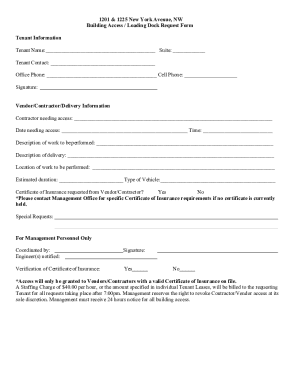

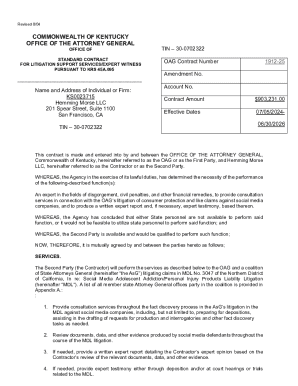

Get the free Business Credit Appliction

Show details

Business Credit Application ... Business Phone Number Business Fax Number. () () ... Person to Contact Regarding the Account; Please Include Phone Number ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business credit appliction

Edit your business credit appliction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business credit appliction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business credit appliction online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit business credit appliction. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business credit appliction

How to Fill Out a Business Credit Application:

01

Begin by gathering all necessary information and documents. This includes your business name, address, contact information, tax identification number, and any relevant legal licenses or permits. You may also be required to provide financial statements, bank statements, and references.

02

Read the application carefully to understand what information is required and any specific instructions for each section. Ensure that you have a clear understanding of the terms and conditions before proceeding.

03

Start by providing basic information about your business, such as the legal entity type, industry, and number of years in operation. This helps the lender assess your business's stability and experience.

04

Continue by entering your business's financial details, including annual revenue, net income, and any outstanding debts. This information allows the lender to evaluate your financial position and repayment ability.

05

Provide information about the business owner or authorized representative, including their name, address, and contact details. You may also be asked to provide personal financial information for credit evaluation purposes.

06

Fill in the necessary sections regarding your desired credit amount, intended use of funds, and repayment terms. Be specific and realistic about your funding requirements and repayment ability.

07

Follow any additional instructions provided, such as attaching supporting documentation or completing supplementary forms. Double-check that all required fields have been completed accurately and legibly.

08

Review the entire application thoroughly before submission to check for any errors or missing information. It's crucial to ensure the accuracy and completeness of the application as any discrepancies may delay the approval process.

09

Sign and date the application as required, acknowledging that the information provided is truthful and accurate to the best of your knowledge. This is a legal declaration that holds you accountable for the information provided.

10

Submit the application and any requested supporting documents through the designated channel, such as online submission, mail, or in-person delivery. Retain a copy of the completed application for your records.

Who Needs a Business Credit Application?

A business credit application is needed by any business that seeks to establish or expand its credit and financing options. This applies to various entities, such as:

01

Small businesses looking for loans or credit lines to support their operations, purchase inventory, or invest in growth opportunities.

02

Startups or entrepreneurs seeking initial financing options to launch their business or fund product development.

03

Established businesses aiming to establish or improve their creditworthiness and financial reputation.

04

Businesses pursuing partnerships or collaborations that require a solid credit history and financial standing.

05

Companies planning to lease or rent commercial equipment or property, as landlords or lessors often require credit applications.

In summary, anyone who wants to access credit or financing options for their business should complete a business credit application. It allows lenders and creditors to assess the business's financial position, evaluate creditworthiness, and make informed decisions regarding loan approvals and terms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete business credit appliction online?

pdfFiller has made it simple to fill out and eSign business credit appliction. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I edit business credit appliction on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign business credit appliction on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete business credit appliction on an Android device?

Complete business credit appliction and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is business credit application?

A business credit application is a form that a business fills out to apply for credit with a vendor or lender.

Who is required to file business credit application?

Any business looking to establish a line of credit with a vendor or lender usually needs to file a business credit application.

How to fill out business credit application?

To fill out a business credit application, the business must provide information about their company, financial history, and credit references.

What is the purpose of business credit application?

The purpose of a business credit application is to provide information to a vendor or lender to evaluate the creditworthiness of the business and determine whether to extend credit.

What information must be reported on business credit application?

Information such as company name, address, financial statements, credit references, and ownership information must be reported on a business credit application.

Fill out your business credit appliction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Credit Appliction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.