Get the free Sales tax relief for louisiana trucking industry - Kean Miller LLP

Show details

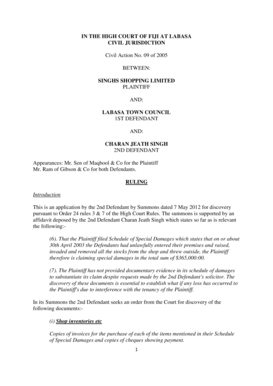

BUSINESS NOTES May 2004 SALES TAX RELIEF FOR LOUISIANA TRUCKING INDUSTRY The Louisiana Legislature has recently enacted La. Acts 2004, No. 10 (1st Ex. Less.) making the sales tax exemption for interstate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sales tax relief for

Edit your sales tax relief for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sales tax relief for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sales tax relief for online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sales tax relief for. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sales tax relief for

How to fill out sales tax relief form:

01

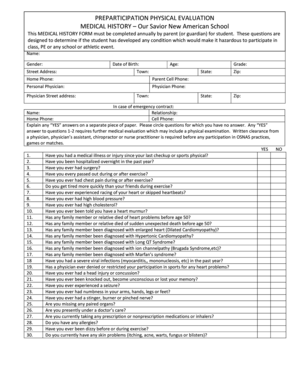

Obtain the necessary form: Start by obtaining the sales tax relief form from your local tax authority. This form is typically available online or at the tax office.

02

Gather the required information: Collect all the relevant information needed to complete the form. This may include personal details, such as your name, address, and social security number, as well as information about the sales tax you paid during the eligible period.

03

Determine eligibility: Ensure that you are eligible for sales tax relief by reviewing the guidelines provided by your tax authority. Eligibility criteria can vary, but it may be based on factors such as income, location, or specific purchases.

04

Fill in personal information: Start filling out the form by providing your personal information accurately. Make sure to double-check the details you provide to avoid potential errors.

05

Enter sales tax paid: Provide the necessary information about the sales tax you paid during the eligible period. This may require you to provide receipts or other supporting documentation as proof of payment.

06

Calculate the relief amount: Depending on the form, you may need to calculate the amount of relief you are eligible for. Follow the instructions provided on the form or consult the guidelines to ensure accurate calculations.

07

Review and sign: Carefully review all the information you have entered on the form. Verify that it is correct and complete. Once satisfied, sign the form and date it.

08

Submit the form: Follow the instructions provided on the form to submit it. This may involve mailing it to the designated address, uploading it online, or submitting it in person at the tax office.

Who needs sales tax relief?

01

Low-income individuals or families: Sales tax relief programs are often targeted towards individuals or families with lower incomes. These programs aim to provide financial assistance by reducing the tax burden on essential purchases.

02

Senior citizens: Some jurisdictions may offer sales tax relief specifically for senior citizens, acknowledging the unique financial challenges they may face.

03

Businesses and organizations: In certain cases, businesses and organizations may be eligible for sales tax relief. This can vary depending on the type of business, location, or specific circumstances.

04

Specific industries or products: Governments sometimes provide sales tax relief for specific industries or products to stimulate economic growth or support certain sectors. This could include sectors such as agriculture, renewable energy, or technology.

05

Natural disaster victims: In the aftermath of natural disasters, governments may offer sales tax relief as part of broader relief efforts. This assists affected individuals and communities in recovering and rebuilding.

It is important to note that the eligibility and availability of sales tax relief programs will vary depending on your jurisdiction. It is recommended to consult your local tax authority or a tax professional for specific information relevant to your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sales tax relief for?

Sales tax relief is designed to provide temporary relief to businesses by reducing the amount of sales tax they owe.

Who is required to file sales tax relief for?

Businesses that meet certain criteria set by the government are required to file for sales tax relief.

How to fill out sales tax relief for?

To fill out sales tax relief, businesses need to provide information about their sales, purchases, and tax owed during the relief period.

What is the purpose of sales tax relief for?

The purpose of sales tax relief is to help businesses manage their cash flow during challenging times.

What information must be reported on sales tax relief for?

Businesses must report their sales revenue, purchases, taxable sales, and tax owed during the relief period.

How can I send sales tax relief for for eSignature?

When you're ready to share your sales tax relief for, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit sales tax relief for straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing sales tax relief for.

How do I complete sales tax relief for on an Android device?

Use the pdfFiller Android app to finish your sales tax relief for and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your sales tax relief for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sales Tax Relief For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.