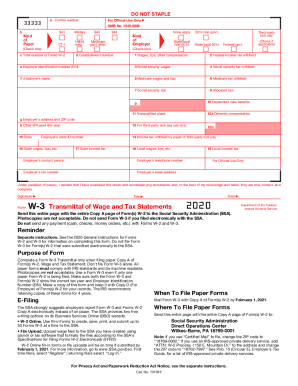

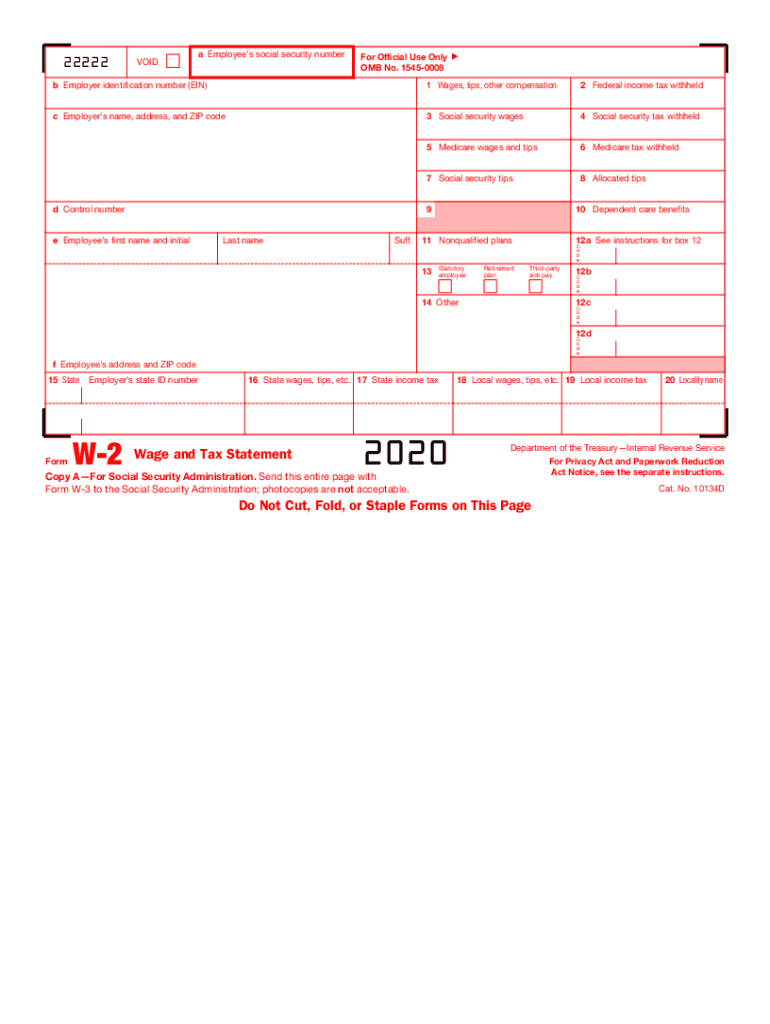

IRS W-2 2020 free printable template

Instructions and Help about IRS W-2

How to edit IRS W-2

How to fill out IRS W-2

About IRS W-2 2020 previous version

What is IRS W-2?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS W-2

What should I do if I discover an error after submitting my IRS W-2?

If you find an error after filing your IRS W-2, you need to correct it by filing a Form W-2c. It's vital to submit this amended form as soon as possible to the IRS and provide copies to affected employees. This will help ensure that incorrect tax information does not impact your employees' tax returns.

How can I track the status of my submitted IRS W-2?

To track the status of your submitted IRS W-2, you can utilize the IRS's online tools or contact their helpline. Be aware of common e-file rejection codes, which can occur if there are discrepancies in the information provided. It’s essential to address these issues quickly to avoid delays in processing.

What are the privacy considerations when filing IRS W-2 forms electronically?

When electronically filing IRS W-2 forms, it's crucial to ensure data security by using reputable software with strong encryption. Maintain compliance with data protection regulations and limit access to sensitive information. Additionally, keep records of all transactions to demonstrate compliance and for future reference.

What steps should I take if I receive an IRS notice regarding my W-2?

If you receive an IRS notice related to your W-2, first read the notice carefully to understand the issue. Gather relevant documentation to support your case, then respond promptly, addressing any discrepancies noted. If necessary, consult with a tax professional to help clarify the situation and ensure compliance.

How do service fees work when e-filing my IRS W-2?

When e-filing your IRS W-2, some service providers may charge a fee for their e-filing services. It's important to review these fees beforehand, as they can vary significantly. If your e-filing is rejected, check if the service offers refunds for errors to ensure you don't incur unnecessary costs.

See what our users say