CA T2 SCH 4 E 2011 free printable template

Show details

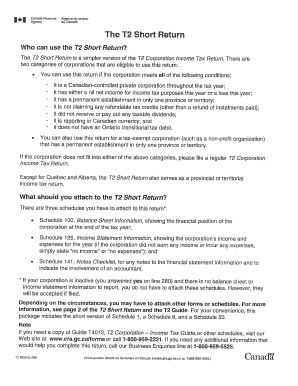

SCHEDULE 4 Code 1101 CORPORATION LOSS CONTINUITY AND APPLICATION 2011 and later tax years Name of corporation Business number Year Tax year-end Month Day Use this form to determine the continuity and use of available losses to determine a current-year non-capital loss farm loss restricted farm loss or limited partnership loss to determine the amount of restricted farm loss and limited partnership loss that can be applied in a year and to ask for ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA T2 SCH 4 E

Edit your CA T2 SCH 4 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA T2 SCH 4 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA T2 SCH 4 E online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CA T2 SCH 4 E. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA T2 SCH 4 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA T2 SCH 4 E

How to fill out CA T2 SCH 4 E

01

Gather necessary financial documents and information for the tax year.

02

Start with the identification section of CA T2 SCH 4 E, including your corporation's name, business number, and tax year.

03

Complete the income section, detailing all income sources, such as sales, dividends, and interest.

04

Fill in the relevant deductions, ensuring to itemize any allowable expenses related to operations.

05

Review the tax payable calculation, ensuring all entries are summed correctly.

06

Signature and date the form, ensuring it is submitted by the appropriate deadline.

Who needs CA T2 SCH 4 E?

01

Corporations filing a tax return in Canada.

02

Businesses that have earned income and incurred expenses during the tax year.

03

Entities that require to disclose their income sources and applicable deductions as part of their corporate tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between T1 and T4 in Canada?

However, when you're comparing the T1 and the T4 forms, things are fairly straightforward. The T1 is a form filled out by employees and business owners, then submitted to the CRA. The T4 form, on the other hand, is filled out by employers and distributed to employees.

What is a T4 tax form in Canada?

T4 Statement of Remuneration Paid Personal income tax.

Is the net income loss shown on the financial statements different from the net income loss for income tax purposes?

Generally, the net income (loss) reported on your financial statements will not be the same as the net income (loss) required for tax purposes.

What are the different tax forms in Canada?

To collect income taxes in Canada, there are three main types of tax returns in Canada: T1 – Personal: The T1 is the standard personal tax return for all Canadian individuals. T2 – Corporate: The T2 is the tax return for registered corporations in Canada. T3 – Trust: The T3 is used to file taxes for a trust in Canada.

What is a W 2 form in Canada?

The W-2 reports how much you earned from your employer as well as how much tax was withheld on your behalf during the tax year. You should consider reviewing your tax withholding annually to ensure you withhold the correct amount of money from your paychecks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CA T2 SCH 4 E in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign CA T2 SCH 4 E and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit CA T2 SCH 4 E on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing CA T2 SCH 4 E, you can start right away.

Can I edit CA T2 SCH 4 E on an Android device?

You can edit, sign, and distribute CA T2 SCH 4 E on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is CA T2 SCH 4 E?

CA T2 SCH 4 E is the Schedule 4, Capital Gains (or Losses) for Corporations form used in conjunction with the T2 Corporation Income Tax Return in Canada.

Who is required to file CA T2 SCH 4 E?

Corporations that have capital gains or losses to report for the tax year are required to file CA T2 SCH 4 E.

How to fill out CA T2 SCH 4 E?

To fill out CA T2 SCH 4 E, corporations must provide details of capital gains and losses, including descriptions of the properties sold, dates of acquisition and disposition, proceeds of disposition, and any allowable deductions or expenses.

What is the purpose of CA T2 SCH 4 E?

The purpose of CA T2 SCH 4 E is to calculate and report capital gains and losses for corporations, which impacts the overall taxable income of the corporation.

What information must be reported on CA T2 SCH 4 E?

Information that must be reported on CA T2 SCH 4 E includes details of capital properties, disposition dates, proceeds from sales, expenses related to the sale, and any capital gains or losses realized during the tax year.

Fill out your CA T2 SCH 4 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA t2 SCH 4 E is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.