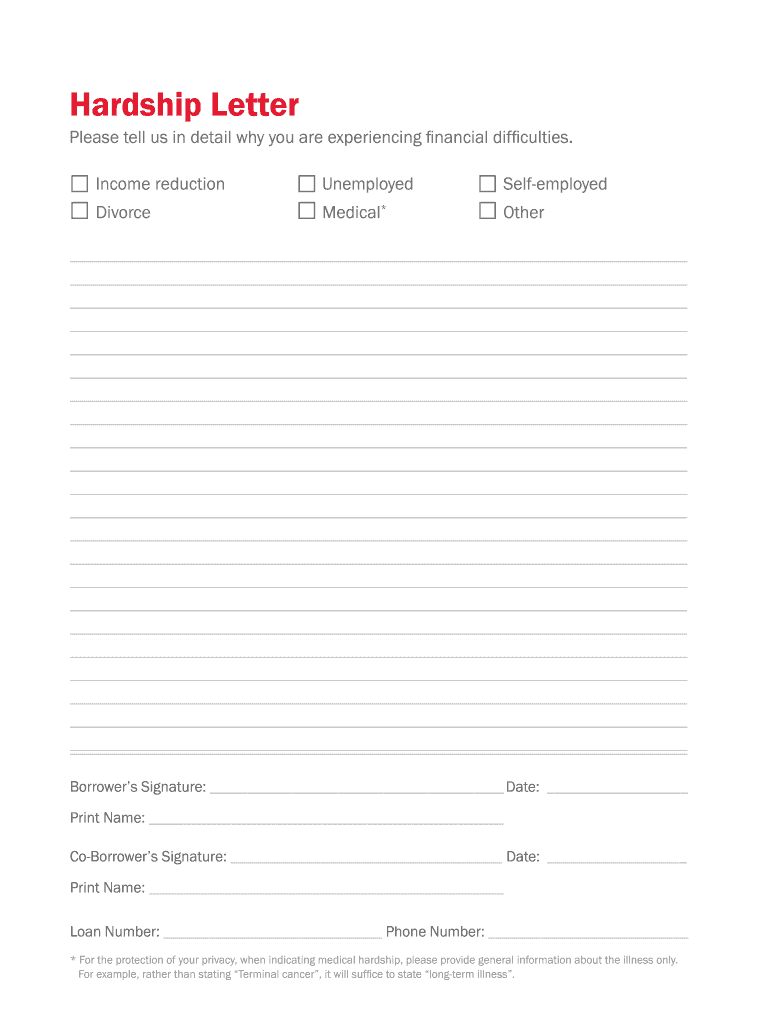

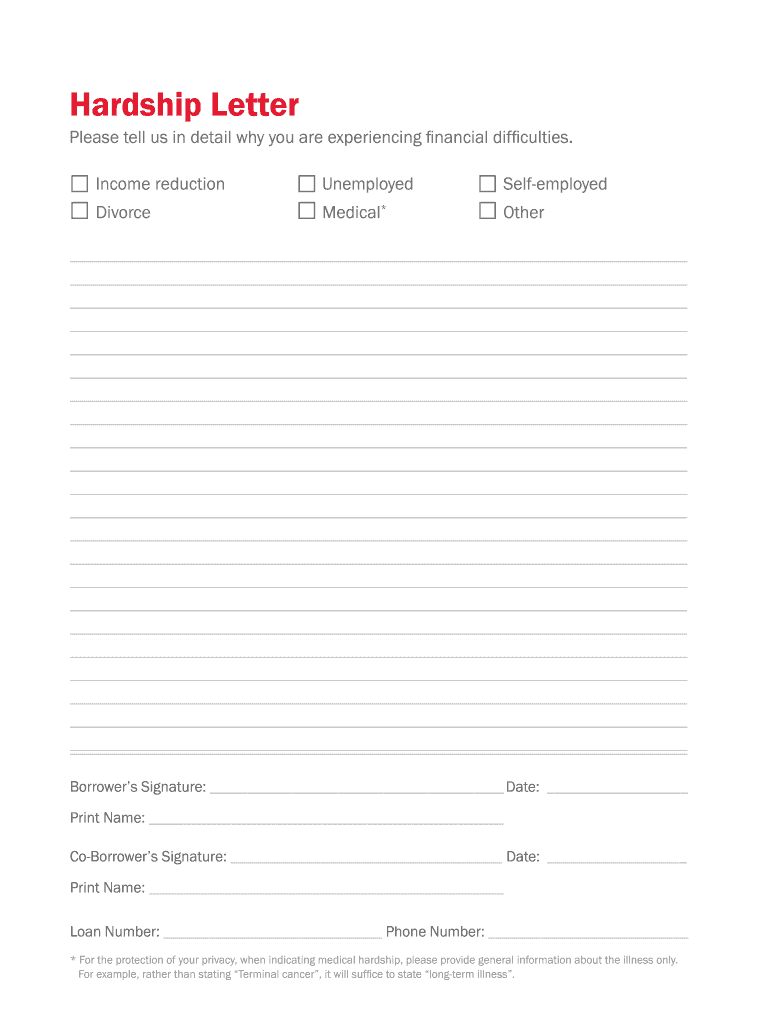

BoFA Hardship Letter free printable template

Get, Create, Make and Sign hardship letter

Editing hardship letter online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hardship letter

How to fill out BoFA Hardship Letter

Who needs BoFA Hardship Letter?

Instructions and Help about hardship letter

Everybody's watching us, and today I have the good fortune to introduce to you our in-house corporate counsel Michael Bairn Merrill he calls him the dad of the group because he's in charge of the distressed asset division and that includes our short sales right, and he's an awesome resource in order to help us get these short sales approved, and today we're going to cover a topic that's very important one of the first things you have to do, but it's how to write an awesome hardship letter that is going to get it's going to get the bank's attention, and it's going to get them to want to approve the short sale, so Michael welcome thank you very much yeah let's talk a little about how to write this hardship letter so how would you advise a client on writing the right parts of letter to get notice by the bank a 1 1 of the things that you need to do is actually be accurate and be concise I've seen arching letters that aren't two three four pages long and those don't work a one-page explanation of what is happening in your case telling them what your hardship is and what you've done to remedy the hardship and why it is that I was no longer portable to you that works okay and should they should people write about how much money they're losing every single month should they detail the analysis in the hardship letter what advice do you give them in that respect well it's basically, so we were constrained to for the effective letter it would go straight one-page right, so one of those paragraph is going to come out and say I'm calling you because I'm sending you this letter because I'm having these difficulties making these payments and difficulty making these payments is because I either got divorced the property is underwater my interest only loan is now it's not just only interest on me, but now its pit Chris was just texting insurance the condo fees have gone too high, so there's a death in the family there's a loss of job so all those things get explained, and it shows what the monthly shortage is in your ability to make the mortgage payments okay and so when that when you tell them the purpose why you are required in this situation, and then you've already tried in most instances they've tried a loan modification sometimes the loan modifications get sometimes approved they don't and in some of those instances where they've been approved even the loan modifications don't work I know cases where the loan modification got approved it went from an interest-only loan to a pit but instead of reducing the monthly payment the monthly payments haven't actually gone up by $$2550 granted it is not including principal interest taxes insurance as opposed to interest only for 1500 as opposed to British tax insurance for 1550 in the long run it's a cheaper product cheaper fixed-rate loan which amortizes belong but instead of making it cheaper for you out of pocket you're actually spending more money out of pocket every month I see that quite also so those...

People Also Ask about

What should I write in a hardship letter?

How do you explain financial hardship?

How do you write a letter for unable to pay?

What is the reason for a hardship letter?

How do I write a hardship letter?

What is a good reason for hardship?

What is an example of a letter of financial hardship?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in hardship letter without leaving Chrome?

Can I edit hardship letter on an iOS device?

How do I complete hardship letter on an iOS device?

What is BoFA Hardship Letter?

Who is required to file BoFA Hardship Letter?

How to fill out BoFA Hardship Letter?

What is the purpose of BoFA Hardship Letter?

What information must be reported on BoFA Hardship Letter?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.