iGoLogic Credit Reference Request 2011-2026 free printable template

Show details

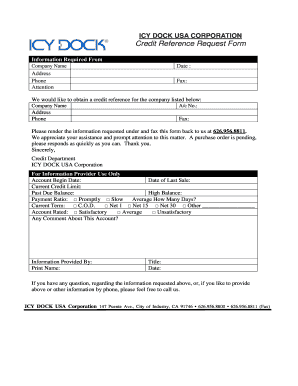

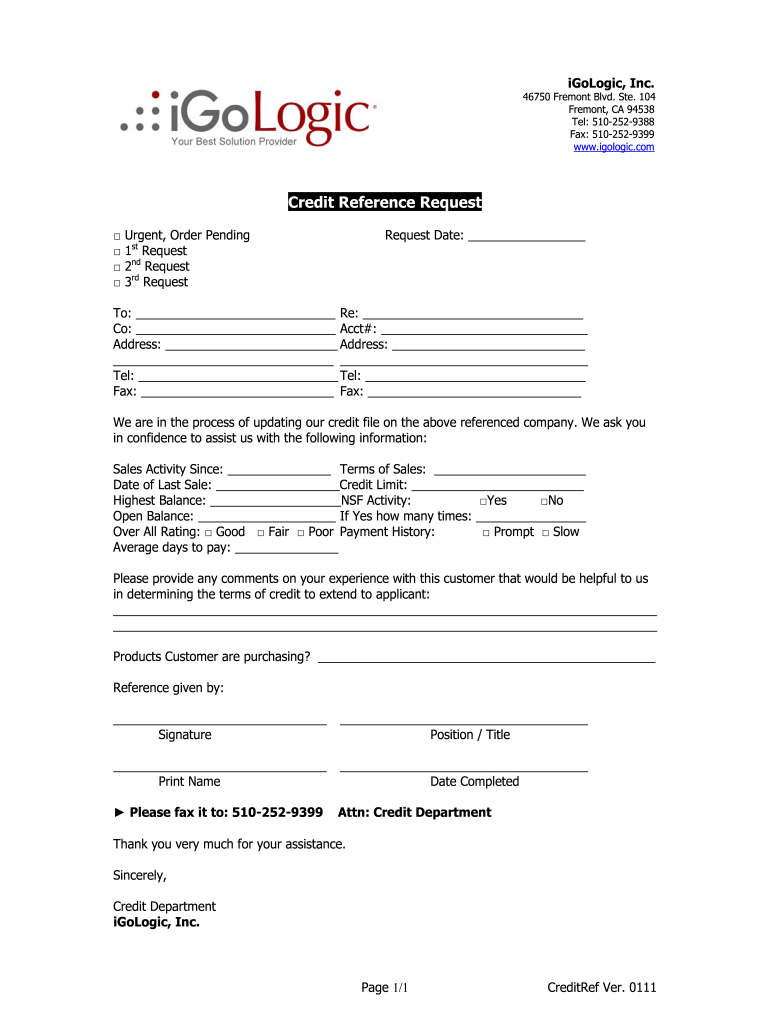

IGoLogic Inc. 46750 Fremont Blvd. Ste. 104 Fremont CA 94538 Tel 510-252-9388 Fax 510-252-9399 www. igologic.com Credit Reference Request Urgent Order Pending 1st Request 2nd Request 3rd Request Request Date To Re Address Address Fax Fax We are in the process of updating our credit file on the above referenced company. We ask you in confidence to assist us with the following information Sales Activity Since Terms of Sales Date of Last Sale Credit Limit Highest Balance NSF Activity Yes No...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign printable blank credit reference form

Edit your credit reference form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit references form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fillable credit reference form online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit reference example form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit reference request form

How to fill out iGoLogic Credit Reference Request

01

Begin by downloading the iGoLogic Credit Reference Request form from the official website.

02

Fill in your personal information, including your full name, contact details, and address.

03

Provide the details of the company or individual you are requesting the credit reference from.

04

Indicate the purpose of the credit reference request in the designated section.

05

Ensure you include any necessary documentation that supports your request.

06

Review the completed form for accuracy and completeness.

07

Submit the form by either mailing it to the specified address or sending it via email as per the instructions.

Who needs iGoLogic Credit Reference Request?

01

Individuals applying for a loan or mortgage who need to verify their creditworthiness.

02

Businesses seeking to evaluate the credit risk of potential clients or partners.

03

Landlords requiring a credit check for prospective tenants.

04

Financial institutions conducting background checks on applicants.

Fill

credit reference template

: Try Risk Free

People Also Ask about printable credit reference form

How do you ask for a credit reference?

Credit references are often part of the process if you're applying for a credit card, loan or apartment. You could get a credit reference by authorizing a credit check, requesting a copy of your credit report or asking a previous lender or landlord for a credit reference letter.

What questions are asked for credit references?

There are many questions you can ask when you follow up with business credit references, for example: How long has Company A had an open account with you? What is their credit limit with you? How many times have they been late? How late? Is there a seasonal pattern to their payment behaviors?

What is a credit reference request?

A credit reference is a document verifying an individual or business's creditworthiness. It is similar to a job reference. The document tries to attest an entity's credit history. Lenders, such as banks, request a credit reference from applicants to weigh the risks associated with the loan approval.

How do I fill out a credit reference form?

What's Included in a Credit Reference Letter The type of account you have with the reference issuer. The length or age of the relationship. The nature of your payment habits. Account numbers and other information required to identify your credit history. The average amount of credit you require from the issuer.

How do I create a credit reference form?

How to Fill Out a Credit Reference Request? Write down your name and contact details. Explain the reason for your request - name the company or institution that needs assistance in making a credit decision and ask the reference provider to share the details of your professional relationship.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit reference sheet in Gmail?

credit reference check form sample and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send credit reference check template to be eSigned by others?

To distribute your credit reference form pdf, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I edit credit reference request fillable form on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing credit reference request form template, you need to install and log in to the app.

What is iGoLogic Credit Reference Request?

iGoLogic Credit Reference Request is a formal document used by financial institutions and businesses to assess the creditworthiness of an individual or entity before extending credit or entering into a financial agreement.

Who is required to file iGoLogic Credit Reference Request?

Typically, lenders, credit companies, and businesses that are considering extending credit or business relationships are required to file iGoLogic Credit Reference Requests.

How to fill out iGoLogic Credit Reference Request?

To fill out the iGoLogic Credit Reference Request, you should provide accurate information including personal or business details, financial history, and any specific requests for information regarding the credit standing of the individual or entity being evaluated.

What is the purpose of iGoLogic Credit Reference Request?

The purpose of the iGoLogic Credit Reference Request is to gather necessary information to evaluate the credit risk of a potential borrower, ensuring informed lending decisions and minimizing financial risk.

What information must be reported on iGoLogic Credit Reference Request?

The information that must be reported on the iGoLogic Credit Reference Request includes identification details, credit history, outstanding debts, payment records, and any relevant financial statements.

Fill out your iGoLogic Credit Reference Request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit References Examples is not the form you're looking for?Search for another form here.

Keywords relevant to credit reference examples

Related to trade reference template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.