Get the free w 8ben florida form

Show details

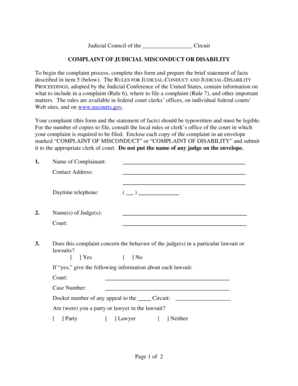

PARTE III Certificaci n La forma W-8BEN debe ser llenada y firmada por el cuentahabiente/beneficiario de la cuenta. Si el beneficiario/cuentahabiente no es un individuo sino una corporaci n entonces deber ser llenada y firmada por la persona autorizada legalmente por la junta directiva de la corporaci n. o Fecha la Forma debe ser fechada el d a de la firma. o Capacity in Which Acting Si la cuenta est a nombre de una corporaci n u otra entidad le...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign w 8ben florida form

Edit your w 8ben florida form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w 8ben florida form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing w 8ben florida form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit w 8ben florida form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out w 8ben florida form

How to fill out the W-8BEN Florida form:

01

Begin by accessing the W-8BEN form, which can be obtained from the Internal Revenue Service (IRS) website or through authorized tax software.

02

Fill out your personal information accurately and completely. This includes your full name, permanent address, and mailing address (if different), country of citizenship, and country of residence for tax purposes.

03

Provide your taxpayer identification number (TIN) or social security number (SSN) if applicable. If you are a foreign individual or entity without a TIN or SSN, you may need to include a valid reason for not having one.

04

Indicate your tax classification by selecting the appropriate option from the checklist provided on the form. This will typically be an individual, corporation, partnership, or disregarded entity.

05

If you are claiming a reduced rate of withholding or exemption from withholding under a tax treaty, provide the necessary details, including the country of residence, the article and paragraph of the treaty, and the maximum withholding rate.

06

Sign and date the W-8BEN form, certifying that the information provided is accurate and complete to the best of your knowledge.

07

Submit the completed form to the relevant withholding agent, such as a financial institution or employer, as instructed by the particular situation.

08

Keep a copy of the filled-out W-8BEN form for your records.

Who needs the W-8BEN Florida form?

01

Non-U.S. individuals or entities who earn income from U.S. sources are typically required to fill out the W-8BEN form.

02

It is commonly used by foreign individuals who receive income from U.S. sources, such as rental properties, investments, royalties, or compensation for services performed in the United States.

03

The form is necessary for establishing whether a tax treaty applies to reduce or eliminate withholding taxes.

04

The W-8BEN form is often requested by U.S. withholding agents, including banks, brokerage firms, employers, and other entities required to report income paid to foreign individuals or entities to the IRS.

05

The form helps ensure compliance with U.S. tax laws and helps prevent excessive taxation for foreign individuals or entities eligible for treaty benefits.

06

Even if you have already provided a W-8BEN form in the past, you may need to update and submit a new one to reflect any changes in your circumstances, such as a change in tax residency or eligibility for a different tax treaty.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my w 8ben florida form directly from Gmail?

w 8ben florida form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I make changes in w 8ben florida form?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your w 8ben florida form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I edit w 8ben florida form on an Android device?

You can edit, sign, and distribute w 8ben florida form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your w 8ben florida form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

W 8ben Florida Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.