Get the free Schedule E (Form 990) - irs

Show details

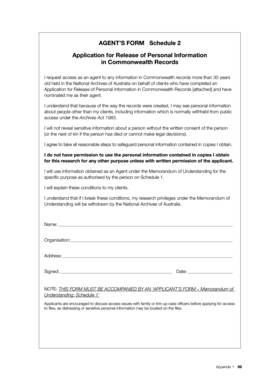

This document is required to be completed by organizations that answer 'Yes' to Form 990, Part VII, line 10, addressing their compliance with racial nondiscrimination in student admissions and other

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule e form 990

Edit your schedule e form 990 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule e form 990 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule e form 990 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit schedule e form 990. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule e form 990

How to fill out Schedule E (Form 990)

01

Obtain Form 990 from the IRS website.

02

Locate Schedule E, which is specifically for reporting on Schools and Educational Institutions.

03

Fill out the general information section, including the name and EIN of the institution.

04

Provide information on the activities of the educational institution in Part I.

05

Report the income and expenses related to educational activities in Part II.

06

Complete Part III if the institution has related organizations.

07

Review the instructions for any special reporting requirements.

08

Ensure all numerical data is accurate and double-check calculations.

09

Sign and date the form before submitting it alongside Form 990.

Who needs Schedule E (Form 990)?

01

Non-profit educational institutions that are required to file Form 990.

02

Schools, colleges, and universities that report financial activities.

03

Organizations that provide educational services as part of their mission.

Fill

form

: Try Risk Free

People Also Ask about

What is the penalty for not filing a 990 EZ?

What are the Penalties for Filing Form 990 Late? The IRS has two different penalty rates for filing Form 990 late, which depend up the organization's gross receipts. A penalty of $20/day for each delayed day will be imposed. The maximum penalty amount is $12,000 or 5% of gross receipt.

How much does it cost to file a 990-EZ?

Tax Professionals Pricing Forms1-10 Returns11+ Returns Form 990-EZ (Price Per Form) $89.90 $69.90 Form 990-PF (Price Per Form) $149.90 $119.90 Form 990 (Price Per Form) $179.90 $139.90 Form 990-T (Price Per Form) $139.90 $109.905 more rows

Where can I get a Schedule E form?

If you file on your own, you can access Schedule E directly from the IRS website or through IRS Free Fillable Forms.

How do I file the IRS Form 990-EZ electronically?

How to file Form 990-EZ Electronically Add Organization Details. Search for your EIN to import your organization's data from the IRS automatically. Choose Tax Year and Form. Choose the tax year you want to file and select Form 990-EZ. Enter Form Data. Review Your Form Summary. Transmit it to the IRS.

How much does it cost to file a 990 form?

Transparent Pricing with User-Friendly Features Forms1-5 Returns (Cost Per Form)5+ Returns (Cost Per Form)* Form 990 $199.90 $179.90 Form 990-PF $169.90 $152.90 Form 990-T $149.90 $134.90 CA Form 199 $79.90 $71.905 more rows

Can I file a 990 EZ for free?

FREE to file Form 990/990-EZ for organizations with less than $100,000 in gross receipts. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41.

How much to charge for 990 EZ?

Tax Professionals Pricing Forms1-10 Returns11+ Returns Form 990-EZ (Price Per Form) $89.90 $69.90 Form 990-PF (Price Per Form) $149.90 $119.90 Form 990 (Price Per Form) $179.90 $139.90 Form 990-T (Price Per Form) $139.90 $109.905 more rows

What is a Schedule E form used for?

Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in real estate mortgage investment conduits (REMICs).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule E (Form 990)?

Schedule E (Form 990) is a supplemental form used by tax-exempt organizations to report information about their professional fundraising services and events.

Who is required to file Schedule E (Form 990)?

Organizations that engage professional fundraisers or have conducted fundraising events during the tax year and are filing Form 990 must file Schedule E.

How to fill out Schedule E (Form 990)?

To fill out Schedule E, organizations must provide details about the fundraising activities, including names of fundraising events, expenses, revenues, and information about professional fundraisers hired.

What is the purpose of Schedule E (Form 990)?

The purpose of Schedule E is to provide transparency and detailed reporting of fundraising activities and expenditures, ensuring compliance with IRS regulations.

What information must be reported on Schedule E (Form 990)?

Schedule E requires reporting information such as the names and contact information of professional fundraisers, details of fundraising events, gross receipts, and expenses related to those activities.

Fill out your schedule e form 990 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule E Form 990 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.