxation.

04

Tax professionals and accountants managing payroll and tax compliance for businesses.

Fill

form

: Try Risk Free

People Also Ask about

Is FICA the same as Social Security tax?

More In Help. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as Social Security taxes, and the hospital insurance taxes, also known as Medicare taxes. Different rates apply for these taxes.

What is the FICA tax on my paycheck?

FICA combines Social Security and Medicare taxes for a total rate of 15.3%, but the cost is split between each party. Specifically, 6.2% of an employee's FICA taxable wages go to Social Security tax and 1.45% of their gross wages go to Medicare tax. The employer must match these percentages for a grand total of 15.3%.

Is FICA the same as 401k?

FICA Taxes While you do not have to pay income tax on your 401(k) contribution, you will still have to pay Federal Insurance Contributions Act (FICA) taxes. Also known as payroll taxes, FICA taxes are calculated based on the full paycheck amount, which is before the portion for the 401(k) contribution is taken.

Does everyone have to pay FICA taxes?

Almost all American workers are required to pay into FICA, which contributes to Social Security benefits for retirees, survivors, and disabled workers, as well as Medicare programs that fund older and certain disabled Americans' health care costs.

Why am I being charged FICA tax?

FICA is a U.S. federal payroll tax. It stands for the Federal Insurance Contributions Act and is deducted from each paycheck. Your nine-digit number helps Social Security accurately record your covered wages or self-employment. As you work and pay FICA taxes, you earn credits for Social Security benefits.

Do I get my FICA tax back?

If you paid FICA taxes but believe you should have been exempt from these payments, you may be able to get a refund. First, request a refund from your employer in writing. If your employer cannot refund you, then you can apply for a refund directly with the U.S. government's Internal Revenue Service (IRS).

How do I know how much FICA tax I paid?

So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%. Self-employed workers get stuck paying the entire FICA tax on their own.

What is the Federal Insurance Contributions Act FICA tax?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as Social Security taxes, and the hospital insurance taxes, also known as Medicare taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Federal Insurance Contributions Act (FICA) Taxation of Amounts Under Employee Benefit Plans?

FICA taxation refers to the federal tax imposed on both employers and employees to fund Social Security and Medicare. Amounts under employee benefit plans, such as retirement or healthcare benefits, may be subject to FICA taxation depending on whether the amounts are considered wages.

Who is required to file Federal Insurance Contributions Act (FICA) Taxation of Amounts Under Employee Benefit Plans?

Employers who pay wages to employees are required to file FICA taxes. Employees who receive benefits under plans that are subject to FICA taxation may also have to report these amounts.

How to fill out Federal Insurance Contributions Act (FICA) Taxation of Amounts Under Employee Benefit Plans?

To fill out FICA taxation forms, employers need to calculate the total wages subject to FICA tax, including amounts under employee benefit plans, and report these figures on their payroll tax returns, typically using Form 941 or Form 944.

What is the purpose of Federal Insurance Contributions Act (FICA) Taxation of Amounts Under Employee Benefit Plans?

The purpose of FICA taxation is to generate revenue for Social Security and Medicare programs, ensuring that employees receive benefits such as retirement income and healthcare coverage in the future.

What information must be reported on Federal Insurance Contributions Act (FICA) Taxation of Amounts Under Employee Benefit Plans?

Employers must report total wages subject to FICA tax, employee contributions, employer contributions, and any benefits provided under employee benefit plans that are considered taxable under FICA.

Fill out your federal insurance contributions act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Insurance Contributions Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.