Get the free Taxation of Tax-Exempt Organizations’ Income From Corporate Sponsorship - irs

Show details

This document contains final regulations regarding the tax treatment of corporate sponsorship payments received by tax-exempt organizations, outlining the definitions and conditions under which such

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxation of tax-exempt organizations

Edit your taxation of tax-exempt organizations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxation of tax-exempt organizations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

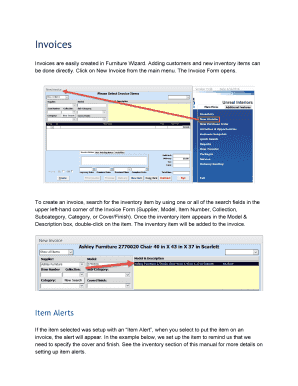

How to edit taxation of tax-exempt organizations online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit taxation of tax-exempt organizations. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxation of tax-exempt organizations

How to fill out Taxation of Tax-Exempt Organizations’ Income From Corporate Sponsorship

01

Gather the necessary financial documents of the tax-exempt organization.

02

Identify all income received from corporate sponsorships during the tax year.

03

Determine the amount of unrelated business taxable income (UBTI) generated from these sponsorships.

04

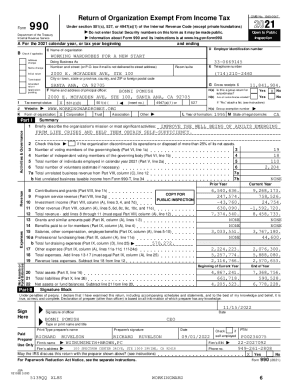

Fill out Form 990-T, which is specifically for reporting UBTI for tax-exempt organizations.

05

Include the details of the sponsorship agreements, specifying if the revenues relate to advertising or other promotional activities.

06

Calculate the taxable income by subtracting allowable deductions from the gross income.

07

Submit the completed Form 990-T to the IRS by the required due date.

Who needs Taxation of Tax-Exempt Organizations’ Income From Corporate Sponsorship?

01

Tax-exempt organizations that receive corporate sponsorship income and generate unrelated business taxable income (UBTI).

02

Non-profit organizations engaging in activities that may be classified as taxable under IRS guidelines.

03

Organizations that want to ensure compliance with IRS regulations regarding taxation on income derived from corporate sponsorships.

Fill

form

: Try Risk Free

People Also Ask about

Is corporate sponsorship a donation?

Is a Sponsorship a Donation? While both are important types of support nonprofits can receive, the main difference between sponsorships and donations is that sponsorships typically include the giver receiving something in return.

How to treat sponsorship income?

The IRS focuses on whether the corporate sponsor has any expectation that it will receive a “substantial return benefit” for its payment. If so, the payment will result in taxable income for the nonprofit which reports the income on IRS Form 990-T.

What is the IRS rule on fiscal sponsorship?

Using a fiscal sponsor satisfies IRS requirements as long as the fiscal sponsor maintains the right to decide, at its own discretion, how it will use contributions. Maintaining control over the donated funds is a requirement of a legitimate fiscal sponsor arrangement.

How to recognize sponsorship revenue?

This is often the case for event-based sponsorships: perhaps a sponsor pays $5,000 for a table at a museum's annual fundraising gala and receives food and entertainment benefits valued at $2,000. In this instance, the nonprofit should recognize revenue of $3,000 as a contribution and $2,000 as an exchange transaction.

Are corporate sponsorships taxable?

Sponsorship dollars generally aren't taxed. Qualified sponsorship payments are made by a person engaged in a trade or business with no arrangement to receive — or expectation of receiving — a substantial benefit from the nonprofit in return for the payment.

Do you have to pay taxes on sponsorships?

The IRS focuses on whether the corporate sponsor has any expectation that it will receive a “substantial return benefit” for its payment. If so, the payment will result in taxable income for the nonprofit which reports the income on IRS Form 990-T.

What is the IRS rule on fiscal sponsorship?

Using a fiscal sponsor satisfies IRS requirements as long as the fiscal sponsor maintains the right to decide, at its own discretion, how it will use contributions. Maintaining control over the donated funds is a requirement of a legitimate fiscal sponsor arrangement.

Do you have to send a 1099 for a sponsorship?

Are sponsorship fees reportable on a Form 1099? Most often, when your company pays for a sponsorship, you are actually receiving a form of advertising in return. If this is the case, the fee is a reportable service (because the money is spent in the "course of trade or business").

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Taxation of Tax-Exempt Organizations’ Income From Corporate Sponsorship?

Taxation of tax-exempt organizations' income from corporate sponsorship refers to the assessment of taxes on income generated by non-profit organizations through sponsorships from corporate entities. While such organizations typically enjoy tax-exempt status, they may still have tax obligations for income that is unrelated to their exempt purpose.

Who is required to file Taxation of Tax-Exempt Organizations’ Income From Corporate Sponsorship?

Organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code and that receive income from corporate sponsorships may be required to file tax returns, particularly if this income is considered unrelated business taxable income (UBTI).

How to fill out Taxation of Tax-Exempt Organizations’ Income From Corporate Sponsorship?

To fill out the taxation forms for income from corporate sponsorship, tax-exempt organizations must carefully report their sponsorship income, classify it correctly as UBTI if applicable, and follow the guidelines provided in IRS forms such as Form 990-T.

What is the purpose of Taxation of Tax-Exempt Organizations’ Income From Corporate Sponsorship?

The purpose of taxing tax-exempt organizations on income from corporate sponsorship is to ensure that entities that generate income unrelated to their exempt purposes contribute to the public revenue and maintain fair competition with for-profit businesses.

What information must be reported on Taxation of Tax-Exempt Organizations’ Income From Corporate Sponsorship?

Organizations must report details such as the amount of sponsorship income received, expenses directly related to generating that income, and any applicable deductions. Additionally, they should disclose their total income and any calculations leading to their taxable income.

Fill out your taxation of tax-exempt organizations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxation Of Tax-Exempt Organizations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.