Who issues the Estate Appeasement and Nonprobate Inventory form?

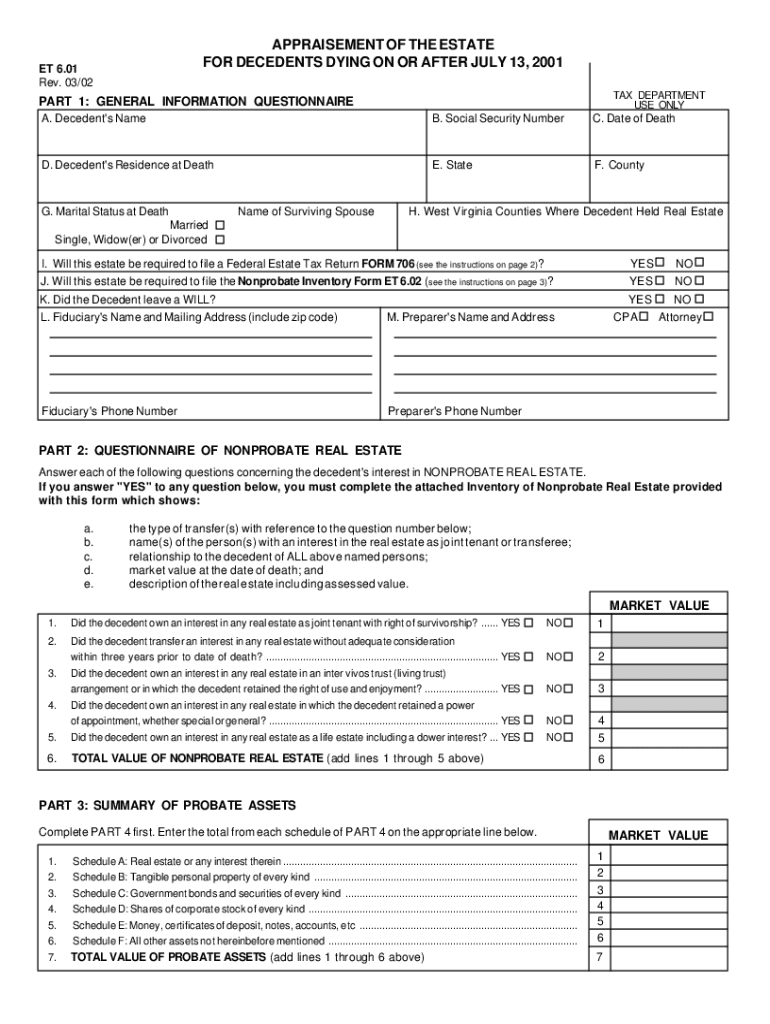

The form, also called ET 6.01 and ET 6.02, is the West Virginia State Tax Department form that must be submitted if a person dies and an estate is created. An estate is the property owned by a deceased person. By law, an individual (a fiduciary) must administer the estate by means of filing the ET 6.01 and 6.02 forms. The procedure of administration also includes making payments for the decedent’s outstanding debts and distribution of the property.

What is the purpose of the ET 6.01 and 6.02 forms?

The form must be completed in order to provide comprehensive information on the possessions of the decedent and to execute the will (if there is one) or to pass the property by laws of intestacy.

When is the Estate Appeasement and Nonprobate Inventory form due?

It is mandatory that the form be completed within 90 days after the qualification and completing final settlement in the decedent’s county of domicile.

Is the ET 6.01 and ET 6.02 form accompanied by any other documents?

No, there is no need to attach any documents or forms to the completed Estate Appeasement and Nonprobate Inventory form.

How do I fill out the ET 6.01 and ET 6.02?

A fiduciary must complete the Estate Appeasement and Nonprobate Inventory form is two original copies, each of them containing the following information:

-

General information about the case (name, residence, marital status of the decedent);

-

Details about nonprobate real estate;

-

Probate possessions summary;

-

Probate assets inventory (described in Schedules A, B, C, D, E, F);

-

List of beneficiaries;

-

Fiduciary’s Oath;

-

Certification if the document by a clerk of the county commission.

-

Nonprobate inventory (if any).