Form 65/Form 1003 2009-2025 free printable template

Show details

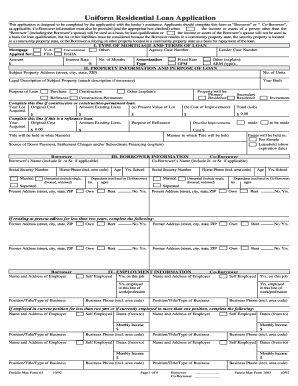

Notice: B/C. Monthly Amount. $. Borrower. Co-Borrower. Freddie Mac Form 65 6/ 09. Fannie Mae Form 1003 6/09. Calyx Form LoanappFRMrm (11/09). Page 2. 0 ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Form 65Form 1003

Edit your Form 65Form 1003 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Form 65Form 1003 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Form 65Form 1003 online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Form 65Form 1003. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Form 65/Form 1003 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Form 65Form 1003

How to fill out Form 65/Form 1003

01

Begin by gathering all necessary personal and financial information, including your Social Security number, employment details, and income sources.

02

Obtain a copy of Form 65/Form 1003 from the relevant authority or website.

03

Start filling out the applicant's information at the top of the form, including name, address, and contact details.

04

Provide information regarding the type of loan or mortgage being applied for, along with property details if applicable.

05

Fill out the section regarding financial information, such as assets, liabilities, and monthly income.

06

Review the credit history section and provide accurate information regarding credit accounts.

07

Complete the employment history section, listing previous employers and positions held.

08

Ensure all required signatures and dates are provided at the end of the form.

09

Double-check the completed form for accuracy and completeness before submission.

Who needs Form 65/Form 1003?

01

Individuals applying for a mortgage or a loan

02

First-time homebuyers seeking financing for a property

03

Real estate investors looking for funding

04

Borrowers refinancing an existing mortgage

05

Finance companies needing a standard loan application for processing

Fill

form

: Try Risk Free

People Also Ask about

What is a uniform residential loan application?

What is the Uniform Residential Loan Application? Uniform Residential Loan Application is a standardized loan form used in the mortgage industry. This form is called a 1003 form, it requires that borrowers fill out all necessary information before a loan can be established between a lender and the borrower.

Why is the uniform loan application important?

The application is designed to help lenders establish all the information needed to accurately determine a borrower's risk level by examining the type and terms of the loan, property information, borrower income and expenses, and more.

What is the 1003 uniform Residential loan application used for?

Lenders use the Uniform Residential Loan Application or Form 1003 to evaluate and determine your creditworthiness when applying for a home loan. This form is designed to help lenders make more informed decisions when extending mortgages to borrowers.

Is the new Urla still a 1003?

All loans with an application date on or after March 1, 2021 and purchased by Fannie and Freddie are required to include the redesigned URLA. The GSEs will continue to accept legacy loans (applications prior to 3/1/21) with the old form 1003 until March 1, 2022.

What is a uniform residential loan application form?

Uniform Residential Loan Application is a standardized loan form used in the mortgage industry. This form is called a 1003 form, it requires that borrowers fill out all necessary information before a loan can be established between a lender and the borrower.

What is the 1003 uniform Residential loan application?

The 1003 loan application, or Uniform Residential Loan Application, is the standardized form most mortgage lenders in the U.S. use. The application asks questions about the borrower's employment, income, assets, and debts, as well as requiring information about the property.

How many pages is the 1003 form?

Known as the Uniform Residential Loan Application (or the 1003, after its Fannie Mae form number), this five-page document provides a lender with the basic information needed to approve a buyer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Form 65Form 1003 for eSignature?

Once your Form 65Form 1003 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find Form 65Form 1003?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the Form 65Form 1003 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I edit Form 65Form 1003 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign Form 65Form 1003 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is Form 65/Form 1003?

Form 65, also known as Form 1003, is a standardized mortgage application form used by borrowers to provide their personal and financial information to lenders when applying for a loan.

Who is required to file Form 65/Form 1003?

Any individual or entity seeking a mortgage loan or real estate financing from a lender is required to file Form 65/Form 1003.

How to fill out Form 65/Form 1003?

To fill out Form 65/Form 1003, borrowers must provide details such as personal identification, employment history, income sources, asset information, and the details of the property being financed.

What is the purpose of Form 65/Form 1003?

The purpose of Form 65/Form 1003 is to collect necessary information from borrowers to assess their creditworthiness and determine their eligibility for a mortgage loan.

What information must be reported on Form 65/Form 1003?

Form 65/Form 1003 requires reporting relevant information including borrower demographics, financial assets, liabilities, income, employment details, and the purpose of the loan.

Fill out your Form 65Form 1003 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 65form 1003 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.