Get the free how to remit msrf with 10 employee 2019 - marshfieldclinic

Get, Create, Make and Sign how to remit msrf

How to edit how to remit msrf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how to remit msrf

How to fill out how to remit msrf:

Who needs to remit msrf:

Instructions and Help about how to remit msrf

Today we're discussing a subject that affects every employer paying your employees and how you're maybe unintentionally breaking the law welcome to HR over coffee a series brought to you by the experts at HR 360 where you will learn how to effectively hire manage and terminate your employees did you know that you may be unintentionally violating the law that's right the basic rules on paying minimum wage and overtime are set by a federal law called the Fair Labor Standards Act or FLEA for short however some of the most common pay practices can cause you to fall out of compliance with the law before we begin a quick note about the importance of state wage and hour laws when both the FLEA and a state law apply the law setting the higher standards must be observed so be sure to check your state's laws and ask an employment law attorney if you have any questions regarding your responsibilities now let's take a look at some common mistakes under the FLEA — any of these statements sound familiar despite common perceptions salaried does not necessarily mean exempt never assume that just because you pay your employees a salary that they are not entitled to a minimum wage and overtime pay protections similarly giving an employee a high-ranking job title such as manager does not by itself determine the employees' status in order for an exemption to apply and employees specific job duties and salary have to meet all the requirements for the exemption claimed no matter how loyal or diligent they are non-exempt employees may not be allowed to work for free they must be paid for all hours worked including time spent doing work not requested by the employer but still allowed these off-the-clock tasks might include for example an employee staying late to finish waiting on a customer or taking work home in the evening to meet a deadline remember even if an employee volunteers to perform the work you must in most cases count his or her hours as compensated all time it is your responsibility as a manager to exercise control and make sure that extra work is performed only with your consent while it's true that independent contractors are not entitled to overtime pay because there's not an employment relationship under the law the existence of a contract alone is not enough to determine a worker status as a manager you must analyze the underlying nature of each work relationship to ensure that your employees are properly classified there is no single rule or test for determining whether an individual is an independent contractor or an employee for the purposes of the FLEA some relevant factors to consider might include the nature and degree of control exercised over the worker the permanency of the relationship and the amount of the workers' investment in facilities and equipment visit the US Department of Labor's website to learn more about these other factors to help you make the right call of course these are just a few examples the rules governing classification...

People Also Ask about

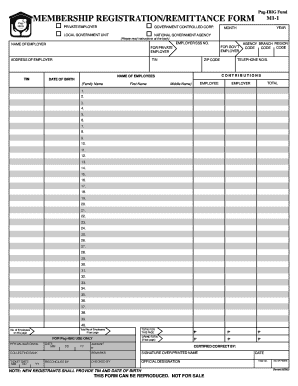

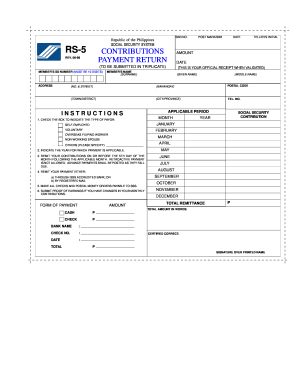

How to fill up Pag-IBIG request slip?

How can I claim 20 years in Pag-IBIG?

Can I cash out my Pag-IBIG contribution?

Can I withdraw my Pag-IBIG contribution after 10 years?

How can I remit my Pag-IBIG contribution to my employer?

How much is the monthly contribution for Pag-IBIG members?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit how to remit msrf from Google Drive?

Where do I find how to remit msrf?

How can I edit how to remit msrf on a smartphone?

What is how to remit msrf?

Who is required to file how to remit msrf?

How to fill out how to remit msrf?

What is the purpose of how to remit msrf?

What information must be reported on how to remit msrf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.