Get the free Model Chapter 13 Plan - Northern District of California - canb uscourts

Show details

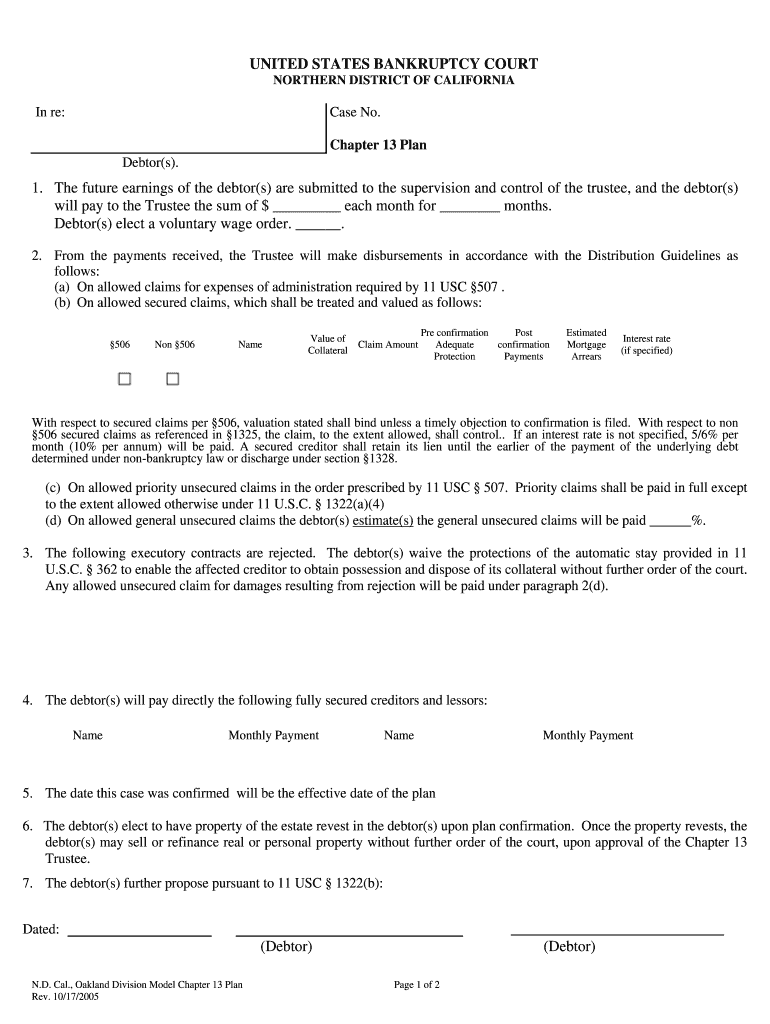

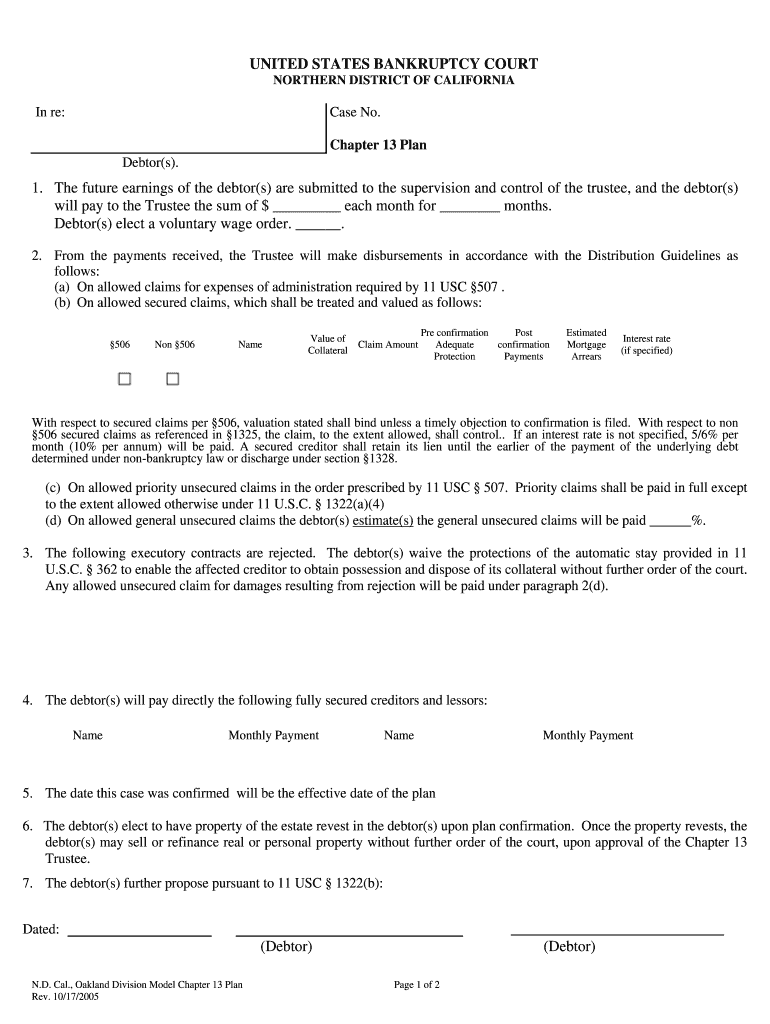

Oct 17, 2005 ... UNITED STATES BANKRUPTCY COURT. NORTHERN DISTRICT OF CALIFORNIA. In re: Case No. Chapter 13 Plan. Debtor(s). 1. The future ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign model chapter 13 plan

Edit your model chapter 13 plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your model chapter 13 plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing model chapter 13 plan online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit model chapter 13 plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out model chapter 13 plan

How to fill out a model chapter 13 plan?

01

Gather all necessary financial documents, including income statements, expense records, and a list of creditors.

02

Evaluate your income and expenses to determine how much disposable income you have available each month to repay your debts.

03

Create a budget that outlines how you will allocate your disposable income towards repaying your creditors.

04

Consult with a bankruptcy attorney or use an online bankruptcy software program to ensure that you are accurately completing the model chapter 13 plan form.

05

Complete the model chapter 13 plan form, providing detailed information about your income, expenses, and debts.

06

Determine the length of your repayment plan, which typically ranges from three to five years.

07

Calculate the total amount of debt you will be able to repay over the course of the repayment plan.

08

Submit the completed model chapter 13 plan form to the bankruptcy court along with the required filing fee.

09

Attend the scheduled confirmation hearing, where the bankruptcy court will review your repayment plan and either approve or modify it.

10

Make regular monthly payments according to the terms of your approved model chapter 13 plan until all eligible debts are paid off.

Who needs a model chapter 13 plan?

01

Individuals or married couples with a regular income who are struggling to repay their debts but want to avoid liquidation through chapter 7 bankruptcy.

02

Those who have sufficient disposable income to repay a portion of their debts over a period of time.

03

Individuals or married couples who wish to protect their assets and retain ownership while seeking debt relief.

04

Those who are committed to making regular monthly payments towards their debts to get a fresh financial start.

05

People who qualify under the specific criteria set by the United States Bankruptcy Code for filing a chapter 13 bankruptcy.

Remember, it is always recommended to seek professional advice from a bankruptcy attorney or credit counselor to ensure that the model chapter 13 plan is filled out correctly and in compliance with the law.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit model chapter 13 plan from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like model chapter 13 plan, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit model chapter 13 plan online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your model chapter 13 plan to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete model chapter 13 plan on an Android device?

Complete model chapter 13 plan and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is model chapter 13 plan?

Model chapter 13 plan is a document outlining how an individual will repay their debts over a period of time, typically three to five years, under Chapter 13 bankruptcy.

Who is required to file model chapter 13 plan?

Individuals who have regular income, unsecured debts below a certain limit, and the ability to make payments are required to file a model chapter 13 plan.

How to fill out model chapter 13 plan?

To fill out a model chapter 13 plan, the individual must provide details of their income, expenses, assets, debts, and proposed repayment plan for review by the bankruptcy court.

What is the purpose of model chapter 13 plan?

The purpose of a model chapter 13 plan is to restructure and repay debts in a manageable way while allowing the individual to keep their assets.

What information must be reported on model chapter 13 plan?

Information such as income, expenses, assets, debts, proposed repayment plan, and any other relevant financial details must be reported on a model chapter 13 plan.

Fill out your model chapter 13 plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Model Chapter 13 Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.