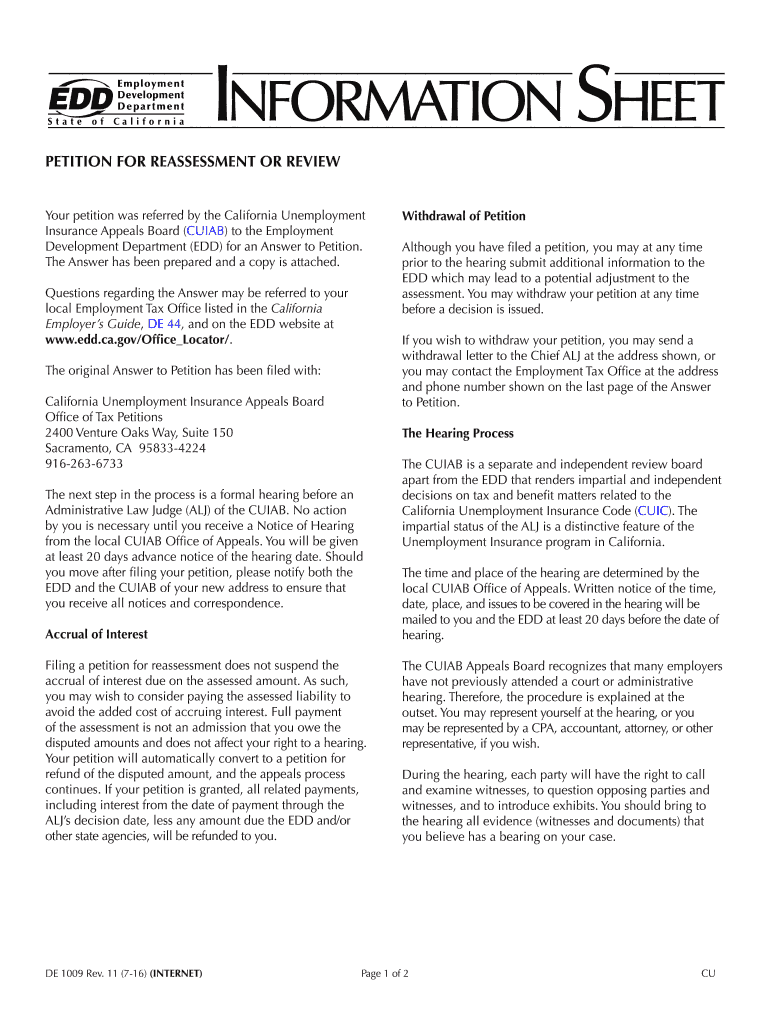

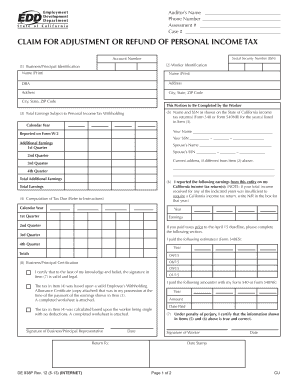

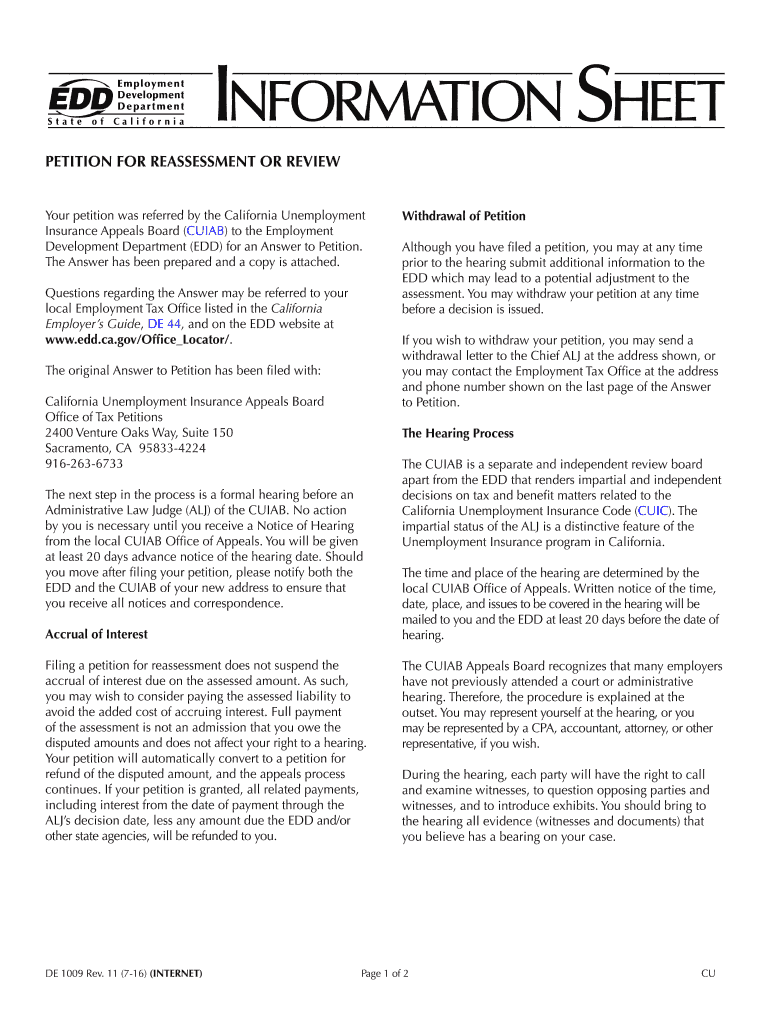

CA DE 1009 2007 free printable template

Get, Create, Make and Sign CA DE 1009

How to edit CA DE 1009 online

Uncompromising security for your PDF editing and eSignature needs

CA DE 1009 Form Versions

How to fill out CA DE 1009

How to fill out CA DE 1009

Who needs CA DE 1009?

Instructions and Help about CA DE 1009

If you are denied unemployment benefits in California you have the right to file an appeal and can still get an opportunity to receive unemployment benefits be sure to file your appeal within 20 days of getting your denial letter if you miss the 20-day deadline the EDD can deny your appeal request even if they don't deny it you'll have to show good cause during the hearing for missing your deadline an attorney that specializes in EDD appeals can advise you on what you should say on your request for appeal keep in mind that your previous employer can appear at your hearing and can bring witnesses to testify against your case and ex-employer witnesses or even the judge himself can ask you questions in your hearing and your answers can mean the difference between a case being won or lost an experienced EDD attorney can significantly help your case by questioning your employer and witnesses the law office of Cyrus Moore can help you navigate that difficult pitfalls in EDD Appeals Cyrus Moore has successfully helped clients through some of the most difficult EDD cases even some that other lawyers couldn't handle whether you quit or were fired talk with an experienced lawyer with a proven track record in EDD Appeals Mr Moore will talk to you free of charge about your case don't let time slip by call the Law Offices of Cyrus Moore today at 949 73 4148 to get the help you need

People Also Ask about

How long does EDD have to collect overpayment?

How do I appeal my EDD assessment?

What happens if you lose EDD appeal?

Can you win EDD appeal?

How long will my EDD be under review?

What happens if you can't pay back EDD overpayment?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in CA DE 1009?

Can I create an eSignature for the CA DE 1009 in Gmail?

Can I edit CA DE 1009 on an Android device?

What is CA DE 1009?

Who is required to file CA DE 1009?

How to fill out CA DE 1009?

What is the purpose of CA DE 1009?

What information must be reported on CA DE 1009?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.