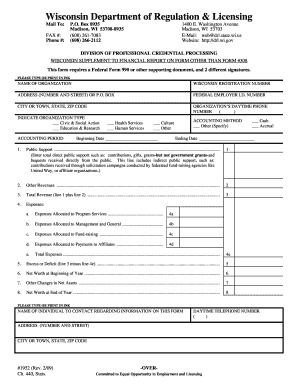

WI DSPS 2620 2011-2025 free printable template

Get, Create, Make and Sign wi dsps annual form

How to edit wi dsps financial form sample online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dsps 2620 reporting blank form

How to fill out WI DSPS 2620

Who needs WI DSPS 2620?

Video instructions and help with filling out and completing wi dsps financial reporting

Instructions and Help about wisconsin dsps 2620 annual sample

Hi again this is john organizer of the creative drive I'm going to show you a little tutorial on the form s 240 that I sent to you in an attachment this is a form that all artists who are participating in the creative drive must fill out and provide to me before you can participate I am working on a Mac in this demonstration I'm going to go down here to the left-hand corner and bring up finder where my documents are I'm going to go into the finder box go up to the creative drive folder and then in that folder I'm going to find sales tax and that sales tax here's a folder for form s 240, and I have a demo s 240 for this situation double-click on it and open it and this should look very similar to the form that I sent you I have deleted some personal information just because it's the public video, but it should be very similar the top half is for the event operator and over here on the left side you can see that it's states event operator and that is me so part an of that section is event information I've entered the creative drive I've entered the dates and the location of sin qua County Baldwin and Roberts area Part B this area here is operator information that is my personal information as it says here to be completed by the operator of the temporary event this is considered a temporary event because it happens just once a year, so I've entered my name my address my telephone number my email the Wisconsin tax account number is my tax account number all the information in this top portion pertains to me as the operator we go down to the bottom section Part C this is seller information, and it says to be completed by seller and given to event operator on or before the first day of the event, and then it says this is not an application for Wisconsin tax account that is a different app that is a different form this is just to give information to me that I provide for the state so that they know that you are at this event in this section you will put your legal name in line one line two is a business name you probably have a business name if you are filed with Minnesota as a business or Wisconsin has a business there's a there's also a possibility that you don't have a business name because you do not have and are not filed with other state this would be your address your city state and zip your telephone here's a business phone if you have a separate one and then Wisconsin tax account number this would be the area this would be the area where your tax account number would be now as explained in video one you may not need to have a tax account number if you have decided not to apply for a tax number then you obviously wouldn't have one to put in that space you would leave it blank line 7 is social security, and they asked for the last four digits of your social security here number eight is federal identification number and that is a number that businesses with employees have so that probably does not pertain to you number nine check one box...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send dsps financial form fill to be eSigned by others?

How do I make changes in dsps 2620 financial get?

How do I edit dsps selecting annual reporting online on an Android device?

What is WI DSPS 2620?

Who is required to file WI DSPS 2620?

How to fill out WI DSPS 2620?

What is the purpose of WI DSPS 2620?

What information must be reported on WI DSPS 2620?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.