SSA-1945 2004 free printable template

Show details

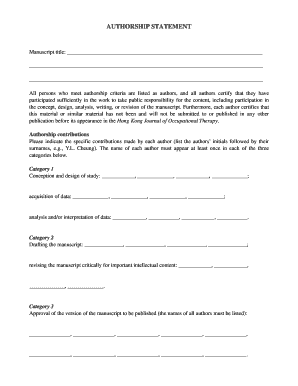

Statement Concerning Your Employment in a Job Not Covered by Social Security Employee Name Employee ID# Employer Name Employer ID# Your earnings from this job are not covered under Social Security.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SSA-1945

Edit your SSA-1945 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SSA-1945 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SSA-1945 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit SSA-1945. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SSA-1945 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SSA-1945

How to fill out SSA-1945

01

Begin by downloading the SSA-1945 form from the Social Security Administration's website or obtaining a physical copy from a local Social Security office.

02

Fill out your personal information in the designated sections, including your name, Social Security number, and date of birth.

03

Indicate the type of benefits you are applying for or the specific request you are making in relation to the form.

04

Provide information about your current financial situation as required by the form.

05

Review the form carefully for any errors or missing information before signing.

06

Sign and date the form to certify that all information provided is accurate.

07

Submit the completed SSA-1945 form to the appropriate Social Security office, either in person or by mail.

Who needs SSA-1945?

01

Individuals applying for or inquiring about specific Social Security benefits.

02

People who need to provide additional information related to their Social Security record or inquiry.

03

Applicants needing to clarify their eligibility for benefits.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from windfall elimination provision?

The WEP may not apply if you have 30 or more years of substantial earnings in employment where you paid Social Security taxes. If you had between 20-30 years of substantial earnings covered by Social Security, the WEP may still apply, but at a reduced level. The WEP only applies to retirement and disability benefits.

How can I maximize my spousal Social Security benefits?

Both wait until age 70 to claim benefits If you or your spouse (or even both of you!) can wait until you're 70, you'll receive your highest Social Security payments—up to 132% of your primary insurance amount (PIA) if your full retirement age (FRA) is 66, and 124% of your PIA if your FRA is 67.

What is the SSA 1945 document?

What is the Form SSA-1945? Form SSA-1945, Statement Concerning Your Employment in a Job Not Covered by Social Security, is the document that employers should use to meet the requirements of the law.

What is the loophole for Social Security spousal benefits?

The Restricted Application Loophole One Social Security loophole allowed married individuals to begin receiving a spousal benefit at full retirement age, while letting their own retirement benefit grow. This was done by filing what is called a restricted application.

When can a wife collect half of her husband's Social Security?

A widow is eligible for between 71 percent (at age 60) and 100 percent (at full retirement age) of what the spouse was getting before they died. We must pay your own retirement benefit first, then supplement it with whatever extra benefits you are due as a widow.

What did the Social Security Act of 1945 do?

—A State shall consult and coordinate, as appropriate, with the Substance Abuse and Mental Health Services Administration in addressing issues regarding the prevention and treatment of mental illness and substance abuse among eligible individuals with chronic conditions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit SSA-1945 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including SSA-1945. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I edit SSA-1945 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign SSA-1945 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete SSA-1945 on an Android device?

Use the pdfFiller app for Android to finish your SSA-1945. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is SSA-1945?

SSA-1945 is a form used by the Social Security Administration (SSA) which is known as the 'Statement Concerning Marriage.' It is primarily used to provide information regarding a person's marital status and related information for the purpose of determining eligibility for Social Security benefits.

Who is required to file SSA-1945?

Individuals who are applying for Social Security benefits and need to provide information about their marital status, particularly if they are married, divorced, or widowed, are required to file SSA-1945.

How to fill out SSA-1945?

To fill out SSA-1945, applicants must complete personal information sections, such as their name, Social Security number, and details about their marital history. They should follow the instructions provided on the form and ensure all information is accurate and complete before submission.

What is the purpose of SSA-1945?

The purpose of SSA-1945 is to gather relevant information about an individual's marital status, which is essential for determining their eligibility and benefit amounts for Social Security.

What information must be reported on SSA-1945?

The information that must be reported on SSA-1945 includes the individual's full name, Social Security number, details regarding current and previous marriages, the dates of marriages, and any relevant information about the spouse or former spouse.

Fill out your SSA-1945 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SSA-1945 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.