Get the free unpostables - irs

Show details

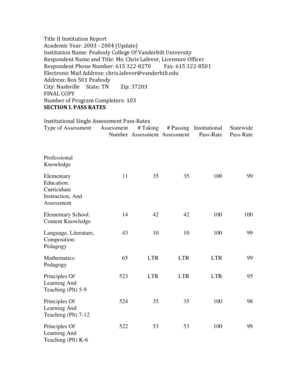

Exception tax period month is 01 and Filer Type Indicator 01 or 05. Note Bypass this UPC on a corrected unpostable. 8B-22 Any return TC 150 - non-document code 51 input to Form 940 tax module MFT 10 and the entity Employment Code equals G. B TC 740 coming from RFC without cancellation code of 1 2 3 8 9 40 60-63 71 72. RPS Unpostable Reasons a Form 1040 with Computer Condition Code S and a remittance with returns. c TC 610 with return doc. code in...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unpostables - irs

Edit your unpostables - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unpostables - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit unpostables - irs online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit unpostables - irs. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out unpostables - irs

How to fill out unpostables:

01

Start by gathering all the necessary information related to the unpostables, such as the specific items or documents that need to be filled out.

02

Carefully read the instructions or guidelines provided for filling out the unpostables to ensure accuracy and compliance.

03

Use a pen or computer program that allows editing for non-electronic unpostables.

04

Fill in all the required fields, making sure to provide accurate and complete information.

05

Double-check the filled-out unpostables to eliminate any errors or omissions.

06

If any supporting documents are required, ensure they are attached or enclosed as instructed.

07

Follow any additional steps or procedures that may be mentioned, such as obtaining signatures or notarization if necessary.

08

Once the unpostables are completely filled out, review them one final time to ensure everything is correct, legible, and understandable.

09

Submit the filled-out unpostables as per the specified method, such as mailing them or submitting them electronically, following any given deadlines or procedures.

Who needs unpostables:

01

Individuals who are required to submit specific forms, documents, or information that cannot be posted or submitted through traditional methods.

02

Organizations or agencies that have specific procedures or requirements for certain transactions or processes that cannot be fulfilled through conventional posting methods.

03

Any entity or person involved in activities or transactions where physical or digital paper trails need to be maintained for legal or administrative purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my unpostables - irs in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign unpostables - irs and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Where do I find unpostables - irs?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the unpostables - irs. Open it immediately and start altering it with sophisticated capabilities.

How do I make edits in unpostables - irs without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing unpostables - irs and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is unpostables?

Unpostables refers to items or documents that cannot be processed or posted properly in a given system or platform.

Who is required to file unpostables?

Typically, organizations or individuals who encounter unpostable items or documents in their financial or administrative processes are required to file unpostables.

How to fill out unpostables?

To fill out unpostables, one must provide relevant details about the unpostable items or documents and describe the issues or errors encountered.

What is the purpose of unpostables?

The purpose of unpostables is to identify, track, and address items or documents that cannot be processed or posted properly, ensuring accurate financial and administrative records.

What information must be reported on unpostables?

The information that must be reported on unpostables typically includes the description or nature of the unpostable item, the date and time of the issue, and any relevant error codes or messages.

Fill out your unpostables - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Unpostables - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.