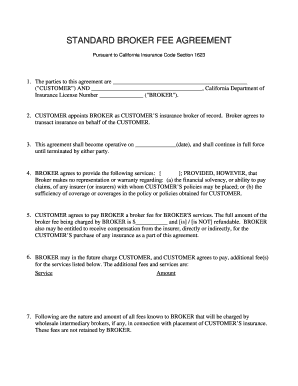

Mortgage Broker Fee Agreement free printable template

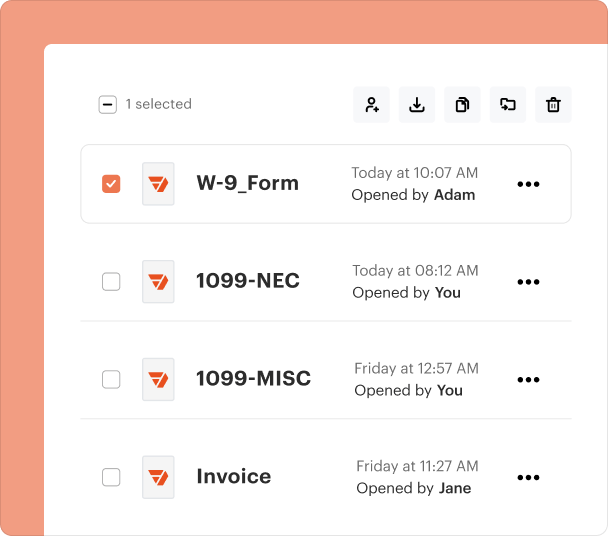

Fill out, sign, and share forms from a single PDF platform

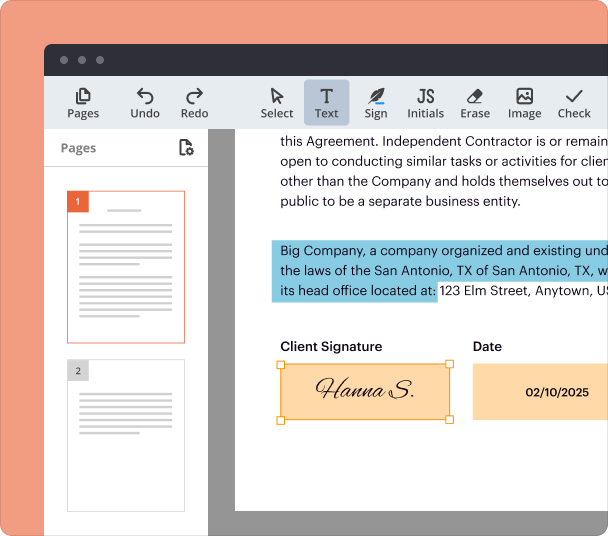

Edit and sign in one place

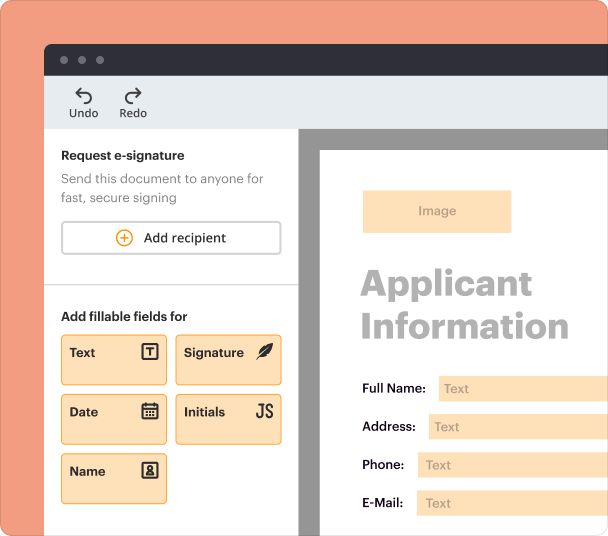

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Understanding the Mortgage Broker Fee Agreement Form

What is the mortgage broker fee agreement form?

The mortgage broker fee agreement form is a legal document that outlines the terms and conditions under which a mortgage broker will provide services to a borrower. This form specifies the fees the broker will charge for arranging a mortgage loan and details the obligations of both the broker and the borrower. It ensures clarity regarding the payment of fees and the nature of services rendered during the mortgage application process.

Key features of the mortgage broker fee agreement form

This form typically includes several essential features designed to protect both parties involved. Key components may include:

-

Details about the mortgage broker, including their name, contact information, and license number.

-

A clear outline of the compensation structure, including any upfront fees, percentage-based fees, and how these fees relate to the loan amount.

-

A description of the specific services the broker will provide, such as loan processing, consultation, and coordination with lenders.

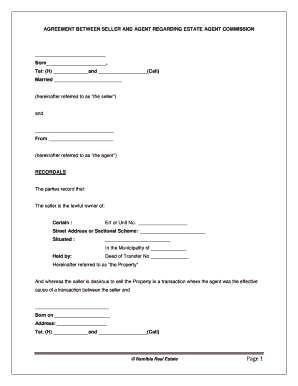

Who needs the mortgage broker fee agreement form?

This form is essential for anyone seeking to engage a mortgage broker for assistance with obtaining a mortgage loan. Borrowers who may benefit include first-time homebuyers, individuals looking to refinance existing loans, or anyone unfamiliar with the mortgage application process. Using this agreement helps ensure that borrowers have a clear understanding of their financial obligations.

Best practices for accurate completion

Filling out the mortgage broker fee agreement form requires careful attention to detail. To ensure accuracy and completeness, consider the following best practices:

-

Before filling it out, review all sections to understand the requirements fully.

-

Ensure that all personal and loan-related information entered is correct and up to date.

-

If unsure about any terms or conditions, engage with the mortgage broker for clarification before signing.

Common errors and troubleshooting

When completing the mortgage broker fee agreement form, some common errors can occur. Awareness and proactive management can prevent these mistakes. Frequent issues include:

-

Leaving sections blank can delay the processing of your loan application.

-

Double-check all calculations, particularly if fees are expressed as percentages of the loan amount.

-

Clarify any ambiguous language with the mortgage broker to avoid misinterpretations.

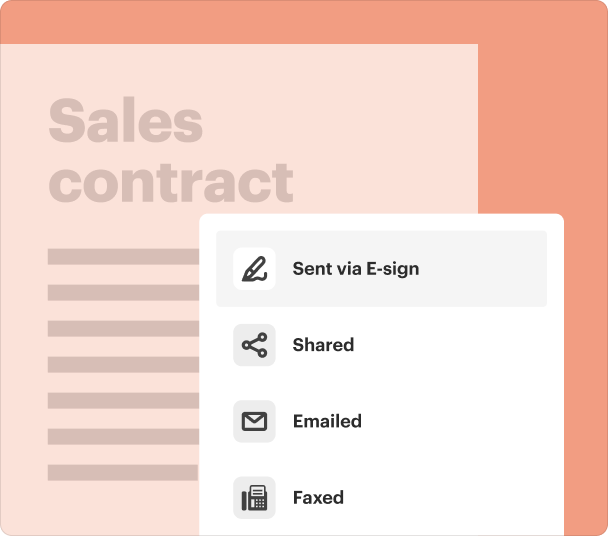

Submission methods and delivery

Once completed, the mortgage broker fee agreement form needs to be submitted according to the broker's specified methods. Common submission methods include:

-

Sending a scanned copy of the signed form via email is a quick and efficient method.

-

Bringing the form directly to the mortgage broker's office ensures immediate processing.

-

If applicable, uploading the completed form to a secure online platform used by the broker may be an option.

Frequently Asked Questions about mortgage broker fee agreement pdf form

What should I do if I disagree with the fees listed in the agreement?

If you disagree with the fees, it's important to discuss them with your mortgage broker. Clarifying the basis for these fees can help address your concerns and ensure transparency in the agreement.

Can I negotiate the broker fees?

Yes, broker fees can often be negotiated. It is advisable to discuss this upfront with your mortgage broker to explore potential adjustments.

pdfFiller scores top ratings on review platforms