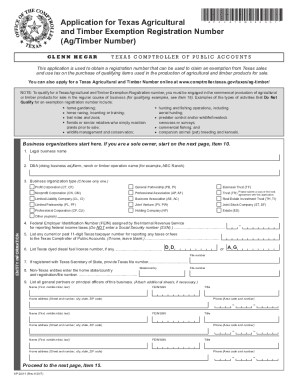

TX AP-228-1 2011 free printable template

Show details

AP-228-2 Rev.12-11/2 Legal name same as Item 1 OR Item 10 Page 2 For Comptroller Use Only If you are a sole proprietor start here. Attach additional sheets if necessary. Name rst middle initial last FEIN Title Home address street and number city state ZIP code Phone area code and number AP-228-1 Rev.12-11/2 Proceed to the next page Item 15. PRINT FORM CLEAR FORM Application for Texas Agricultural and Timber Exemption Registration Number Ag/Timber Number This application is used to obtain a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX AP-228-1

Edit your TX AP-228-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX AP-228-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX AP-228-1 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX AP-228-1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX AP-228-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX AP-228-1

How to fill out TX AP-228-1

01

Download the TX AP-228-1 form from the official Texas Comptroller website.

02

Start by indicating the applicant's name and address in the designated fields.

03

Fill in the taxpayer number or Social Security number as required.

04

Provide details about the property for which the application is submitted, including the physical address.

05

Specify the type of exemption you are applying for by checking the appropriate boxes.

06

If applicable, attach any supporting documents that validate your exemption claim.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form at the bottom.

09

Submit the form to the appropriate appraisal district office before the deadline.

Who needs TX AP-228-1?

01

Individuals or entities applying for property tax exemptions in Texas.

02

Property owners seeking to qualify for homestead exemptions.

03

Non-profit organizations or businesses looking for specific tax relief.

Fill

form

: Try Risk Free

People Also Ask about

How long are tax exempt forms good for in Texas?

A seller is required to keep exemption certificates for a minimum of four years from the date on which the sale is made and throughout any period in which any tax, penalty, or interest may be assessed, collected, or refunded by the comptroller or in which an administrative hearing or judicial proceeding is pending.

How do I renew my Texas AG and timber number?

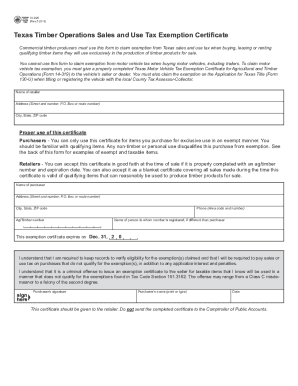

Ag/Timber Numbers must be renewed every four years, regardless of when the number was first issued. Renewed and new Ag/Timber Numbers expire Dec. 31, 2023. You must enter the expiration date on the exemption certificate you give to retailers on your qualifying purchases.

How do I renew my Texas tax exempt certificate?

There are three options for renewing your exemption certificate: online, by phone or by mail. Online renewal is the fastest option, as you will receive your confirmation number immediately. If you apply by phone, expect to get your confirmation letter by mail in five to seven days.

Do Texas tax exempt certificates expire?

The resale certificate is the seller's evidence as to why sales tax was not collected on that transaction and should be retained in the seller's books and records for four years.

How many acres do you need for timber exemption in Texas?

How many acres do you need to be ag exempt in Texas? Ag exemption requirements vary by county, but generally speaking, you need at least 10 acres of qualified agricultural land to be eligible for the special valuation.

How do I get a Texas ag exemption number?

To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You must include the Ag/Timber Number on the agricultural exemption certificate (PDF) or the timber exemption certificate (PDF) when buying qualifying items.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my TX AP-228-1 in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your TX AP-228-1 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send TX AP-228-1 to be eSigned by others?

TX AP-228-1 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for the TX AP-228-1 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your TX AP-228-1 and you'll be done in minutes.

What is TX AP-228-1?

TX AP-228-1 is a form used by certain taxpayers in Texas to report specific types of tax information to the state.

Who is required to file TX AP-228-1?

Taxpayers who have engaged in certain transactions or activities as defined by Texas tax law are required to file TX AP-228-1.

How to fill out TX AP-228-1?

To fill out TX AP-228-1, taxpayers should gather necessary financial information, complete each section of the form accurately, and submit it following the provided instructions and deadlines.

What is the purpose of TX AP-228-1?

The purpose of TX AP-228-1 is to collect important tax-related data from taxpayers to ensure compliance with state tax laws.

What information must be reported on TX AP-228-1?

TX AP-228-1 requires reporting detailed information such as income details, types of deductions taken, and any applicable credits claimed by the taxpayer.

Fill out your TX AP-228-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX AP-228-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.