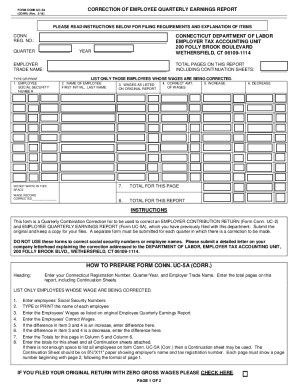

CT CONN UC-5A 2004 free printable template

Get, Create, Make and Sign CT CONN UC-5A

How to edit CT CONN UC-5A online

Uncompromising security for your PDF editing and eSignature needs

CT CONN UC-5A Form Versions

How to fill out CT CONN UC-5A

How to fill out CT CONN UC-5A

Who needs CT CONN UC-5A?

Instructions and Help about CT CONN UC-5A

Hey everybody Genesis Jones here from total G shockers and in this episode of the top 10 things you should know video series will be going through the GA 705 a which is one of the analog digital model let's get into it the G sharp G a 700cc analog digital watch with a bold new case silhouette and whose main feature is its iconic front button now the G a 700 you see model features a utility color found in military uniforms that adds a subdued touch to the G a 704 a truly modern design so here are the top 10 things you should know about the G a 700 you see — v 8 time piece number one color the base color of the watch is tan in the face of the watch features black and tan accents number two construction the GA 700 you c — 5a is enraptured in a tan resin band is accented with the utility color palette that is found in military uniforms and utility jackets and features 3d dial and hands for a multi-dimensional carved out of a metal look this design not only improves reading but projects added toughness with front button super illuminator LED light adding to its overall dynamic styling number three resistance the GA 704 stock resistant with an impact structure that uses a hollow case infused with the toughness philosophy that has been handed down to all G Shock watches in addition this watch comes with magnetic resistance as well as water resistance up to 200 meters number 4 power source this GA 700 PS off a cr2016 battery number 5 battery life now this watches approximate battery life is 5 years on the cr2016 battery number 6 LED light this watch has a super illuminator LED light selectable illumination duration that you can set for 15 seconds for 30 seconds and afterglow number 7 hourly time signal the hourly time signal is a feature in which the watch beats at the top of every hour of course you have the option of turning this one or off number 8 world time the GA 701 clues up to 31 time zones now this is 48 different cities plus UTC which is Coordinated Universal Time now Coordinated Universal Time is simply a universal time standard it's not considered a time zone in addition there is also daylight saving time and the option to swap your home time city with a world time city number 9 stopwatch countdown timer the GA feature in which the hands move out of the way to provide an unobstructed view of digital display contents and a full auto calendar which is pre-programmed until the year 2099 now the weight of the Y's is 69 grams the face of the watch is fifty-three point four millimeters wide and the retail price is 99 in US currency so there you go those are the top ten things you should know about the GA 700 you see — 5 X now if you liked this video give it a thumbs up if you didn't like this video give it a thumbs down all I care about is making relevant and valuable content that will help you out, so your feedback is greatly appreciated I also make sure you subscribe if you haven't already and hit that notification bell for dropping content...

People Also Ask about

What is the SUTA rate for 2022 in Connecticut?

Is the $300 unemployment over in CT?

What will the payroll tax rates be in 2023?

How to calculate unemployment benefits in CT?

What is CT uc2?

How much is unemployment in CT 2022?

What is the maximum unemployment benefit in CT 2022?

What is the CT unemployment tax rate for 2023?

How much will I get on unemployment in CT?

What is the FICA limit for 2023?

What are the tax changes for 2023 in CT?

What is the most you can get weekly from unemployment?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CT CONN UC-5A directly from Gmail?

How do I edit CT CONN UC-5A online?

How do I edit CT CONN UC-5A on an iOS device?

What is CT CONN UC-5A?

Who is required to file CT CONN UC-5A?

How to fill out CT CONN UC-5A?

What is the purpose of CT CONN UC-5A?

What information must be reported on CT CONN UC-5A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.