DC OTR Tax Certification Affidavit free printable template

Show details

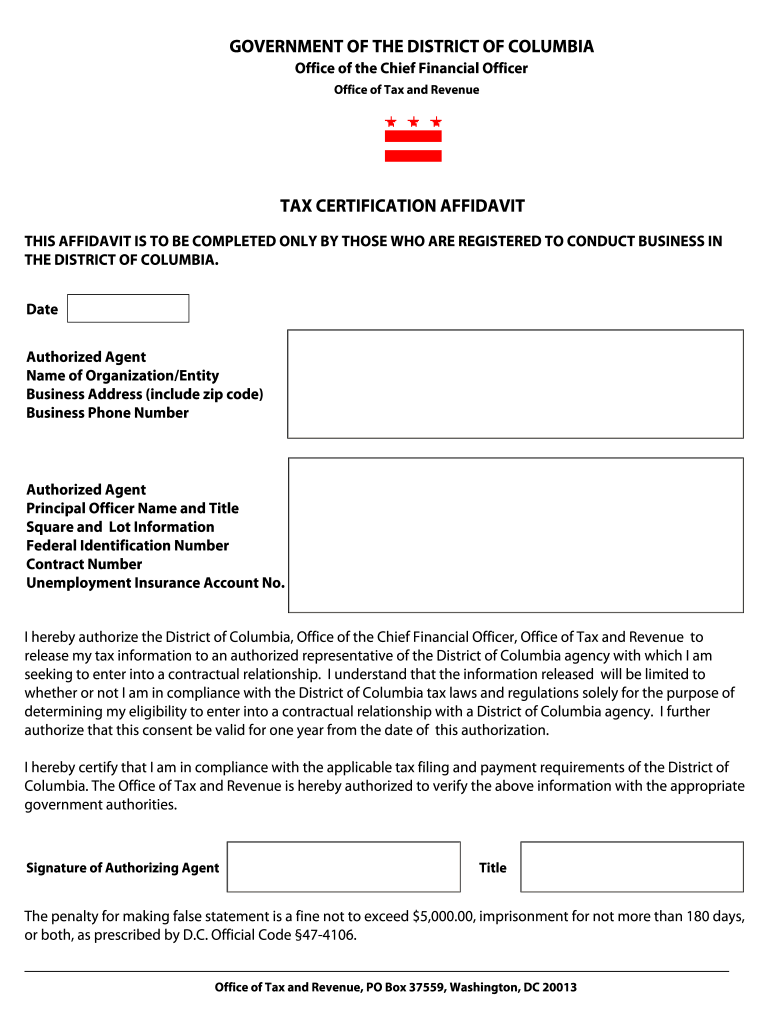

Office of Tax and Revenue, PO Box 37559, Washington, DC 20013. THIS AFFIDAVIT IS TO BE COMPLETED ONLY BY THOSE WHO ARE REGISTERED TO ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tax certification affidavit form

Edit your dc tax affidavit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your officer tax certification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing district columbia affidavit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dc certification affidavit form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax cert affidavit form

How to fill out DC OTR Tax Certification Affidavit

01

Begin by downloading the DC OTR Tax Certification Affidavit form from the official website.

02

Fill out your personal information in the designated fields, including your name, address, and contact details.

03

Indicate the type of tax certification you are applying for.

04

Provide your Social Security Number or Employer Identification Number as required.

05

Make sure to include any additional documentation that may be necessary to support your application.

06

Review the completed form for accuracy and completeness.

07

Sign and date the affidavit at the bottom of the form.

08

Submit the affidavit to the appropriate tax office or department as instructed on the form.

Who needs DC OTR Tax Certification Affidavit?

01

Individuals or businesses seeking tax certification from the District of Columbia Office of Tax and Revenue.

02

Property owners applying for property tax exemptions or abatements.

03

Taxpayers who need to certify their tax status for certain transactions or applications.

Fill

district revenue affidavit

: Try Risk Free

People Also Ask about tax district authorize

Does DC have a state tax form?

Who must file a Form D-4? Every new employee who resides in DC and is required to have DC income taxes withheld, must fill out Form D-4 and file it with his/her employer.

What is D 40B form?

Any non-resident of DC claiming a refund of DC income tax with- held or paid by estimated tax payments must file a D-40B. A non-resident is anyone whose permanent home was outside DC during all of 2022 and who did not maintain a place of abode in DC for a total of 183 days or more during 2022.

What is the DC out of state tax form?

Any non-resident of DC claiming a refund of DC income tax with- held or paid by estimated tax payments must file a D-40B. A non-resident is anyone whose permanent home was outside DC during all of 2022 and who did not maintain a place of abode in DC for a total of 183 days or more during 2022.

Does DC have a state tax return?

Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. Your permanent residence was in the District of Columbia for either part of or the full taxable year.

How do I get a copy of my DC property tax bill?

If you need assistance, call the Customer Service Center at (202) 727-4TAX or contact OTR via email. Mortgage/Title Companies: Visit Real Property Public Extract and Billing/Payment Records.

What is a DC tax certificate?

Tax certificates reflect the most current general taxes and special assessment fees intended for real property purchases as outlined under DC Official Code §47-405.

How do I get a DC tax ID number?

District of Columbia Tax Account Numbers If you are a new business, register online with the DC Office of Tax and Revenue. If you already have a DC Withholding Account Number, you can look this up online or on on correspondence from the DC Office of Tax and Revenue. If you're unsure, contact the agency at 202-727-4829.

How do I file DC taxes as a non resident?

Any non-resident of DC claiming a refund of DC income tax with- held or paid by estimated tax payments must file a D-40B. A non-resident is anyone whose permanent home was outside DC during all of 2022 and who did not maintain a place of abode in DC for a total of 183 days or more during 2022.

What is my DC tax ID number?

District of Columbia Tax Account Numbers If you already have a DC Withholding Account Number, you can look this up online or on on correspondence from the DC Office of Tax and Revenue. If you're unsure, contact the agency at 202-727-4829.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send dc tax cert to be eSigned by others?

When you're ready to share your district affidavit conduct, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I edit district affidavit those on an iOS device?

You certainly can. You can quickly edit, distribute, and sign district revenue authorize on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How can I fill out revenue affidavit those on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your district hereby government. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is DC OTR Tax Certification Affidavit?

The DC OTR Tax Certification Affidavit is a legal document required by the District of Columbia Office of Tax and Revenue to certify that an individual or business is compliant with local tax laws.

Who is required to file DC OTR Tax Certification Affidavit?

Individuals and businesses that are seeking certain licenses, permits, or contracts in the District of Columbia may be required to file the DC OTR Tax Certification Affidavit.

How to fill out DC OTR Tax Certification Affidavit?

To fill out the DC OTR Tax Certification Affidavit, an individual or business must complete the form by providing accurate personal or business information, tax identification numbers, and confirming compliance with tax obligations.

What is the purpose of DC OTR Tax Certification Affidavit?

The purpose of the DC OTR Tax Certification Affidavit is to ensure that the individual or entity is in good standing with tax obligations, thereby allowing them to obtain necessary business licenses or permits.

What information must be reported on DC OTR Tax Certification Affidavit?

The information that must be reported on the DC OTR Tax Certification Affidavit includes the applicant's name, address, tax identification number, and a declaration of compliance with local tax laws.

Fill out your dc tax certification affidavit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chief Tax Affidavit is not the form you're looking for?Search for another form here.

Keywords relevant to district revenue hereby

Related to tax columbia hereby

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.