Get the free iras

Show details

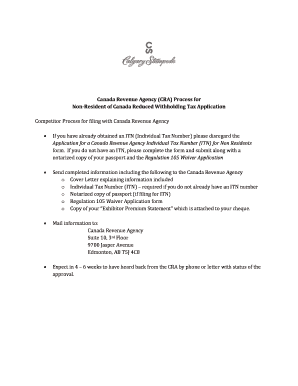

Funds are rolled over to an IRA, the new custodian or trustee will report the rollover contribution to Form 5498. Even if you roll over the entire amount of the funds ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign iras

Edit your iras form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iras form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit iras online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit iras. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out iras

How to fill out IRAs:

01

Gather all necessary documents: Before you begin filling out your IRAs, make sure you have all the required documents, such as your social security number, identification proof, financial statements, and contribution limits for the specific tax year.

02

Determine the type of IRA: There are different types of IRAs, including Traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. Understand the eligibility criteria and decide which type suits your financial goals and circumstances.

03

Determine your contribution amount: Identify how much you are eligible to contribute to your IRA based on the current tax laws. Consult with a financial advisor if you are unsure or need assistance in determining the appropriate contribution amount.

04

Complete the necessary forms: Obtain the appropriate IRS forms for your selected IRA type. The most commonly used forms are Form 8606 for Traditional IRA contributions, Form 5498 for reporting IRA contributions, and Form 8880 for claiming the Saver's Credit for retirement contributions.

05

Provide accurate information: Ensure that you fill out the forms accurately and use the correct information. This includes your personal details, contribution amounts, and any relevant deductions or credits. Double-checking your work can help avoid mistakes and potential issues in the future.

06

Submit your forms: Once you have completed the required forms, submit them to the designated IRS address. Consider mailing them via certified mail or using an electronic filing method for faster processing and proof of submission.

Who needs IRAs:

01

Individuals planning for retirement: IRAs are an excellent investment tool for individuals who want to save and grow their retirement funds. It allows you to contribute a portion of your income on a tax-advantaged basis and potentially accumulate significant wealth for your post-retirement years.

02

Self-employed individuals: If you are self-employed or own a small business, IRAs provide an opportunity to save for retirement beyond traditional pension plans. Depending on your situation, SEP IRAs or SIMPLE IRAs might be suitable options. Consult with a financial advisor to determine the best IRA choice for your specific circumstances.

03

Individuals seeking tax advantages: IRAs offer various tax advantages, such as tax-deductible contributions for Traditional IRAs or tax-free withdrawals for Roth IRAs in retirement. If reducing your taxable income or minimizing future tax liabilities is a priority, an IRA can be a beneficial financial instrument.

Note: While the information provided is based on general knowledge, it is crucial to consult with a qualified financial advisor or tax professional to ensure you receive personalized advice based on your specific financial situation and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get iras?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the iras in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for signing my iras in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your iras right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit iras on an iOS device?

You certainly can. You can quickly edit, distribute, and sign iras on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

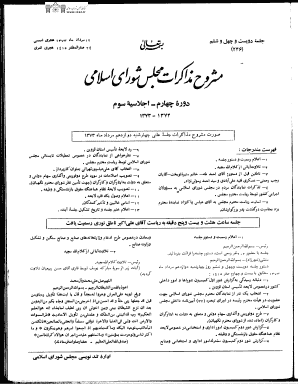

What is iras?

IRAS stands for Inland Revenue Authority of Singapore, which is the national tax authority of Singapore.

Who is required to file iras?

All individuals and companies earning income in Singapore are required to file IRAS.

How to fill out iras?

IRAS can be filled out online through the IRAS website or submitted manually using the paper forms provided by IRAS.

What is the purpose of iras?

The purpose of IRAS is to collect taxes to fund government services and infrastructure in Singapore.

What information must be reported on iras?

IRAS requires information on income, deductions, and reliefs to be reported accurately.

Fill out your iras online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Iras is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.