Canada T1178 E 2011 free printable template

Show details

T1178 E 11 Required line items must be completed. Required if any of line items 3660 to 3745 are completed. Vous pouvez obtenir ce formulaire en fran ais www.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T1178 E

Edit your Canada T1178 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T1178 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada T1178 E online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada T1178 E. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T1178 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T1178 E

How to fill out Canada T1178 E

01

Obtain the T1178 E form from the Canada Revenue Agency (CRA) website.

02

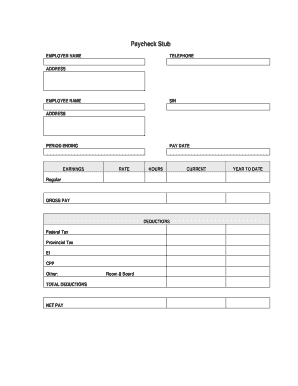

Provide your personal information in the designated fields including your name, address, and Social Insurance Number (SIN).

03

Indicate the year for which you are filing the T1178 E.

04

Fill out the sections related to your foreign income and the amount of foreign taxes paid.

05

Calculate the total foreign tax credit you are claiming and ensure it is accurately reflected in the appropriate boxes.

06

Include any required supporting documentation to substantiate your claims, such as tax returns from foreign countries.

07

Review the completed form for accuracy and completeness.

08

Submit the form as instructed, either by mailing it to the CRA or electronically if applicable.

Who needs Canada T1178 E?

01

Individuals who are Canadian residents and have earned income from foreign sources and paid foreign taxes on that income.

02

Taxpayers seeking to claim a foreign tax credit to avoid double taxation on their income.

Fill

form

: Try Risk Free

People Also Ask about

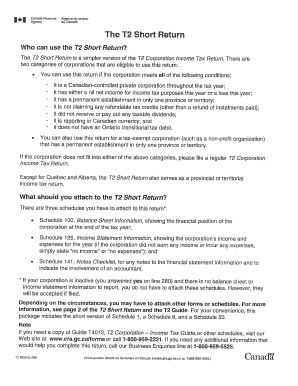

What is the T1 summary?

What Is the T1 Tax Form? This form is a summary of all income taxes paid to the Canada Revenue Agency. All working Canadians need to fill out and file this form for each tax year. As well as summarizing all of the taxes paid to tax authorities, it also declares all of the income generated for the year.

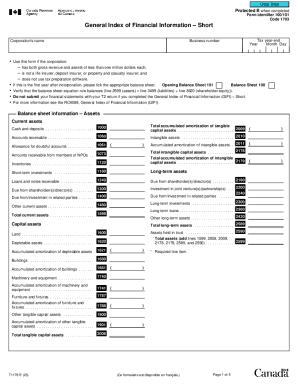

How does GIFI work?

The GIFI codes identify items that are usually found on a corporation's financial statement (balance sheets, income statements, and statements of retained earnings). Each item is assigned its own unique code. This allows the CRA to collect financial statement information in a standardized format.

What is a T1 form in Canada?

The T1 General Income Tax and Benefit Return is the tax return used by individuals to calculate their annual tax liability and get federal or provincial benefits such as the GST/HST Credit.

What is a GIFI code in Sage?

The GIFI (General Index of Financial Information) is an index of items generally found on balance sheets, income statements, and statements of retained earnings. The Canada Revenue Agency (CRA) uses GIFI Codes to support their electronic filing and T2 processing system.

What is the description of the GIFI?

The GIFI consists of items you find on a balance sheet and on an income statement. The balance sheet section consists of items pertaining to assets, liabilities, and equity for corporations or partners' capital for partnerships.

What is the general index of financial information guideline?

The General Index of Financial Information (GIFI) is a standard list of codes that you use to prepare your financial statements. All corporations (except for insurance corporations) should prepare their financial statement information using the GIFI codes and file it with their T2 returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the Canada T1178 E electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your Canada T1178 E in minutes.

Can I edit Canada T1178 E on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute Canada T1178 E from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete Canada T1178 E on an Android device?

Use the pdfFiller mobile app and complete your Canada T1178 E and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is Canada T1178 E?

Canada T1178 E is a form used by individuals to report certain types of income from foreign sources, particularly related to tax obligations under the Income Tax Act.

Who is required to file Canada T1178 E?

Individuals who receive income from foreign sources and are subject to Canadian income tax must file Canada T1178 E if they meet the specific criteria outlined by the Canada Revenue Agency (CRA).

How to fill out Canada T1178 E?

To fill out Canada T1178 E, you need to provide personal identification information, details about the foreign income received, and complete any relevant sections as instructed by the CRA guidelines.

What is the purpose of Canada T1178 E?

The purpose of Canada T1178 E is to ensure that individuals accurately report their foreign income, facilitating compliance with Canadian tax laws and preventing tax evasion.

What information must be reported on Canada T1178 E?

Information required on Canada T1178 E includes personal details, types of foreign income, amounts received, and any taxes paid to foreign governments that may affect Canadian tax obligations.

Fill out your Canada T1178 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t1178 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.