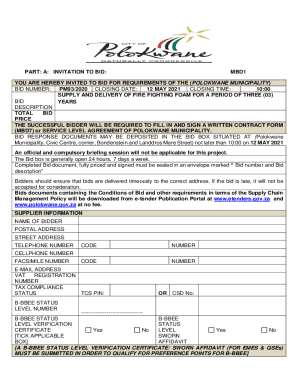

Get the free Schedule F (Form 990) - irs

Show details

This form is used by organizations to provide details regarding their activities and financial assistance provided outside the United States. It is specifically for organizations that respond affirmatively

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule f form 990

Edit your schedule f form 990 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule f form 990 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule f form 990 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit schedule f form 990. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule f form 990

How to fill out Schedule F (Form 990)

01

Begin by downloading the latest version of Schedule F (Form 990) from the IRS website.

02

Fill in your organization's name, address, and Employer Identification Number (EIN) at the top of the form.

03

In Part I, report the organization's foreign activities by checking the relevant boxes regarding its involvement in foreign countries.

04

In Part II, disclose details about foreign grants given by reporting total amounts and recipient information.

05

In Part III, describe specific foreign programs and activities, including the nature of each program and its objectives.

06

Ensure accuracy in the financial information provided, including revenues and expenses related to foreign activities.

07

Complete any additional schedules or forms that are required based on your organization's activities.

08

Review the filled form for any errors or omissions before submitting it.

09

File Schedule F with the main Form 990 by the tax deadline.

Who needs Schedule F (Form 990)?

01

Organizations that are required to file Form 990 and have foreign operations or activities.

02

Nonprofits that make grants or contributions to foreign organizations or individuals.

03

Tax-exempt organizations that engage in foreign fundraising or have offices and programs outside the U.S.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for Schedule F?

Sole proprietor farming businesses use IRS Schedule F, Profit or Loss from Farming to report income and expenses of the farming business. Schedule F can be used by partnerships, Corporations, Trusts and Estates to report farming activities.

What is the use of Schedule F?

The purpose of the provision is to increase the president's control over the federal career civil service by removing their civil service protections and making them easier to dismiss, which proponents stated would increase flexibility and accountability to elected officials.

What is Schedule F reporting?

Farmers running a for profit business have special tax forms required of them when filing with the IRS. Any farm that receives income from the sale of products raised on the farm (or bought for resale) fills out a Schedule F in order to report net income gain or loss from the farm in any one tax year.

What qualifies you to file Schedule F?

Sole proprietor farming businesses use IRS Schedule F, Profit or Loss from Farming to report income and expenses of the farming business. Schedule F can be used by partnerships, Corporations, Trusts and Estates to report farming activities.

What is a Schedule F for dummies?

Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040, 1040-SR, 1040-SS, 1040-NR, 1041, or 1065. Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees. Check with your state and local governments for more information.

What is the IRS Form Schedule F?

What Is Schedule F? The IRS form Schedule F is a form that any sole proprietorship / single-member LLC farming business must complete when filing your federal taxes.

What is a Schedule F penalty?

Schedule F Penalty An insurance company can use any reinsurer for its coverage needs. However, statutory accounting limits the amount an insurer can report as receivable on certain categories of reinsurers. Penalties apply for both collateral deficiencies and past due receivables.

What is a Schedule F for dummies?

Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040, 1040-SR, 1040-SS, 1040-NR, 1041, or 1065. Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees. Check with your state and local governments for more information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule F (Form 990)?

Schedule F (Form 990) is a supplementary form that nonprofit organizations use to provide additional information about their professional fundraising services, including the details of fundraising activities, arrangements with professional fundraisers, and the total cost of fundraising efforts.

Who is required to file Schedule F (Form 990)?

Organizations that have engaged the services of professional fundraisers or that have raised funds through fundraising services are required to file Schedule F with their Form 990.

How to fill out Schedule F (Form 990)?

To fill out Schedule F, organizations must complete various sections that document their fundraising activities, including details of professional fundraising contracts, costs associated with fundraising, and the total contributions received. Instructions provided with Form 990 guide the filling process.

What is the purpose of Schedule F (Form 990)?

The purpose of Schedule F is to provide transparency regarding how organizations solicit and collect donations, including information about professional fundraisers and the effectiveness of fundraising efforts.

What information must be reported on Schedule F (Form 990)?

Organizations must report information such as the names of any professional fundraisers they have contracted, the nature of the fundraising arrangements, total contributions received, expenses incurred, and the amount retained by the organization versus the fundraiser.

Fill out your schedule f form 990 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule F Form 990 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.