Get the free Pershing ira distribution forms fillable

Show details

With a Traditional IRA, contributions may be federally tax-deductible, and your ..... for federal income tax purposes unless you elect on the distribution form not to ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pershing ira distribution forms

Edit your pershing ira distribution forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pershing ira distribution forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pershing ira distribution forms online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pershing ira distribution forms. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pershing ira distribution forms

How to fill out Pershing IRA distribution forms:

01

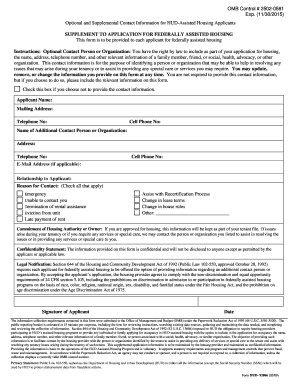

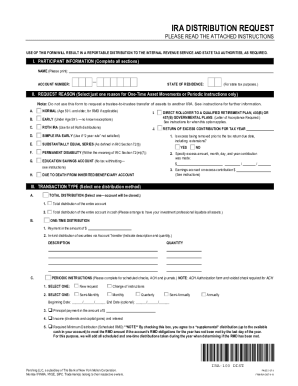

Gather necessary information: Before filling out the Pershing IRA distribution forms, gather all the required information such as your personal details, IRA account number, the distribution amount, and the reason for the distribution.

02

Obtain the forms: Contact your Pershing IRA custodian or visit their website to obtain the necessary distribution forms. These forms may vary depending on the type of distribution you require, such as a premature distribution, a required minimum distribution (RMD), or a qualified distribution.

03

Read the instructions: Thoroughly read the instructions provided with the distribution forms to ensure you understand the requirements and any specific documentation that may be required.

04

Complete personal information: Start by providing your personal details, including your full name, address, social security number, and contact information. Make sure all the information is accurate and up to date.

05

Enter IRA account details: Fill in your Pershing IRA account number and specify the type of IRA you hold (Traditional IRA, Roth IRA, SEP IRA, etc.). Provide any additional information requested about your IRA account.

06

Specify distribution details: Indicate the distribution amount you wish to withdraw and specify the reason for the distribution, such as retirement, financial hardship, or other qualifying events. Some distribution forms may also require you to select the method of distribution, such as a lump-sum, partial distribution, or systematic withdrawal.

07

Attach required documentation: Depending on the type of distribution, you may need to attach supporting documentation such as proof of age (if applying for early distribution), financial hardship proof, or beneficiary information. Ensure you have all the necessary documents attached as per the instructions.

08

Review and sign: Carefully review all the information filled out on the distribution forms to ensure accuracy. Make sure you understand the terms and conditions related to the distribution. Sign and date the forms before submitting them.

Who needs Pershing IRA distribution forms?

01

Individuals with a Pershing IRA: Anyone who holds an Individual Retirement Account (IRA) with Pershing can potentially require distribution forms. This includes those who are approaching retirement age and need to take required minimum distributions (RMDs) or individuals who may need to make other types of IRA distributions.

02

Individuals experiencing financial hardship: In some cases, individuals facing certain hardships may need to make early or premature distributions from their Pershing IRA. This could include situations such as medical expenses, educational expenses, or the purchase of a first home.

03

Beneficiaries of Pershing IRA owners: Upon the death of an IRA owner, beneficiaries may need to fill out Pershing IRA distribution forms to receive their inherited IRA distribution according to the applicable rules and regulations.

Note: It is always recommended to consult with a financial advisor or tax professional when making any distribution from an IRA to ensure compliance with the relevant laws and regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I request an IRA distribution?

Regardless of your age, you will need to file a Form 1040 and show the amount of the IRA withdrawal. Since you took the withdrawal before you reached age 59 1/2, unless you met one of the exceptions, you will need to pay an additional 10% tax on early distributions on your Form 1040.

When can I withdraw from an IRA without paying taxes?

Generally, early withdrawal from an Individual Retirement Account (IRA) prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty. There are exceptions to the 10 percent penalty, such as using IRA funds to pay your medical insurance premium after a job loss.

When can I take IRA distributions without penalty?

Once you reach age 59½, you can withdraw funds from your Traditional IRA without restrictions or penalties.

How do I avoid paying taxes on my IRA withdrawal?

If you have a Roth IRA, you can withdraw the money you contributed at any time as long as the account has been open for at least five years. You already paid the income taxes, so you won't owe more.

What is IRA distribution request form?

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of $10 or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans.

What is a Pershing IRA?

Pershing is a one-stop source for a range of individual retirement solutions—along with a wealth of tools and resources to help advisors grow their retirement business. Choose from Traditional, Roth, and Rollover individual retirement accounts (IRAs) that feature convenient account services and distribution options.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the pershing ira distribution forms electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your pershing ira distribution forms in seconds.

How do I fill out the pershing ira distribution forms form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign pershing ira distribution forms and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete pershing ira distribution forms on an Android device?

Use the pdfFiller app for Android to finish your pershing ira distribution forms. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is pershing ira distribution forms?

Pershing IRA distribution forms are documents used to request distributions from an Individual Retirement Account held with Pershing.

Who is required to file pershing ira distribution forms?

Individuals who wish to take distributions from their Pershing IRA account are required to file pershing IRA distribution forms.

How to fill out pershing ira distribution forms?

To fill out Pershing IRA distribution forms, one must provide personal information, account details, distribution amount, and reason for the distribution.

What is the purpose of pershing ira distribution forms?

The purpose of Pershing IRA distribution forms is to initiate the process of withdrawing funds from an individual's IRA account.

What information must be reported on pershing ira distribution forms?

Information such as account holder's name, account number, distribution amount, reason for distribution, and tax withholding preferences must be reported on Pershing IRA distribution forms.

Fill out your pershing ira distribution forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pershing Ira Distribution Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.